The Maricopa Arizona Amendment to Articles of Incorporation serves as a crucial legal document that outlines the guidelines and regulations concerning the payment of distributions from funds available within a corporation. By providing a detailed description of this amendment, we can better understand its purpose and implications. The primary objective of the Maricopa Arizona Amendment to Articles of Incorporation is to establish a framework for making distributions, ensuring that they are paid solely from funds that are legally available for such purposes. This amendment aims to protect the interests of both the corporation and its shareholders by preventing the distribution of funds that could potentially lead to financial instability or violation of legal obligations. The key focus of this amendment is the concept of "funds legally available therefor." This term refers to the specific source of funds from which distributions can be made in compliance with the Maricopa Arizona state laws and regulations. The amendment ensures that any distribution made by a corporation is sourced from profits or surplus that can be appropriately utilized for this purpose, while also adhering to other financial obligations, such as creditor claims or legal requirements. Within the Maricopa Arizona Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor, several subcategories may exist. Some commonly observed types are: 1. General Distribution Guidelines: This section provides a comprehensive overview of the rules and regulations for making distributions from funds legally available within the corporation. It outlines the criteria that must be met to ensure compliance and protect the corporation's financial stability. 2. Definition of Legally Available Funds: This subsection delves into the specific types of funds that are considered legally available for distributions. These may include accumulated profits, surplus from previous fiscal years, or other income sources deemed acceptable under Maricopa Arizona laws. 3. Scope of Distributions: This clause outlines the range of permissible distributions, such as dividends, stock buybacks, or other forms of liquidity-sharing with shareholders. It may also entail restrictions or criteria that must be met before a distribution can be executed, such as profitability requirements or shareholder approval. 4. Safeguarding Creditors and Legal Obligations: This portion ensures that the process of making distributions does not jeopardize the corporation's ability to fulfill its financial obligations, including payments to creditors, taxes, or any regulatory requirements. It prioritizes the stability and compliance of the corporation over the distribution of funds. In summary, the Maricopa Arizona Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor establishes a clear framework for corporations to make distributions while upholding financial stability and legal compliance. By delineating the guidelines and emphasizing the importance of sourcing funds legally, this amendment ensures the protection of the corporation's interests and the rights of its shareholders.

Maricopa Arizona Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor

Description

How to fill out Maricopa Arizona Amendment To Articles Of Incorporation Regarding Paying Distributions Out Of Any Funds Legally Available Therefor?

Whether you plan to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business case. All files are grouped by state and area of use, so picking a copy like Maricopa Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few more steps to get the Maricopa Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor. Follow the instructions below:

- Make certain the sample fulfills your individual needs and state law regulations.

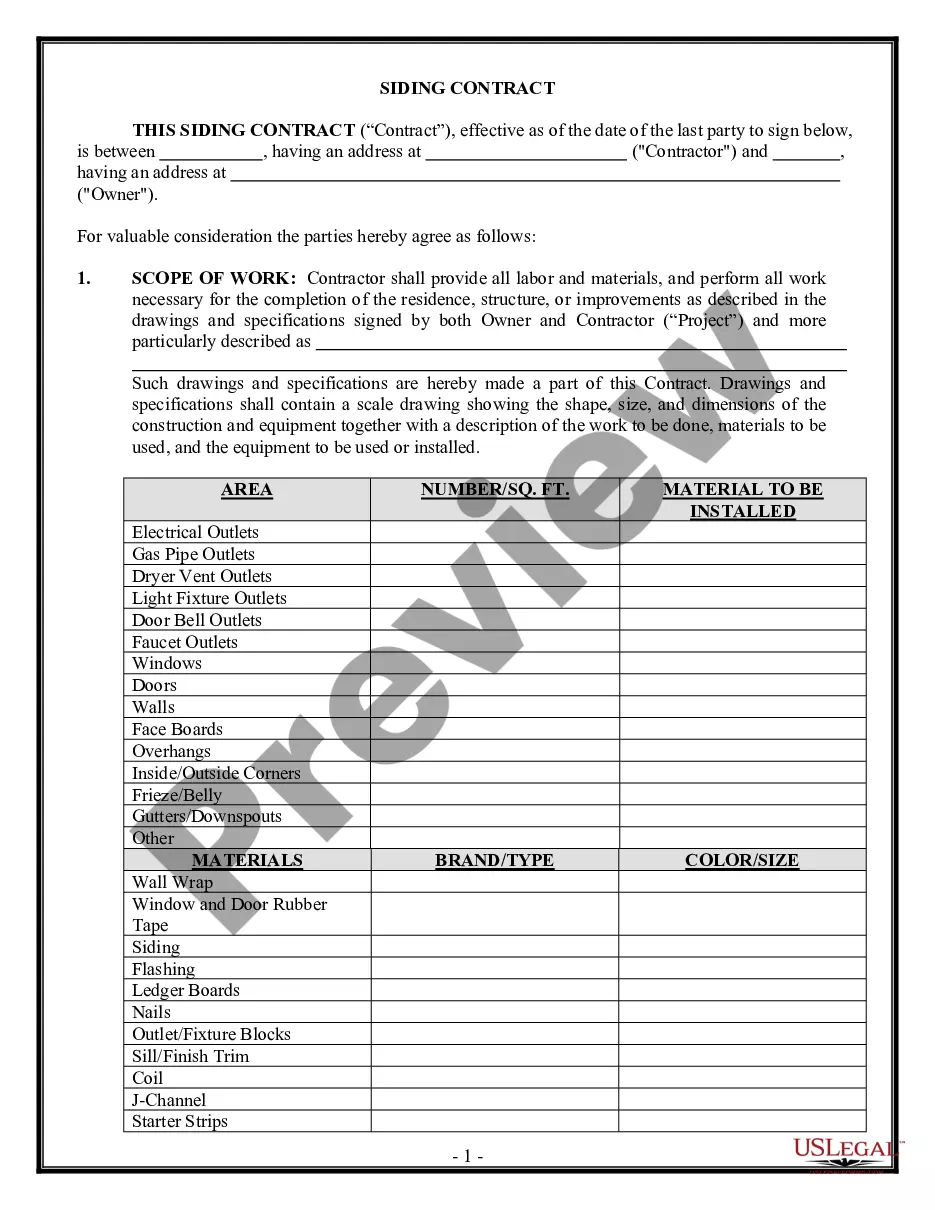

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to get the file when you find the right one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!