Title: Understanding Travis Texas Amendment to Articles of Incorporation: Paying Distributions Legally Introduction: The Travis Texas Amendment to Articles of Incorporation outlines the provisions pertaining to paying distributions out of any funds legally available for corporations in Travis County, Texas. This detailed description delves into the key aspects of this amendment, highlighting its importance and various types that may exist. Keywords: Travis Texas, Amendment to Articles of Incorporation, paying distributions, funds legally available I. Overview of Travis Texas Amendment to Articles of Incorporation: The Travis Texas Amendment to Articles of Incorporation represents a legal provision that regulates the payment of distributions by corporations registered in Travis County, Texas. This amendment ensures that distributions are made only from funds that are legally available, safeguarding the interests of stakeholders and maintaining the financial stability of the corporation. II. Importance of Paying Distributions Legally: 1. Protecting Stakeholders' Interests: The amendment ensures that distributions are made responsibly, preventing any misuse of corporate resources that could harm shareholders' investments. 2. Financial Stability: By allowing distributions only from funds that are legally available, the amendment safeguards the corporation's financial stability and viability in the long run. 3. Compliance with Legal Obligations: This provision ensures corporations adhere to legal requirements and regulations related to financial matters. III. Types of Travis Texas Amendment to Articles of Incorporation regarding Paying Distributions: There can be various types of amendments related to paying distributions out of any funds legally available in Travis County, Texas. These variations may include: 1. Condition-Driven Amendments: — Restricted Distribution: A specific condition for eligible funds to be used for distributions, such as earnings exceeding a certain threshold or after fulfilling cumulative preferred stock dividend obligations. — Time-Based Distribution: Payment of distributions allowed only after a specified period or milestone has been reached. 2. Purpose-Driven Amendments: — Operating Income Amendment: Distributions are permitted from the corporation's operating income or net profit sources, excluding capital appreciation or non-operational gains. — Dividend Amendment: Defines conditions under which dividends can be paid to shareholders, considering factors like the corporation's financial health, dividend policy, and any applicable legal restrictions. 3. Statutory Compliance Amendments: — Compliance with Texas State Law: Incorporates provisions to ensure legal compliance with specific requirements set by the Texas Secretary of State or other relevant authorities. — Regulatory Change Amendment: Introduces modifications to align the corporation's distribution practices with newly enacted laws or regulations. IV. Conclusion: The Travis Texas Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available is a significant provision that governs the responsible disbursement of funds for corporations in Travis County, Texas. By adhering to this amendment, corporations protect the interests of stakeholders, maintain financial stability, and ensure compliance with legal obligations. Understanding the various types of amendments related to paying distributions helps corporations establish a robust and legally compliant framework for their financial operations.

Travis Texas Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor

Description

How to fill out Travis Texas Amendment To Articles Of Incorporation Regarding Paying Distributions Out Of Any Funds Legally Available Therefor?

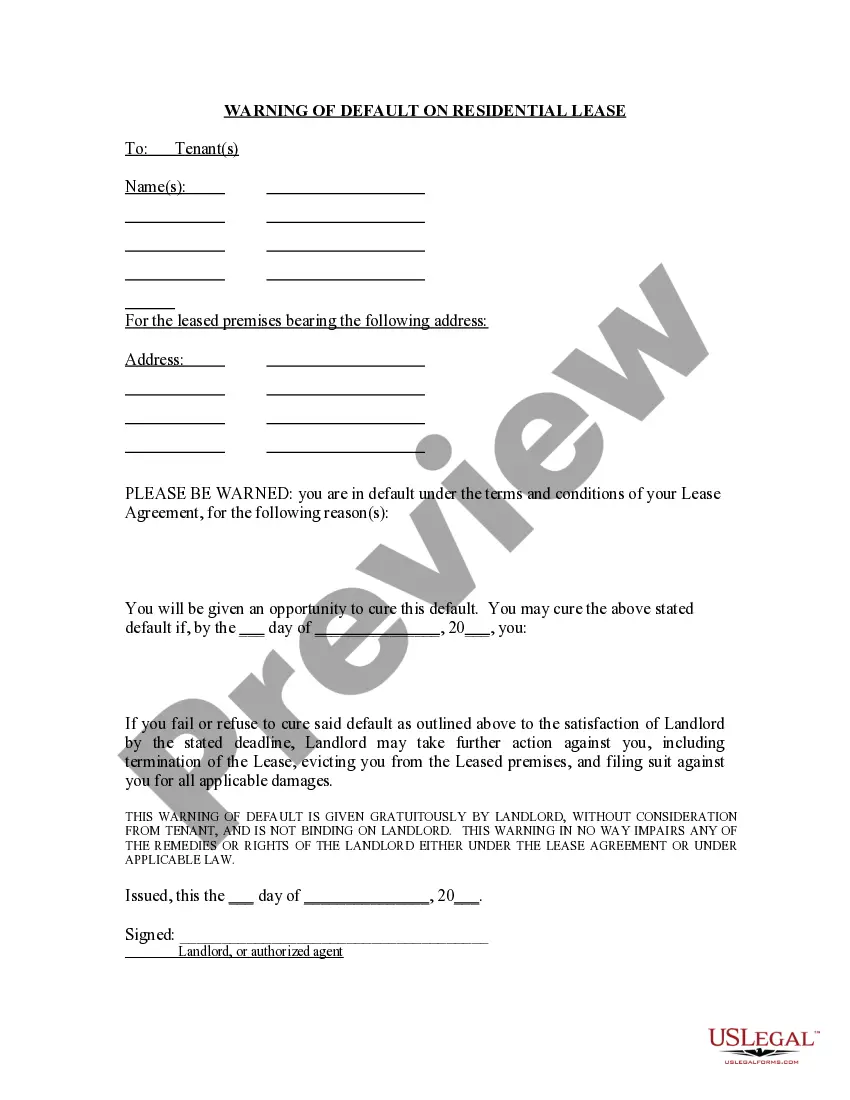

Creating documents, like Travis Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor, to take care of your legal affairs is a challenging and time-consumming process. Many circumstances require an attorney’s involvement, which also makes this task expensive. However, you can get your legal affairs into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms crafted for different cases and life circumstances. We ensure each form is compliant with the laws of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Travis Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor form. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your form? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is just as simple! Here’s what you need to do before downloading Travis Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor:

- Make sure that your document is compliant with your state/county since the rules for creating legal documents may differ from one state another.

- Find out more about the form by previewing it or reading a brief description. If the Travis Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start using our website and download the form.

- Everything looks good on your end? Hit the Buy now button and select the subscription plan.

- Select the payment gateway and enter your payment information.

- Your form is ready to go. You can try and download it.

It’s easy to locate and buy the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!