The Maricopa Arizona Amendment of terms of Class B preferred stock refers to a specific modification made to the original terms and conditions associated with Class B preferred stock issued within the Maricopa region of Arizona. This amendment aims to introduce changes or updates that better align with the evolving financial landscape and the specific needs of the investors or shareholders. Class B preferred stock typically represents a specific class of shares that hold priority over common stock in terms of dividend payments and liquidation rights. It offers investors the advantage of receiving fixed dividends and potentially higher yields compared to common stockholders. These shares also hold specific voting rights that may differ from those of common stock. Within the Maricopa Arizona region, there may be different types of amendments made to the terms of Class B preferred stock, each designed to address particular requirements. These types can include: 1. Dividend Modifications: This amendment may involve changes to the dividend payment structure, frequency, rate, or calculation methodology associated with Class B preferred stock. It aims to adapt the dividend payments to the financial performance of the company or market conditions. 2. Conversion Terms Amendment: This type of amendment focuses on the conversion terms associated with Class B preferred stock. It may alter the ratio at which Class B preferred stock can be converted into common stock or adjust the conversion price to reflect changing market dynamics. 3. Liquidation Preference Adjustment: This amendment involves modifications to the liquidation preference of Class B preferred stock. This could entail changes in the priority of payment during liquidation events, either increasing or decreasing the preferred stockholders' right to receive funds before common stockholders. 4. Voting Rights Revision: In some cases, the Maricopa Arizona Amendment may specifically address adjustments to the voting rights of Class B preferred stockholders. This could involve changes in the number of votes attached to each share, modification of voting thresholds, or alterations in the issues on which preferred stockholders hold voting power. It's important to note that the specific amendments made to the terms of Maricopa Arizona's Class B preferred stock can vary based on the company, industry, and specific circumstances of the stock issuance. These changes aim to provide flexibility and adaptability to better serve the interests of both the company and the preferred stockholders, ensuring alignment with the prevailing market dynamics and investor expectations.

Maricopa Arizona Amendment of terms of Class B preferred stock

Description

How to fill out Maricopa Arizona Amendment Of Terms Of Class B Preferred Stock?

Drafting paperwork for the business or personal demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to create Maricopa Amendment of terms of Class B preferred stock without expert assistance.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Maricopa Amendment of terms of Class B preferred stock by yourself, using the US Legal Forms web library. It is the greatest online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the required form.

If you still don't have a subscription, adhere to the step-by-step guideline below to get the Maricopa Amendment of terms of Class B preferred stock:

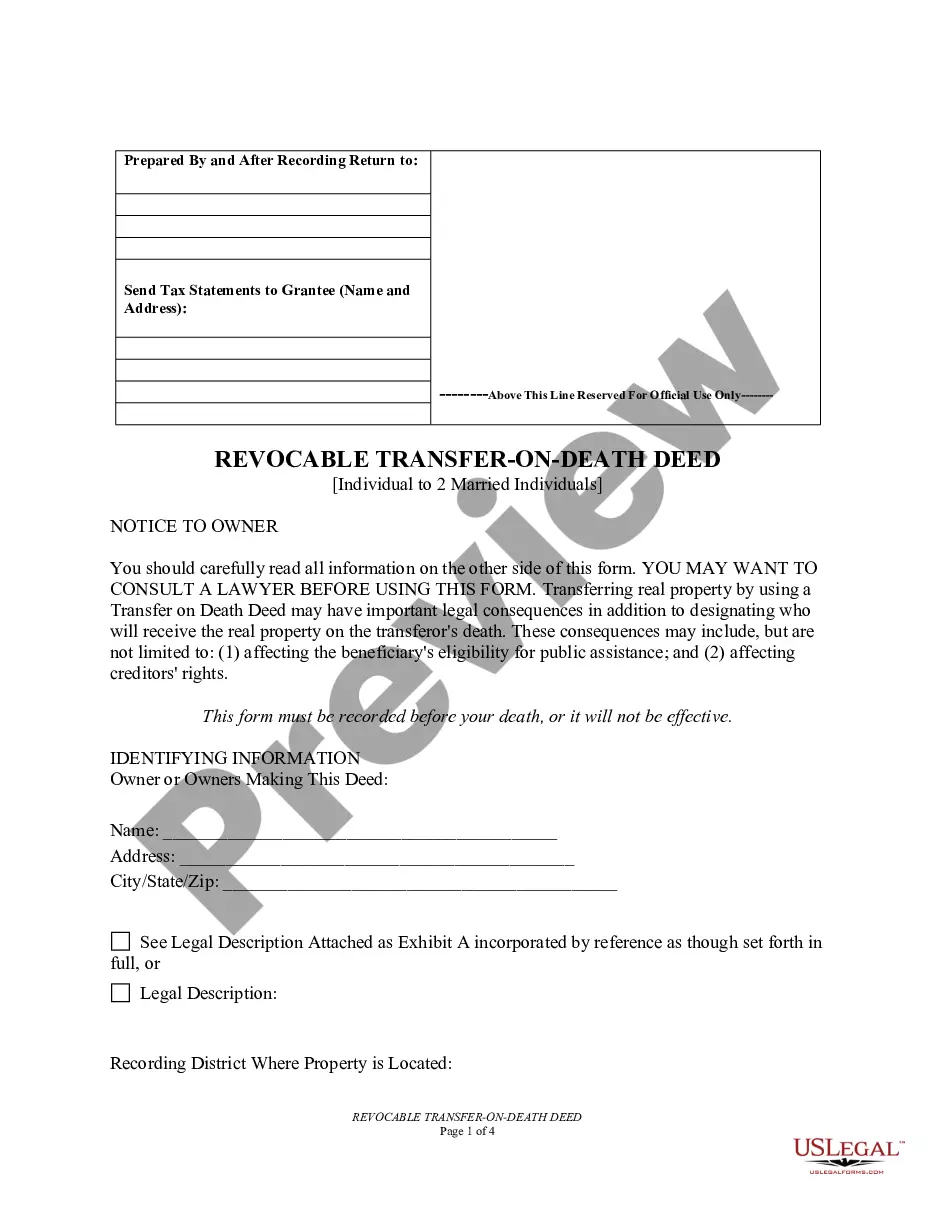

- Look through the page you've opened and check if it has the document you require.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that fits your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any scenario with just a few clicks!