Fairfax Virginia Amendment to Articles of Incorporation: Paying Distributions Legally Available In Fairfax, Virginia, amendments to the Articles of Incorporation can be made to address the process of paying distributions out of any funds legally available for such purposes. The purpose of these amendments is to provide clear guidelines and regulations for corporations in Fairfax regarding the payment of distributions to shareholders or owners of the company. The amendment ensures that organizations operate within the legal boundaries when it comes to distributing funds to shareholders. It outlines the specific requirements and procedures that must be followed, ensuring compliance with Virginia state laws and regulations. The Fairfax Virginia Amendment to Articles of Incorporation includes the following key aspects: 1. Definition of Legally Available Funds: This section specifies the types of funds that can be considered legally available for distribution. These may include profits, retained earnings, or other forms of surplus defined by the state corporation laws. 2. Considerations for Distributions: The amendment may outline the factors to be taken into account before authorizing distributions. This could include ensuring that the corporation has sufficient funds to meet its obligations, such as paying debts, taxes, and other legal requirements. 3. Board Approval: The amendment may require that the board of directors approves distributions from legally available funds. This ensures responsible decision-making and protects the interests of both shareholders and the corporation itself. 4. Limitations and Restrictions: The amendment may impose restrictions or limitations on the distribution of funds. For instance, it may specify a maximum percentage of profits that can be allocated as distributions, or it may outline circumstances under which distributions are prohibited. 5. Reporting and Documentation: The amendment may require corporations to maintain accurate records and documentation regarding distributions. This ensures transparency and helps to prevent any potential misuse of funds. Different Types of Fairfax Virginia Amendments to Articles of Incorporation Regarding Paying Distributions: 1. Authorized Distributions: This type of amendment specifies the types of distributions that are legally allowed, including dividends, share repurchases, or other forms of monetary distributions. 2. Prohibited Distributions: Some amendments may focus on defining restrictions or circumstances where distributions are prohibited. This could include situations where the corporation lacks sufficient funds, thereby safeguarding its financial stability. 3. Special Distributions: This type of amendment addresses specific scenarios where special distributions may be authorized, such as distributions related to mergers, acquisitions, or stock options. 4. Non-Monetary Distributions: Certain amendments may expand the definition of distributions to include non-monetary assets, such as property or securities. These amendments establish guidelines for the transfer of assets as distributions among shareholders. It is important for corporations in Fairfax, Virginia, to carefully consider and understand the applicable amendments regarding paying distributions out of any funds legally available. Adhering to these regulations ensures compliance with state laws and fosters transparency in financial operations. It is advisable to consult legal professionals specializing in corporate law to ensure the proper implementation of these amendments within a corporation's Articles of Incorporation.

Fairfax Virginia Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor

Description

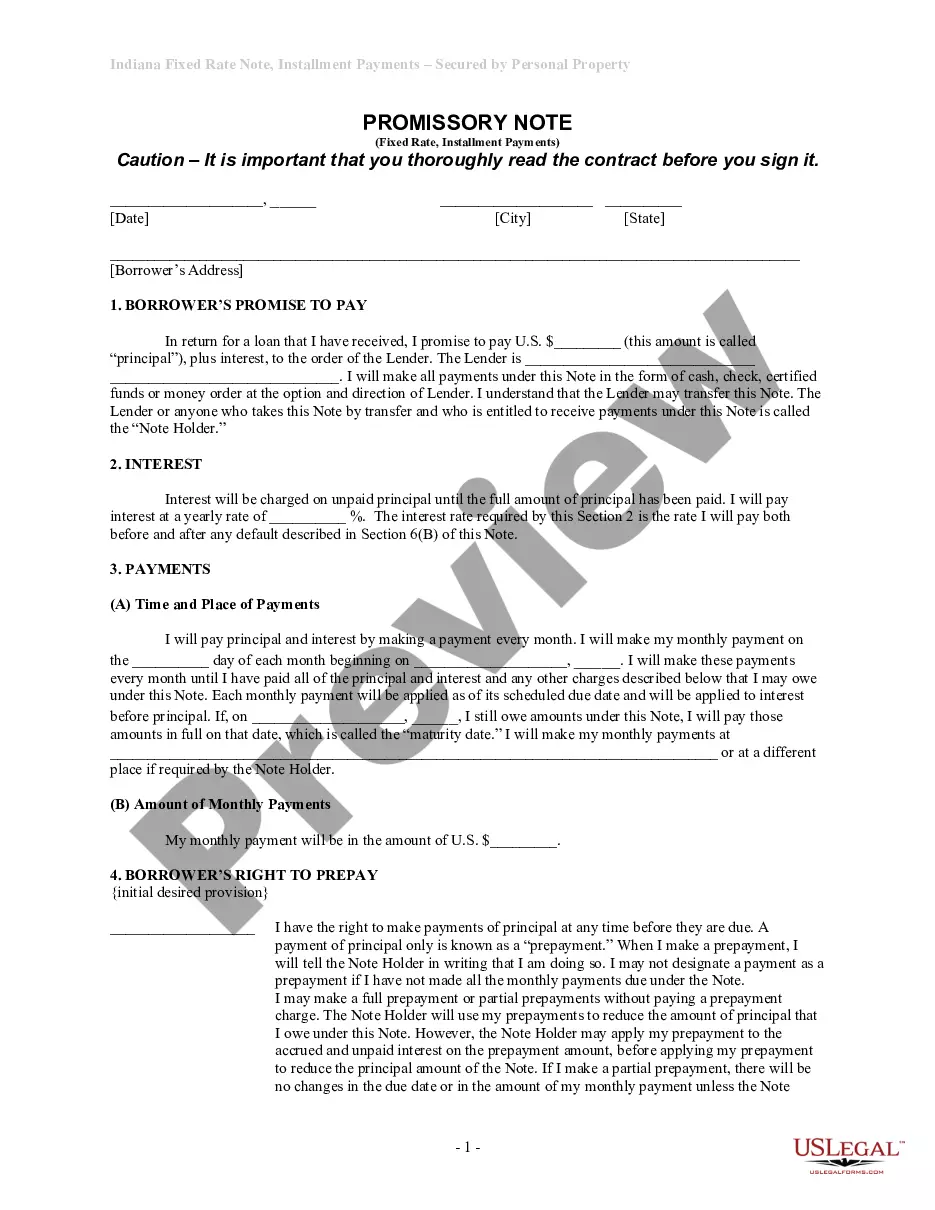

How to fill out Fairfax Virginia Amendment To Articles Of Incorporation Regarding Paying Distributions Out Of Any Funds Legally Available Therefor?

How much time does it usually take you to create a legal document? Since every state has its laws and regulations for every life situation, finding a Fairfax Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor suiting all local requirements can be tiring, and ordering it from a professional attorney is often expensive. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, collected by states and areas of use. Aside from the Fairfax Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor, here you can get any specific form to run your business or individual affairs, complying with your county requirements. Experts check all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can retain the document in your profile at any time in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Fairfax Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Fairfax Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!