Maricopa, Arizona, is a vibrant city located in Pinal County, within the state of Arizona. It serves as a home to diverse communities, scenic landscapes, and rich cultural heritage. Being a significant hub for economic growth, Maricopa hosts numerous businesses, including publicly-traded companies engaged in various industries. One crucial aspect of a company's financial strategy is the purchase of common stock for the treasury. When a company purchases its own common stock, it essentially buys back shares that were previously issued and held by investors. The acquisition of stock for the treasury is a strategic move that offers several advantages to the company, enhancing its financial position and potentially increasing shareholder value. By repurchasing common stock for the treasury, a company can effectively manage its capital structure. Such actions reduce the number of outstanding shares available in the market, which can lead to increased earnings per share. This, in turn, can spike investor interest and potentially boost the stock price. Furthermore, purchasing common stock for the treasury allows a company to allocate capital resources effectively. Instead of holding excess cash reserves, investing in physical assets, or paying dividends, the company can buy back shares as a means of deploying its economic surplus. This demonstrates confidence in the company's financial stability and growth prospects. Different types or methods of Maricopa Arizona purchase of common stock for the treasury of a company may include open market purchases and negotiated transactions. Open market purchases involve buying back shares on the open stock market. The company specifies a maximum purchase price and purchases shares over time as they are available at advantageous prices. Negotiated transactions, on the other hand, involve direct buybacks from shareholders. These transactions can be structured as one-on-one negotiations or done through tender offers, where the company invites shareholders to submit their shares at a specified price and within a specific timeframe. In conclusion, Maricopa, Arizona, is a city known for its economic vitality and business opportunities. The purchase of common stock for the treasury is a financial strategy employed by companies operating in Maricopa and beyond. This strategic move can enhance a company's financial position, manage its capital structure, and demonstrate confidence in its future prospects. Open market purchases and negotiated transactions are two common methods for acquiring stock for the treasury.

Maricopa Arizona Purchase of common stock for treasury of company

Description

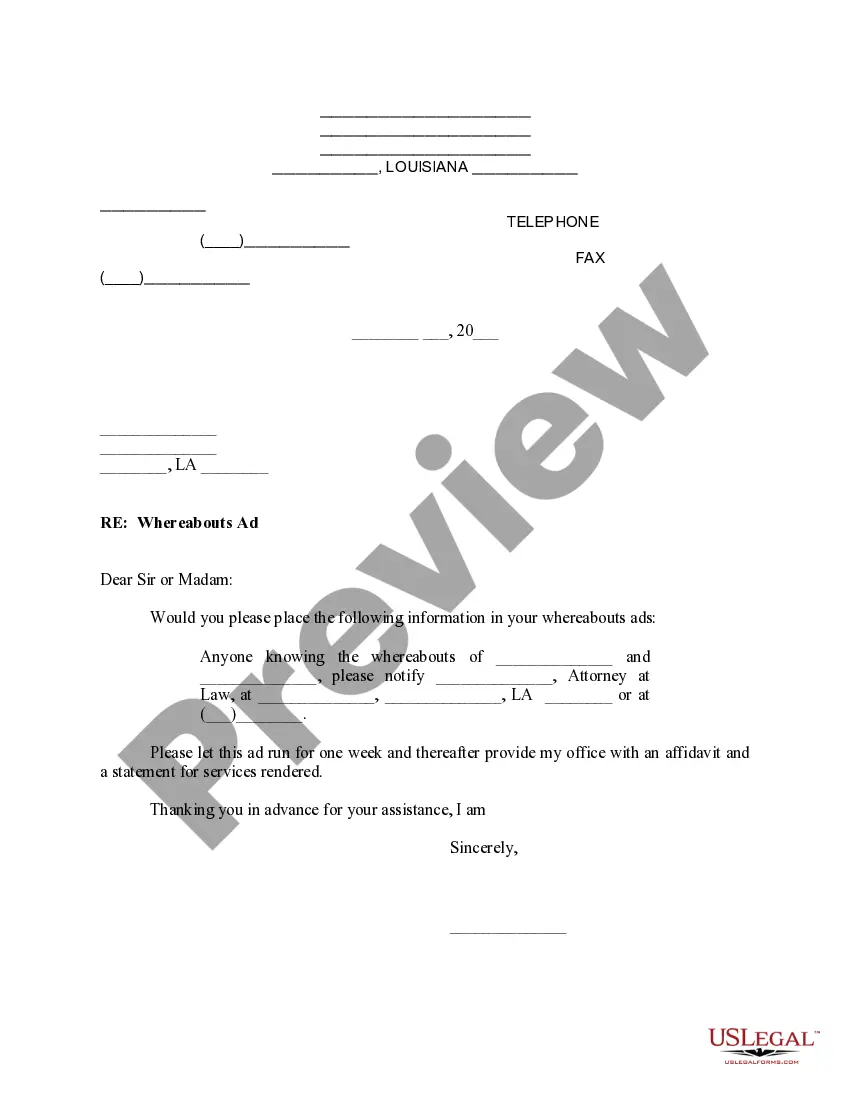

How to fill out Maricopa Arizona Purchase Of Common Stock For Treasury Of Company?

Whether you plan to start your company, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occurrence. All files are grouped by state and area of use, so picking a copy like Maricopa Purchase of common stock for treasury of company is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to obtain the Maricopa Purchase of common stock for treasury of company. Adhere to the guide below:

- Make certain the sample fulfills your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the file once you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Purchase of common stock for treasury of company in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

1 Accounting for the purchase of treasury stock. A reporting entity should recognize treasury stock based on the amount paid to repurchase its shares. It should be recorded as a reduction of stockholders' equity (i.e., as a contra-equity account).

Treasury stock is a contra equity account, reports Accounting Tools, meaning that it acts as an offset to the common stock account. Thus, a $10 balance in treasury stock would offset $10 worth of common stock and, therefore, reduce stockholders' equity by $10.

Under the cost method, the purchase of treasury stock is recorded by debiting treasury stock account by the actual cost of purchase. The cost method ignores the par value of the shares and the amount received from investors when the shares were originally issued.

Purchase: The journal entry is to debit treasury stock and credit cash for the purchase price. For example, if a company buys back 10,000 shares at $5 per share, the amount debited and credited is $50,000 (10,000 x $5).

What Happens to Treasury Stock? When a business buys back its own shares, these shares become treasury stock and are decommissioned. In and of itself, treasury stock doesn't have much value. These stocks do not have voting rights and do not pay any distributions.

What Is the Cost Method of Accounting for Treasury Stock? The cost method of accounting values treasury stock according to the price the company paid to repurchase the shares, as opposed to the par value.

How is the cost method used in case of Treasury Stock? As explained above, when shares are acquired, the Treasury Stock account is debited and the cash account is credited. When the shares are reissued, cash is debited for the proceeds and Treasury Stock is credited for the amount paid out originally.

Purchase: The journal entry is to debit treasury stock and credit cash for the purchase price. For example, if a company buys back 10,000 shares at $5 per share, the amount debited and credited is $50,000 (10,000 x $5).