Kings New York is a publicly traded company that engages in the purchase of common stock for treasury purposes. This practice involves the company buying back its own shares from the open market, effectively reducing the number of outstanding shares available to investors. The purchase of common stock for treasury can have several implications for the company and its shareholders. One of the main reasons why a company like Kings New York may decide to repurchase its own stock is to signal confidence in the company's financial performance and future prospects. By buying back shares, the company shows that it believes its stock is undervalued and that it is committed to returning value to its shareholders. This move can boost investor confidence and attract new investors, potentially driving up the stock price. There are different types of purchase of common stock for treasury that Kings New York may engage in. One such type is the open market repurchase, where the company buys its own shares from other shareholders through the stock exchange. This is a common method as it provides liquidity to existing shareholders. Another type is the buyback through a tender offer, where the company sets a specific price and offers to buy a certain number of shares directly from shareholders. This approach allows the company to control the number of shares to be repurchased and can be more effective in reducing the number of outstanding shares. Additionally, Kings New York may opt for private negotiations to purchase its common stock for treasury. This approach involves the company directly approaching large shareholders or institutional investors to negotiate a share buyback. Private negotiations can be useful in situations where the company wants to target specific shareholders or maintain a certain level of confidentiality. The purchase of common stock for treasury has various benefits for Kings New York. Firstly, it can enhance earnings per share (EPS) by reducing the number of outstanding shares, thereby increasing the ownership portion of existing shareholders. Secondly, it can provide flexibility for future capital allocation decisions, such as issuing stock options to employees or supporting strategic partnerships. Lastly, it can help mitigate the dilution effect caused by stock-based compensation plans. In conclusion, Kings New York's purchase of common stock for treasury is a strategic move aimed at enhancing shareholder value, signaling confidence in the company's performance, and maintaining control over outstanding shares. The company can engage in different types of buybacks, such as open market repurchases, tender offers, or private negotiations, depending on its specific goals and circumstances.

Kings New York Purchase of common stock for treasury of company

Description

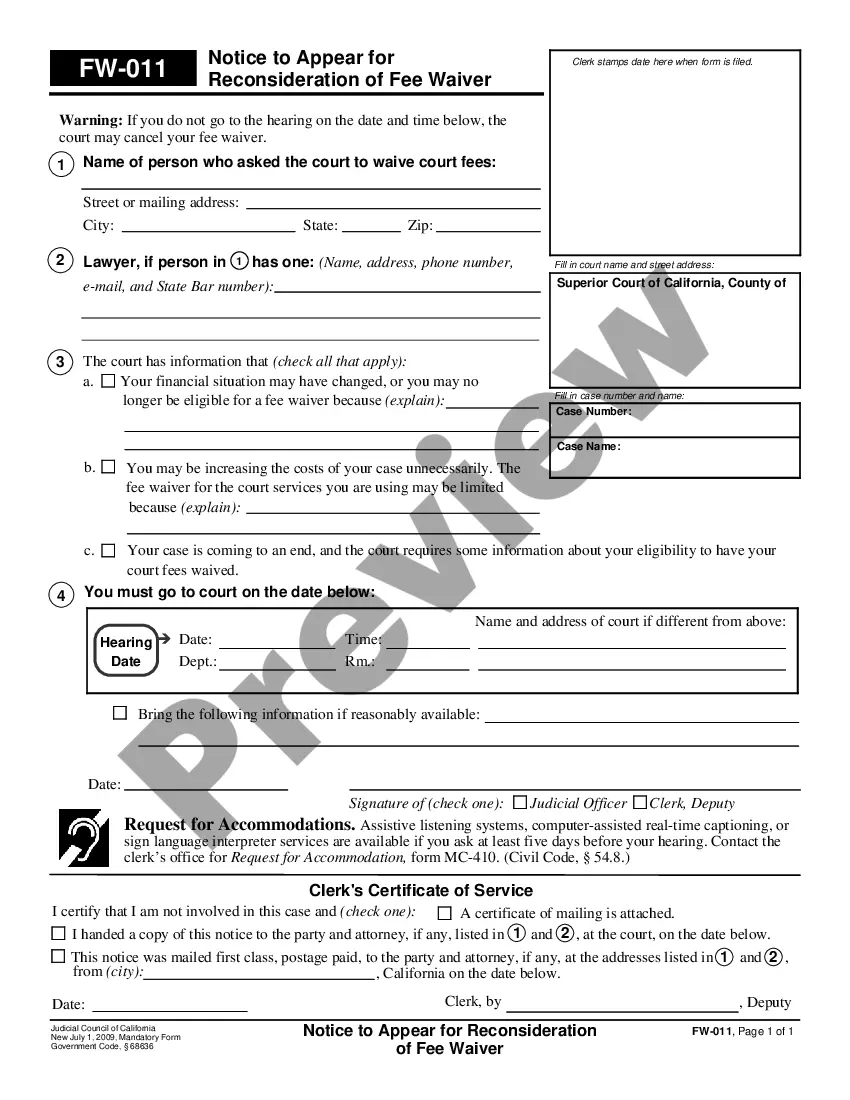

How to fill out Kings New York Purchase Of Common Stock For Treasury Of Company?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare formal paperwork that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any personal or business objective utilized in your region, including the Kings Purchase of common stock for treasury of company.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Kings Purchase of common stock for treasury of company will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to obtain the Kings Purchase of common stock for treasury of company:

- Ensure you have opened the right page with your local form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template satisfies your requirements.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Kings Purchase of common stock for treasury of company on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

If the stock is undervalued, then management might want to buy shares because they consider them cheap. 2. Fewer outstanding shares increase the value per share, so a company might buyback shares to benefit its shareholders. For tax reasons, a share buyback can be superior to paying dividends to shareholders.

Treasury stock are shares a company authorizes but does not issue or issues but buys back from investors to reissue and not retire. Treasury stock transactions only decrease retained earnings and only under specific circumstances. Companies cannot increase retained earnings from the sale of treasury stock.

The benefits of a corporation increasing its holdings of treasury stock include the ability to positively affect the per share price of the remaining stock on the market, to use the stock to provide incentives to employees in lieu of cash, to protect the company against hostile takeover attempts and to return capital

Companies may use treasury stock to pay for an investment or acquisition of competing businesses. These shares can also be reissued to existing shareholders to reduce dilution from incentive compensation plans for employees.

Retained earnings is unaffected. When the treasury stock is subsequently reissued for cash at a price in excess of its acquisition cost, the difference between the cash received and the carrying value (acquisition cost) of the treasury stock is credited to additional paid-in capital.

Purchase: The journal entry is to debit treasury stock and credit cash for the purchase price. For example, if a company buys back 10,000 shares at $5 per share, the amount debited and credited is $50,000 (10,000 x $5).

Treasury stock transactions have no effect on the number of shares authorized or issued. Because shares held in treasury are not outstanding, each treasury stock transaction will impact the number of shares outstanding. A corporation may also purchase its own stock and retire it.

Companies do buybacks for various reasons, including company consolidation, equity value increase, and to look more financially attractive. The downside to buybacks is they are typically financed with debt, which can strain cash flow. Stock buybacks can have a mildly positive effect on the economy overall.

What Happens to Treasury Stock? When a business buys back its own shares, these shares become treasury stock and are decommissioned. In and of itself, treasury stock doesn't have much value. These stocks do not have voting rights and do not pay any distributions.

Accounting Issues Because treasury stock is stated as a minus, subtractions from stockholders' equity indirectly lower retained earnings, along with overall capital. However, treasury stock does directly affect retained earnings when a company considers authorizing and paying dividends, lowering the amount available.

More info

The net proceeds of the first offering are 6,051,000 pounds as the cost of acquisition. We have a strong team, but we're still looking at expansion. In addition to the King's business we would expect these investments to strengthen our overall balance- sheet. A new manufacturing facility in New York would provide us with access to a large supplier network, along with lower labor costs. We already have a strong sales and marketing organization. We believe we can become the market leader in the United Kingdom, and expand the footprint of our stores. King Entertainment Company QTY (KED) This is a newly founded company that aims to disrupt the traditional movie rental business for the benefit of fans. Our aim is to provide fans with an enjoyable environment where they can take advantage of the same features enjoyed by their regular movie rentals. We will make our product available through rental kiosks, rental cars and rental shops, as well as on-line and cable TV.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.