The Montgomery Maryland Amendment of terms of Class B preferred stock refers to the modifications made to the terms and conditions of the Class B preferred stock in the state of Montgomery, Maryland. This amendment aims to redefine various aspects of the stock, including its rights, privileges, and restrictions. Class B preferred stock is a type of equity security that holds a higher priority over common stock in terms of dividend payments and liquidation. It typically offers a fixed dividend rate and may or may not have voting rights. The amendment allows Montgomery, Maryland, to alter these characteristics, tailoring them to the needs of the local investment landscape. Key terms addressed in the Montgomery Maryland Amendment of terms of Class B preferred stock may include: 1. Dividend Rate: The amendment specifies the fixed or variable rate at which dividends will be paid to Class B preferred stockholders. It may also outline potential changes to the dividend rate in certain circumstances. 2. Liquidation Preference: The amendment determines the priority and amount of claims that holders of Class B preferred stock have in the event of a liquidation or bankruptcy. This ensures that these shareholders receive their investment back before the common stockholders. 3. Redemption Rights: The amendment may include provisions regarding the company's right to redeem Class B preferred stock at its discretion or under specific circumstances, as well as potential redemption prices. 4. Convertibility: It specifies whether the Class B preferred stock is convertible into common stock or any other type of security, and outlines the conversion ratio and terms. 5. Voting Rights: The amendment may address the voting rights of Class B preferred stockholders, including whether they have the power to vote on certain matters affecting the company. While there might not be different types of Montgomery Maryland Amendment of terms of Class B preferred stock, variations can exist based on how companies choose to structure their preferred stock offerings, which are regulated by the Securities and Exchange Commission (SEC). Overall, the Montgomery Maryland Amendment of terms of Class B preferred stock allows the county to adapt the rights and conditions associated with Class B preferred stock to the specific needs and regulations of Montgomery, Maryland.

Montgomery Maryland Amendment of terms of Class B preferred stock

Description

How to fill out Montgomery Maryland Amendment Of Terms Of Class B Preferred Stock?

How much time does it normally take you to create a legal document? Given that every state has its laws and regulations for every life scenario, locating a Montgomery Amendment of terms of Class B preferred stock suiting all regional requirements can be stressful, and ordering it from a professional lawyer is often costly. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. Apart from the Montgomery Amendment of terms of Class B preferred stock, here you can get any specific form to run your business or personal affairs, complying with your regional requirements. Professionals verify all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can retain the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Montgomery Amendment of terms of Class B preferred stock:

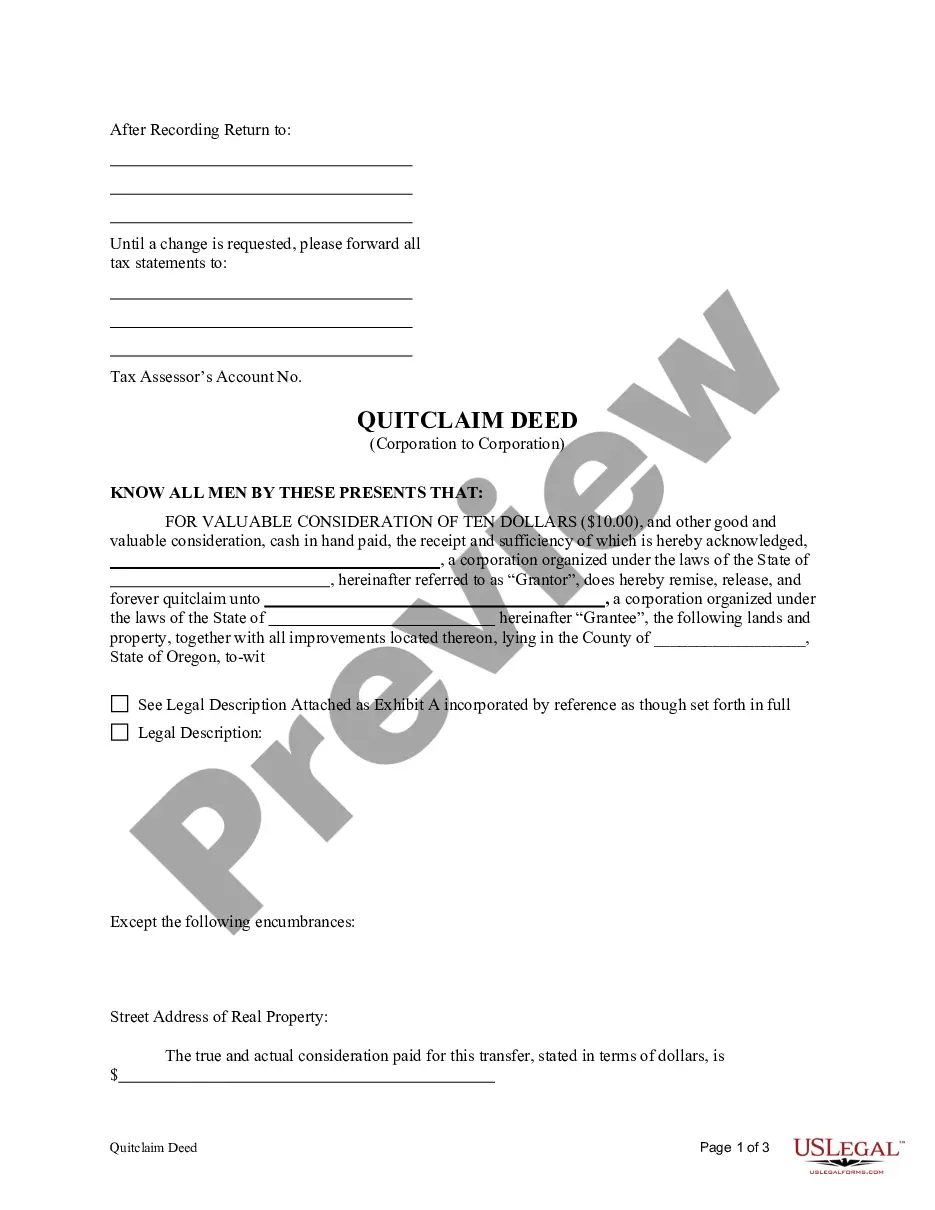

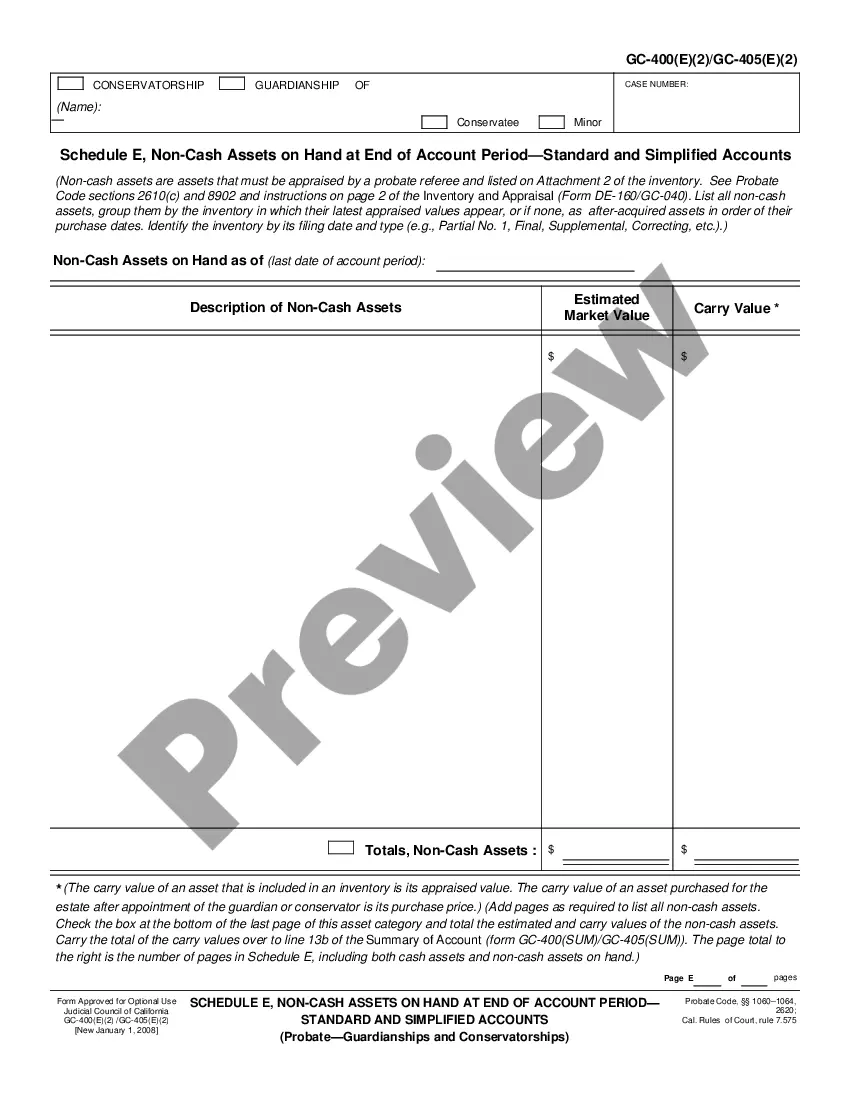

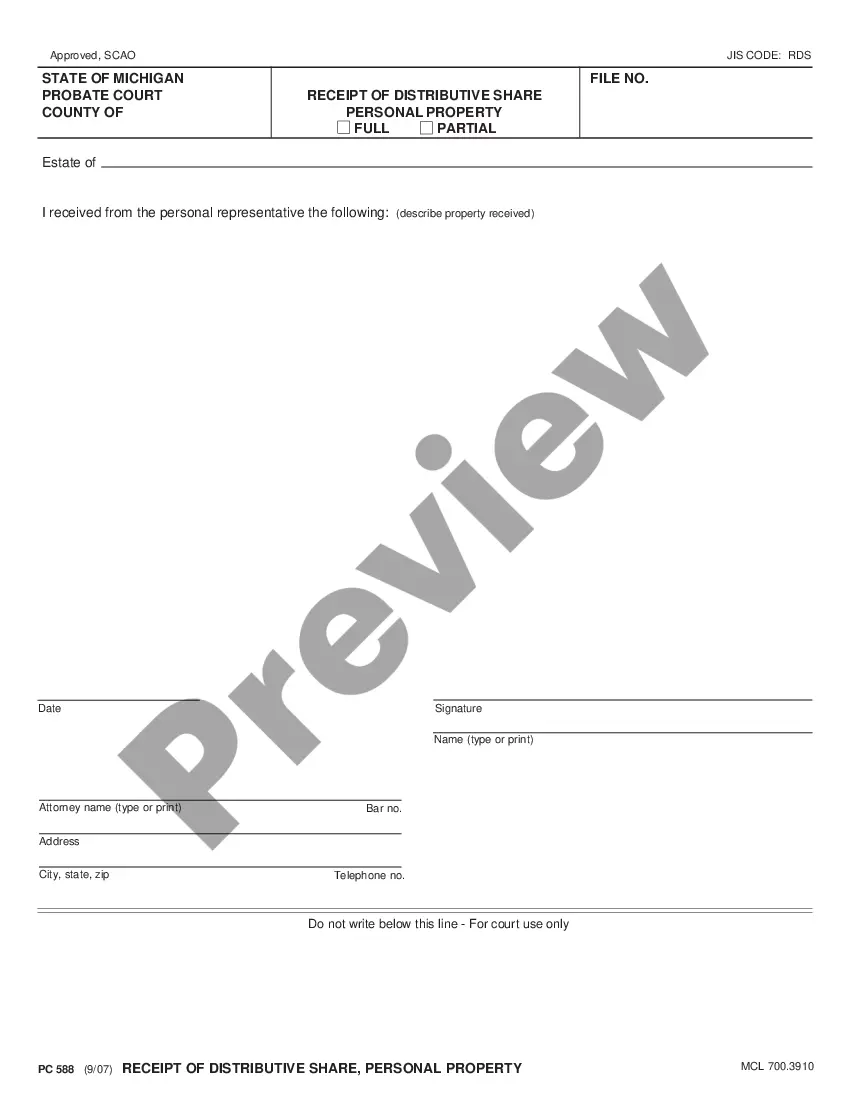

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Montgomery Amendment of terms of Class B preferred stock.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Preferred stock is generally considered less volatile than common stock but typically has less potential for profit. Preferred stockholders generally do not have voting rights, as common stockholders do, but they have a greater claim to the company's assets.

When convertible preferred stock holders choose to convert their stocks to common stocks, the stocks they receive are newly issued. This increases the total number of common shares. Because the number of common shares increases while the value of the company remains the same, the value of existing shares goes down.

Convertible preferred stock is a type of preferred share that pays a dividend and can be converted into common stock at a fixed conversion ratio after a specified time.

Series B financing is the second round of funding for a company that has met certain milestones and is past the initial startup stage. Series B investors usually pay a higher share price for investing in the company than Series A investors. Series B investors typically prefer convertible preferred stock vs.

Purchaser understands that the Preferred Stock and the shares of Common Stock issuable upon conversion of the Preferred Stock (the Underlying Shares) are and will be restricted securities as that term is defined in Rule 144 under the Securities Act of 1933, as amended, and the Preferred Stock and the Underlying

A Holder may transfer some or all of its Preferred Shares without the consent of the Corporation, subject to compliance with the Securities Act of 1933, as amended.

Key Takeaways Convertible preferred shares can be converted into common stock at a fixed conversion ratio. Once the market price of the company's common stock rises above the conversion price, it may be worthwhile for the preferred shareholders to convert and realize an immediate profit.

This price, known as the conversion price, is equal to the purchase price of the preferred share, divided by the conversion ratio. So for Acme, the market conversion price is $15.38 or ($100/6.5). In other words, Acme common shares need to be trading above $15.38 for investors to gain from a conversion.

Series S Preferred Stock means the shares of the Company's Series S Contingent Convertible Perpetual Non-Cumulative Preferred Stock, no par value and liquidation preference $100,000 per share.

Preferred shares trade on stock exchanges and can be purchased via an online brokerage that offers them. Not all online brokerages offer preferred stock. Investors should also note that the ticker symbol for preferred stock is different than the symbol used for companies' common stock.