The Nassau New York Amendment to Articles of Incorporation is a legal process undertaken by corporations registered in Nassau County, New York, to modify their existing Articles of Incorporation for specific purposes, including the payment of distributions out of legally available funds. This amendment is crucial for corporations seeking to allocate profits and dividends to their shareholders in compliance with applicable laws and regulations. There are different types of Nassau New York Amendments to Articles of Incorporation that pertain to the payment of distributions out of any funds legally available therefor. Some important variations include: 1. Basic Amendment: This amendment allows the corporation to make distributions to its shareholders, subject to legal requirements and the availability of funds as stipulated by governing authorities. By modifying the original Articles of Incorporation, this type of amendment typically outlines procedures, limitations, and guidelines for distributing funds among shareholders. 2. Capital Distribution Amendment: This amendment specifically deals with the distribution of capital or extraordinary dividends to shareholders. It ensures compliance with legal provisions and defines the circumstances under which such distributions can be made, usually requiring the approval of the board of directors or shareholders. 3. Dividend Payment Amendment: This amendment focuses on the payment of regular dividends to shareholders. It provides clarity on the frequency, amount, and criteria for determining dividend payments. The amendment may also outline the process for declaring dividends and any limitations imposed by state laws. 4. Surplus Distribution Amendment: In scenarios where a corporation has accumulated surplus funds beyond its capital requirements, this amendment enables the distribution of surplus to shareholders. It sets forth guidelines and procedures for the distribution, ensuring compliance with relevant regulations. 5. Taxable Distribution Amendment: This amendment addresses taxable distributions made by the corporation. It ensures proper compliance with the Internal Revenue Service (IRS) rules and regulations related to the taxable treatment of distributions, such as dividends, capital gains, or liquidation proceeds. It is important to consult legal professionals specializing in corporate law to navigate the intricacies of Nassau New York Amendments to Articles of Incorporation regarding paying distributions out of any funds legally available therefor. These professionals can help ensure that the amendment accurately reflects the corporation's intentions while adhering to relevant laws, ultimately safeguarding the corporation's interests and its shareholders.

Nassau New York Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor

Description

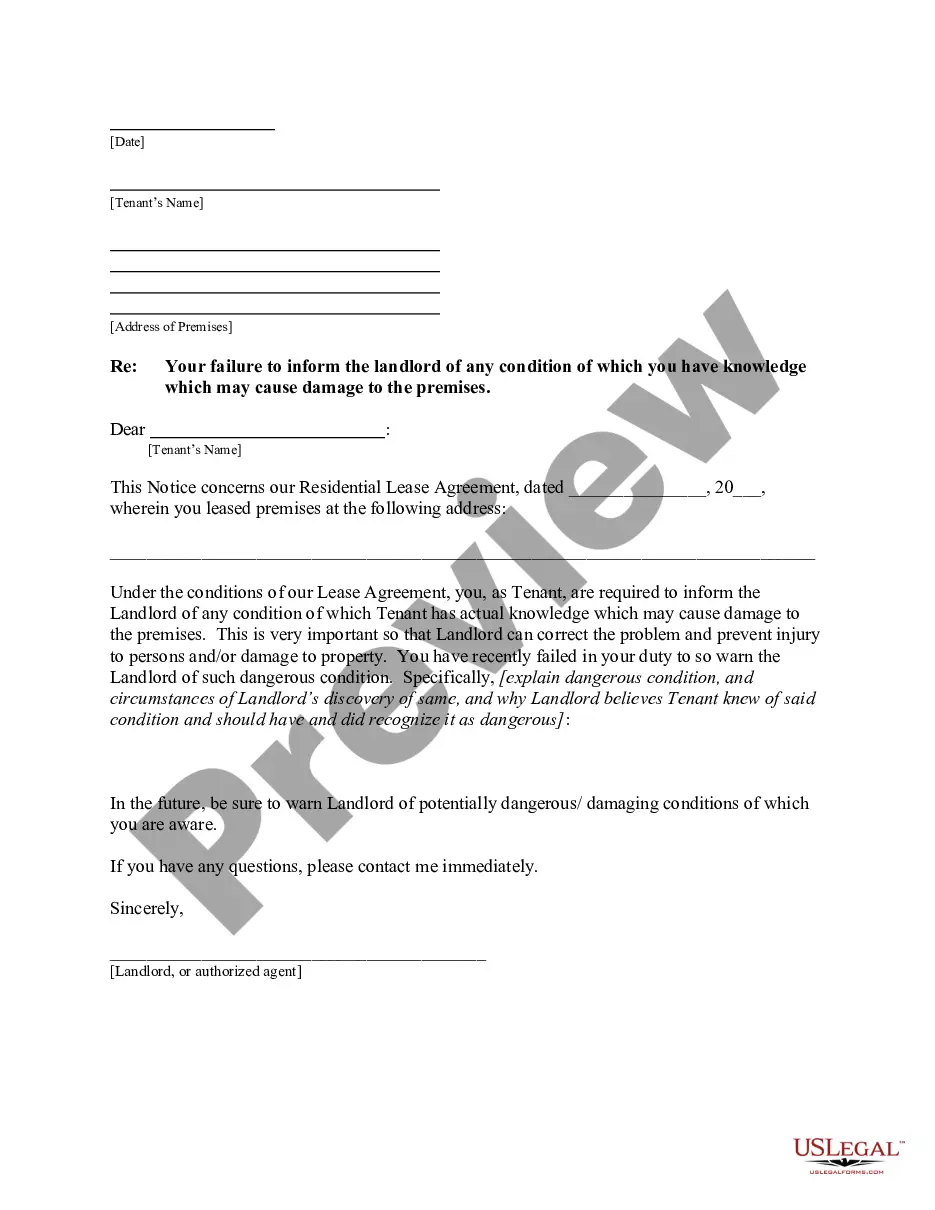

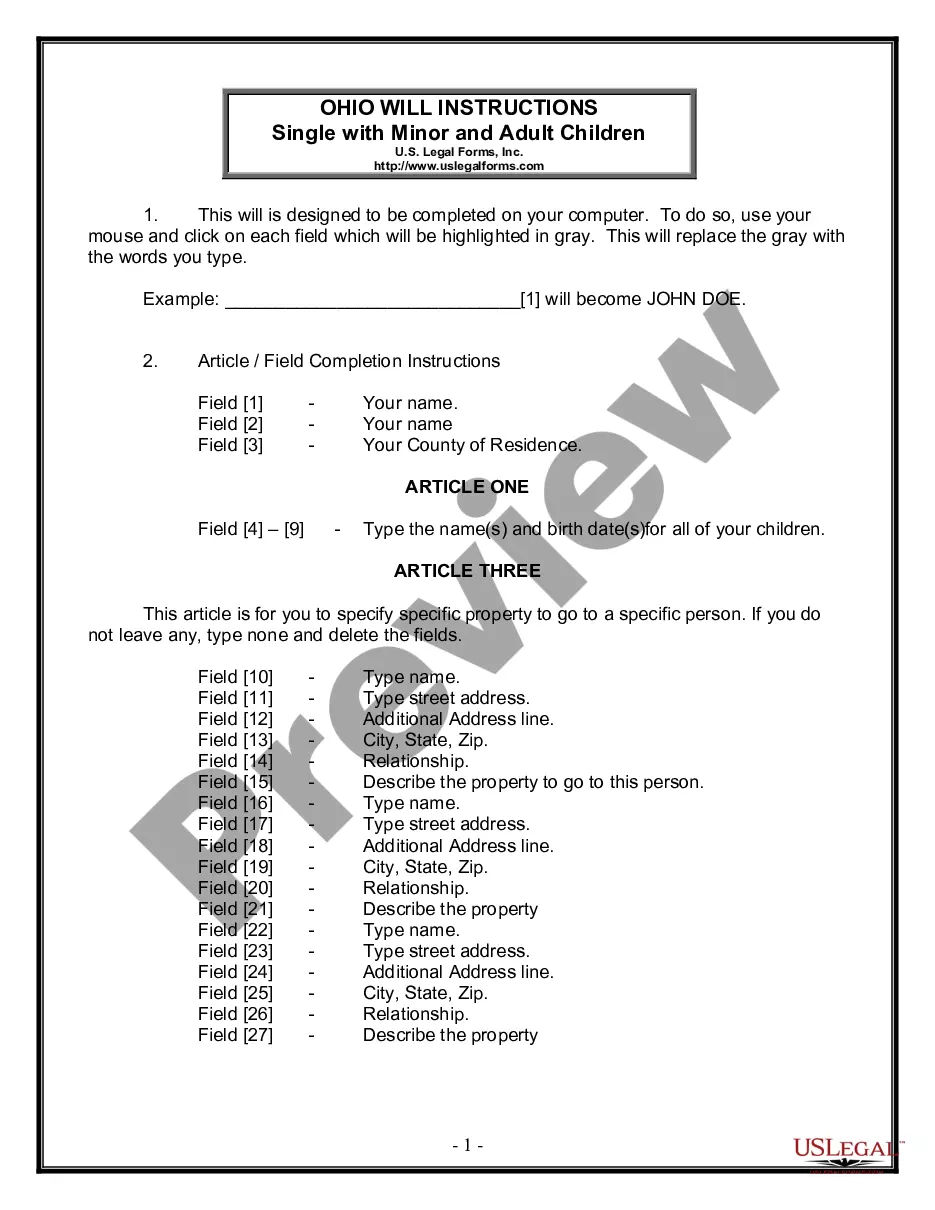

How to fill out Nassau New York Amendment To Articles Of Incorporation Regarding Paying Distributions Out Of Any Funds Legally Available Therefor?

If you need to get a trustworthy legal document supplier to find the Nassau Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed form.

- You can browse from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of supporting resources, and dedicated support team make it simple to find and execute different papers.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply select to look for or browse Nassau Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor, either by a keyword or by the state/county the document is intended for. After locating needed form, you can log in and download it or retain it in the My Forms tab.

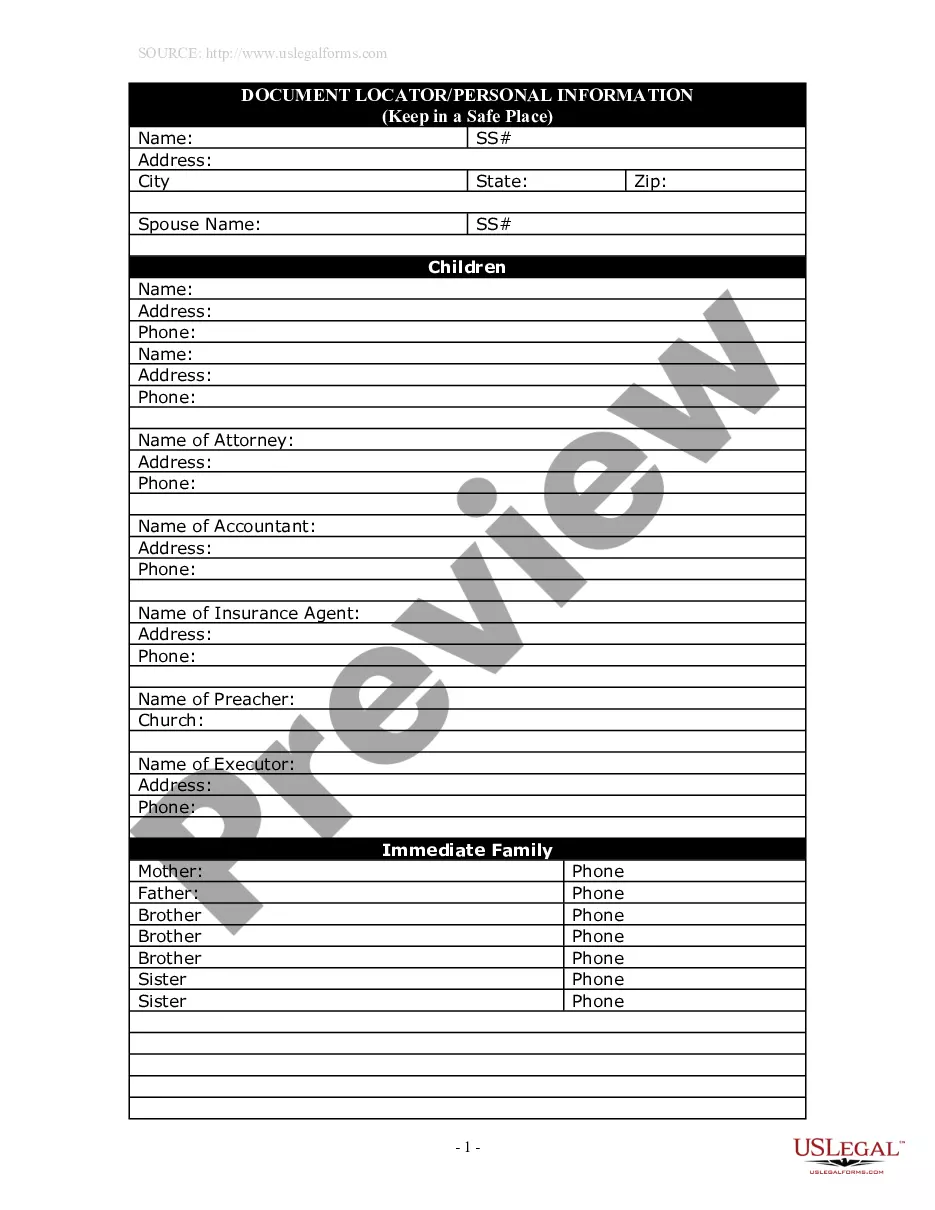

Don't have an account? It's effortless to get started! Simply find the Nassau Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor template and take a look at the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Register an account and select a subscription plan. The template will be instantly ready for download as soon as the payment is processed. Now you can execute the form.

Taking care of your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes these tasks less expensive and more reasonably priced. Create your first business, arrange your advance care planning, create a real estate contract, or execute the Nassau Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor - all from the convenience of your sofa.

Join US Legal Forms now!