Nassau, New York Equity Incentive Plan is a comprehensive program designed to attract and retain talented individuals by offering them equity-based compensation. This plan allows eligible employees to become shareholders in the company, aligning their interests with the long-term success of the organization. Equity incentive plans are commonly implemented in various industries and are particularly popular among start-ups, high-growth companies, and established organizations alike. The Nassau, New York Equity Incentive Plan grants employees the opportunity to acquire ownership stakes or stock options, presenting a powerful motivational tool. By providing employees with a financial stake in the company, this plan encourages them to go above and beyond their regular duties, fostering a stronger sense of commitment and motivation. In turn, this often leads to increased productivity, higher levels of job satisfaction, and improved overall company performance. There are different types of Nassau, New York Equity Incentive Plans, depending on the specific objectives and preferences of the company. Some common variations include: 1. Stock Options: Stock options are the most widely used form of equity incentive plans. They grant employees the right to purchase company stock at a predetermined price (exercise price) within a specified timeframe. Stock options often have a vesting schedule, which means that employees must work for a certain period before they can exercise their options. 2. Restricted Stock Units (RSS): RSS are grants of company stock that are subject to certain restrictions or vesting conditions. Employees receive these units as compensation, but they do not own them outright until the vesting requirements are met. Once the RSS vest, employees gain full ownership of the corresponding shares. 3. Employee Stock Purchase Plans (ESPN): ESPN enable employees to purchase company shares at a discounted price, usually through payroll deductions. These plans give employees the opportunity to accumulate company stock gradually and are often offered as a means of fostering a sense of ownership and loyalty. 4. Performance Shares: Performance shares are granted based on specific performance goals or metrics set by the company. If the predefined targets are achieved, employees receive shares at a predetermined ratio. This type of equity incentive plan emphasizes performance and aligns the interests of employees with the company's strategic objectives. Nassau, New York Equity Incentive Plan serves as a valuable tool for companies looking to not only attract and retain top talent but also encourage dedication, motivation, and ultimately drive long-term success. It is important for businesses to consult legal and financial professionals to create and implement the most suitable plan for their specific needs and goals.

Nassau New York Equity Incentive Plan

Description

How to fill out Nassau New York Equity Incentive Plan?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for professional help to draft some of them from scratch, including Nassau Equity Incentive Plan, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in different categories varying from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching process less challenging. You can also find information materials and tutorials on the website to make any activities associated with paperwork completion straightforward.

Here's how you can find and download Nassau Equity Incentive Plan.

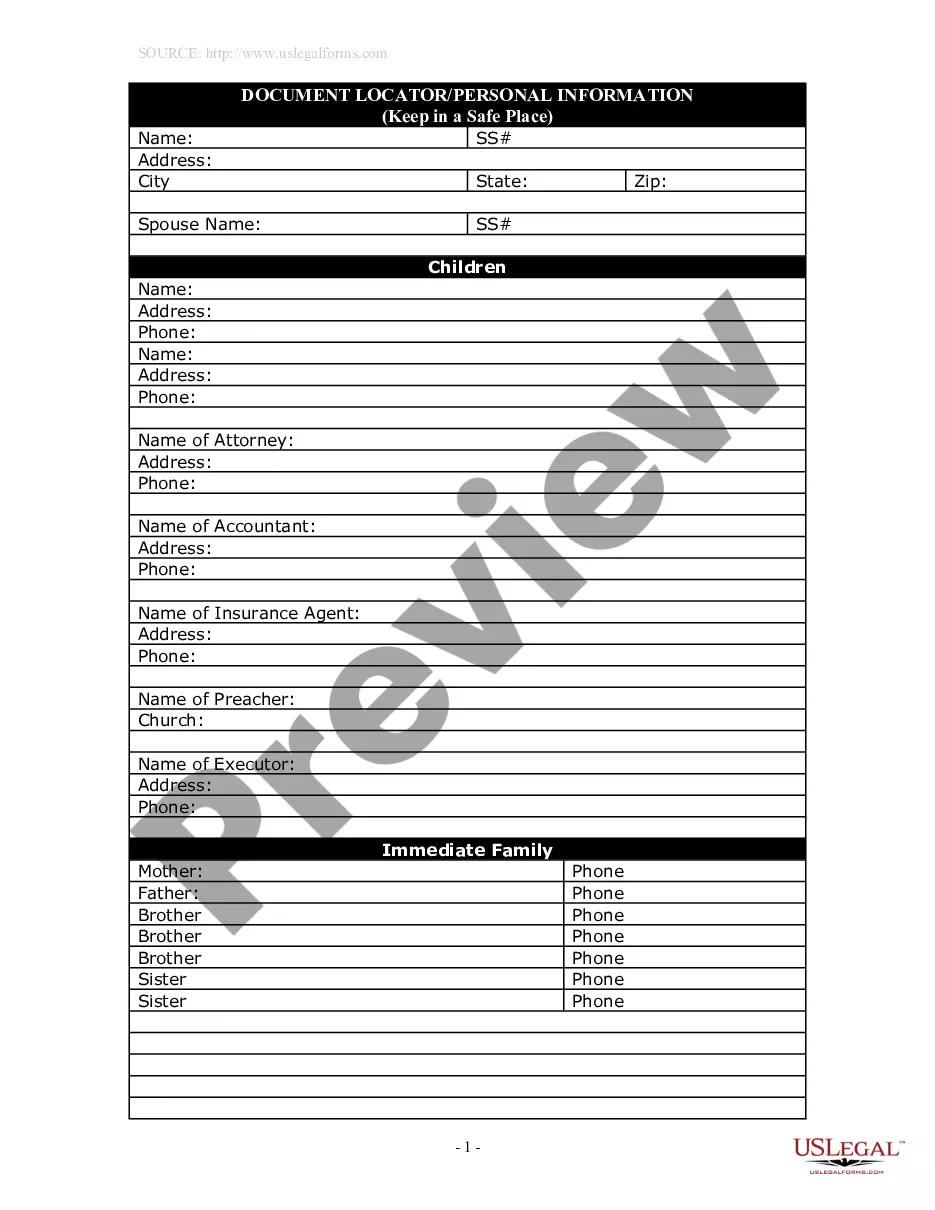

- Take a look at the document's preview and outline (if available) to get a basic information on what you’ll get after downloading the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can affect the validity of some records.

- Examine the related document templates or start the search over to locate the right file.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment method, and buy Nassau Equity Incentive Plan.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Nassau Equity Incentive Plan, log in to your account, and download it. Needless to say, our platform can’t replace a lawyer completely. If you have to cope with an exceptionally challenging case, we recommend getting an attorney to examine your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Become one of them today and get your state-specific paperwork with ease!