The Wayne County, Michigan Amendment to the Articles of Incorporation allows businesses to eliminate the concept of par value in their corporate structure. Par value refers to the nominal value assigned to each share of stock issued by a company. When a corporation is formed, its articles of incorporation outline the key details, including the number of authorized shares and the par value assigned to each share. However, many businesses nowadays prefer to eliminate par value altogether for greater flexibility and operational advantages. By eliminating par value, companies can issue shares without a fixed minimum value. This enables them to have more flexibility in pricing their shares and providing more attractive investment opportunities. Additionally, eliminating par value can simplify corporate processes and reduce administrative burdens associated with calculating stock prices, dividends, and stock splits. There are different types of Wayne Michigan Amendments to the Articles of Incorporation that eliminate par value. These include: 1. Full Elimination: This type removes par value completely, allowing companies to issue shares without any minimum value attached. It grants flexibility to the corporation in setting prices and attracting investors. 2. Partial Elimination: In this case, the amendment reduces the par value from its original amount to a nominal value. This may be done to maintain some level of par value for legal or regulatory reasons, while still providing some operational benefits associated with eliminating par value entirely. 3. Statutory Conversion: Some states or jurisdictions have specific statutes that allow businesses to convert par value shares to no-par value shares. This allows companies to take advantage of the benefits of operating without par value. When considering an amendment to eliminate par value, companies should consult with legal professionals specialized in corporate law. They can guide businesses through the process and ensure compliance with applicable laws and regulations. In conclusion, the Wayne County, Michigan Amendment to the Articles of Incorporation provides businesses with the opportunity to eliminate par value from their corporate structure. By doing so, companies can enjoy greater flexibility in setting share prices and providing attractive investment opportunities, while simplifying administrative processes. Different types of amendments include full elimination, partial elimination, and statutory conversion, each offering unique benefits for businesses in Wayne County, Michigan.

Wayne Michigan Amendment to the articles of incorporation to eliminate par value

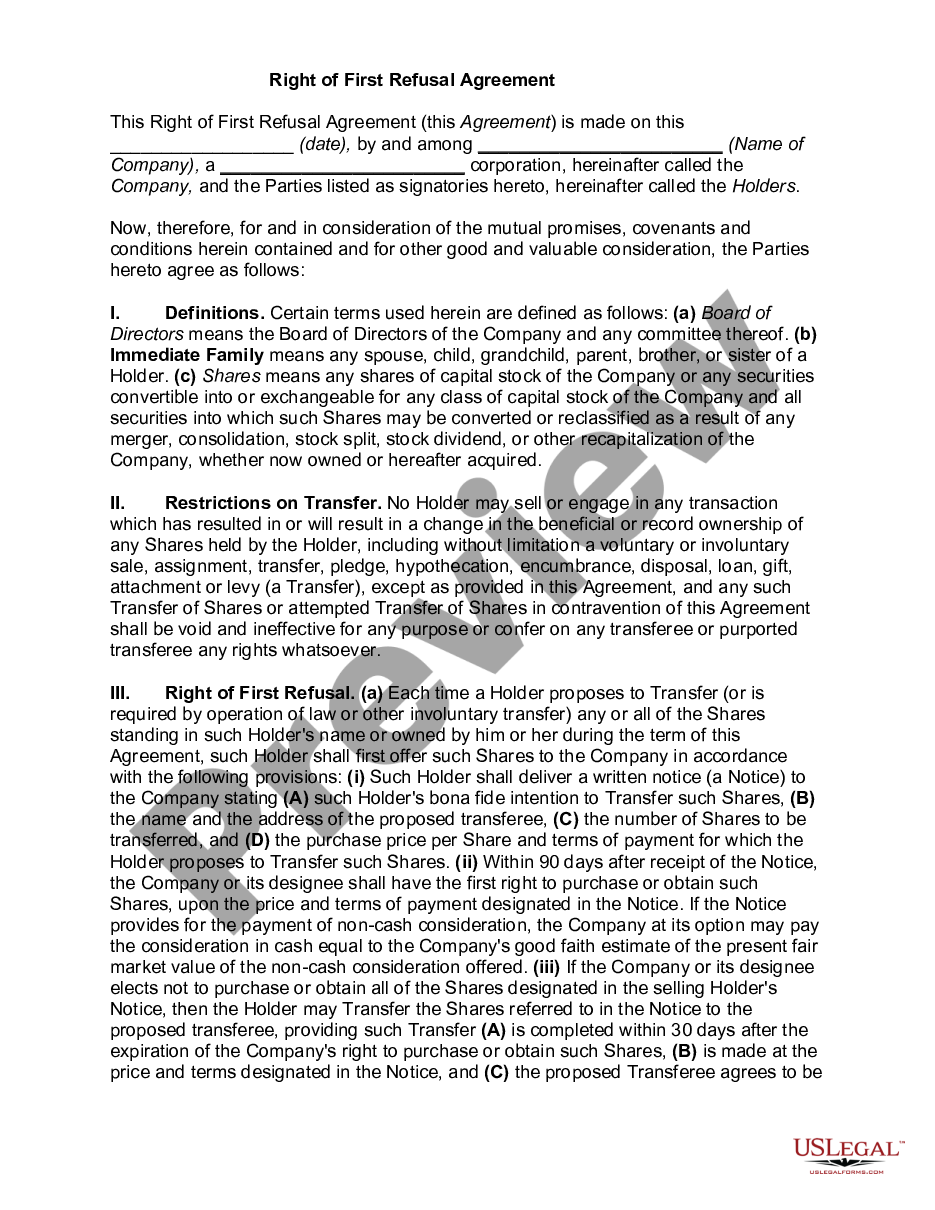

Description

How to fill out Wayne Michigan Amendment To The Articles Of Incorporation To Eliminate Par Value?

Preparing documents for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to create Wayne Amendment to the articles of incorporation to eliminate par value without expert assistance.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Wayne Amendment to the articles of incorporation to eliminate par value by yourself, using the US Legal Forms online library. It is the largest online collection of state-specific legal templates that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the required form.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Wayne Amendment to the articles of incorporation to eliminate par value:

- Examine the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that suits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any scenario with just a few clicks!