Harris Texas Purchase of Common Stock for Treasury of Company: A Comprehensive Overview In the financial world, the Harris Texas Purchase of Common Stock for Treasury of Company refers to a strategic move made by a company to buy back its own shares from the open market. By repurchasing its outstanding common stock, a company like Harris Texas seeks to create value and manage its capital structure effectively. The practice of buying common stock for treasury shares involves the company investing its retained earnings or surplus cash in purchasing its own shares from existing shareholders or the secondary market. This transaction reduces the total number of outstanding shares in circulation, thereby increasing the ownership stake of existing shareholders. Why Companies Engage in the Purchase of Common Stock for Treasury: 1. Reinforcing Market Confidence: Companies, including Harris Texas, may engage in the Purchase of Common Stock for Treasury to signal market confidence in their financial soundness, development, or future growth prospects. 2. Capital Allocation Optimization: This strategic move helps optimize the company's capital allocation by reallocating surplus cash towards investment opportunities with more lucrative returns. 3. Earnings per Share Enhancement: By reducing the number of outstanding shares, the company can enhance its earnings per share (EPS). This can lead to increased investor confidence and a potentially positive impact on the stock price. 4. Preventing Hostile Takeovers: A higher percentage of treasury stock held by the company can act as a deterrent against hostile takeovers and protect the business's strategic interests. Different Types of Harris Texas Purchase of Common Stock for Treasury: 1. Open Market Purchases: In open market purchases, Harris Texas acquires its own shares through normal trading channels like the stock exchange, where shares are bought from public shareholders. 2. Private Negotiated Purchases: Alternatively, Harris Texas may directly negotiate with significant shareholders or institutional investors to acquire their common stock, usually at a mutually agreed-upon price. 3. Tender Offers: In some cases, Harris Texas may initiate a tender offer to buy back shares from its shareholders at a specific price over a specified period. Shareholders have the option to accept or reject the offer. Conclusion: The Harris Texas Purchase of Common Stock for Treasury of Company is a strategic financial maneuver undertaken by companies to buy back their own shares from the open market or directly from shareholders. This practice aims to optimize capital allocation, enhance investor confidence, and protect the company's interests. By reducing the number of shares outstanding, companies like Harris Texas can potentially improve earnings per share and deter hostile takeovers, resulting in long-term value creation.

Harris Texas Purchase of common stock for treasury of company

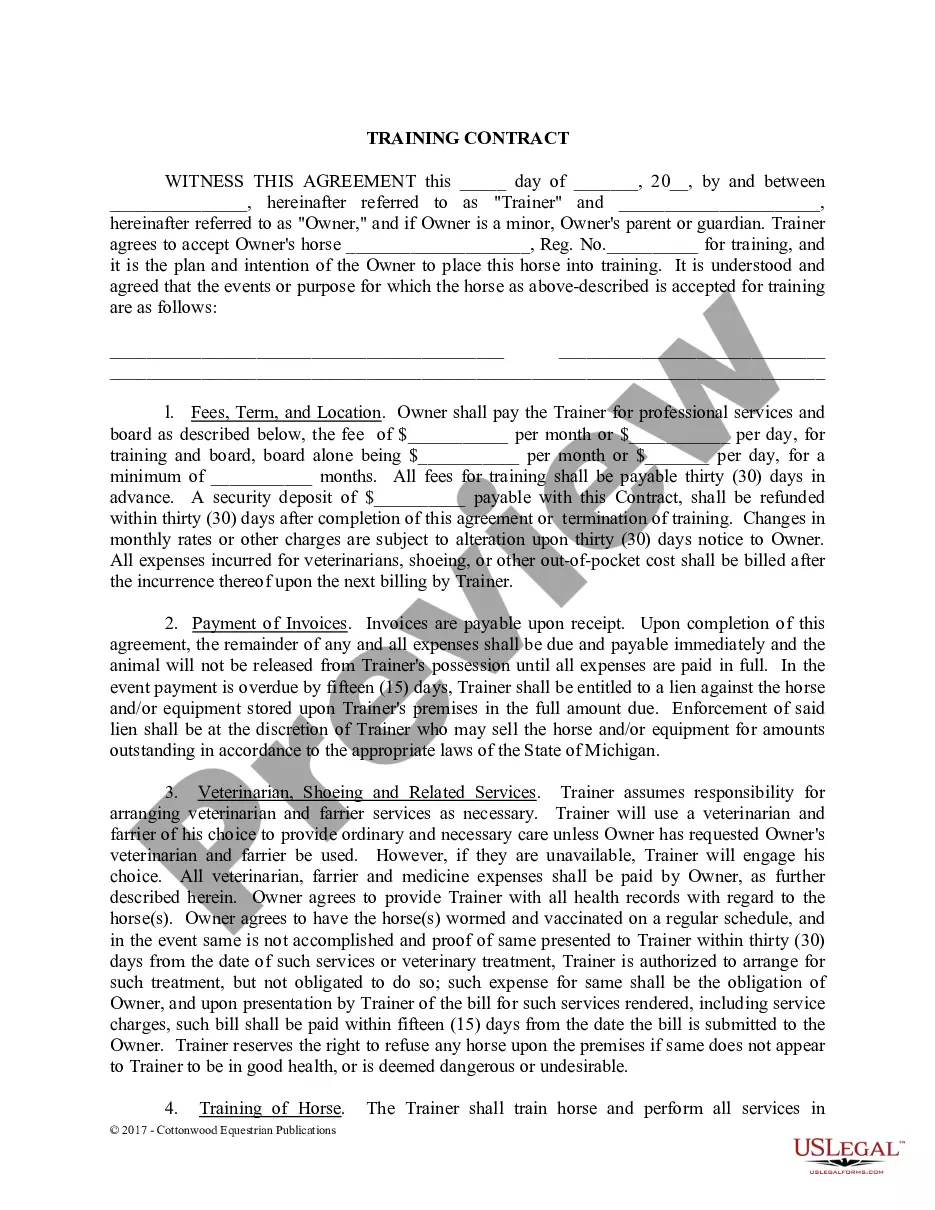

Description

How to fill out Harris Texas Purchase Of Common Stock For Treasury Of Company?

Preparing legal documentation can be burdensome. Besides, if you decide to ask a legal professional to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Harris Purchase of common stock for treasury of company, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Therefore, if you need the latest version of the Harris Purchase of common stock for treasury of company, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Harris Purchase of common stock for treasury of company:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Harris Purchase of common stock for treasury of company and download it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!