The Alameda California Authorization to Purchase 6 Percent Convertible Debentures provides an opportunity for investors to purchase these financial instruments. These debentures are characterized by their convertibility feature, which allows holders to convert them into a predetermined number of common stock shares of the issuing company. This offers investors the potential for equity participation while receiving a fixed interest rate of 6 percent. Convertible debentures, like the ones authorized in Alameda California, are a popular choice for both companies seeking to raise capital and investors looking for a blend of fixed income and potential equity gains. They offer advantages for both parties involved. One type of Alameda California Authorization to Purchase 6 Percent Convertible Debentures includes those issued by tech companies operating in Silicon Valley. These companies often offer convertible debentures to attract capital for their research and development, growth initiatives, or to fund acquisitions. The debentures enable investors to participate in the potential upside of these high-growth companies and can be an appealing investment opportunity. Another type of Alameda California Authorization to Purchase 6 Percent Convertible Debentures could include those issued by renewable energy companies. These companies often use convertible debentures as a means of securing financing for clean energy projects and infrastructure development. Investing in these debentures allows individuals to support sustainable initiatives while potentially benefiting from the growth of the renewable energy industry. The Alameda California Authorization to Purchase 6 Percent Convertible Debentures provides a transparent and regulated platform for investors to engage in this investment opportunity. It ensures that both issuers and investors adhere to applicable securities laws and regulations, safeguarding the interests of all parties involved. Investors considering these types of debentures should carefully evaluate the terms and conditions of each offering, such as conversion prices, maturity dates, and any applicable call or put options. It is important to consider the financial health and prospects of the issuing companies, as well as their respective industries, to make informed investment decisions. In summary, the Alameda California Authorization to Purchase 6 Percent Convertible Debentures allows investors to participate in the potential growth of companies based in the region. These debentures provide a unique investment opportunity by blending fixed income with the potential for equity appreciation. By researching and understanding the specific terms and conditions, investors can make informed decisions to align their investment strategies with their financial goals.

Alameda California Authorization to purchase 6 percent convertible debentures

Description

How to fill out Alameda California Authorization To Purchase 6 Percent Convertible Debentures?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare formal documentation that varies throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any personal or business purpose utilized in your county, including the Alameda Authorization to purchase 6 percent convertible debentures.

Locating templates on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Alameda Authorization to purchase 6 percent convertible debentures will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to get the Alameda Authorization to purchase 6 percent convertible debentures:

- Make sure you have opened the right page with your local form.

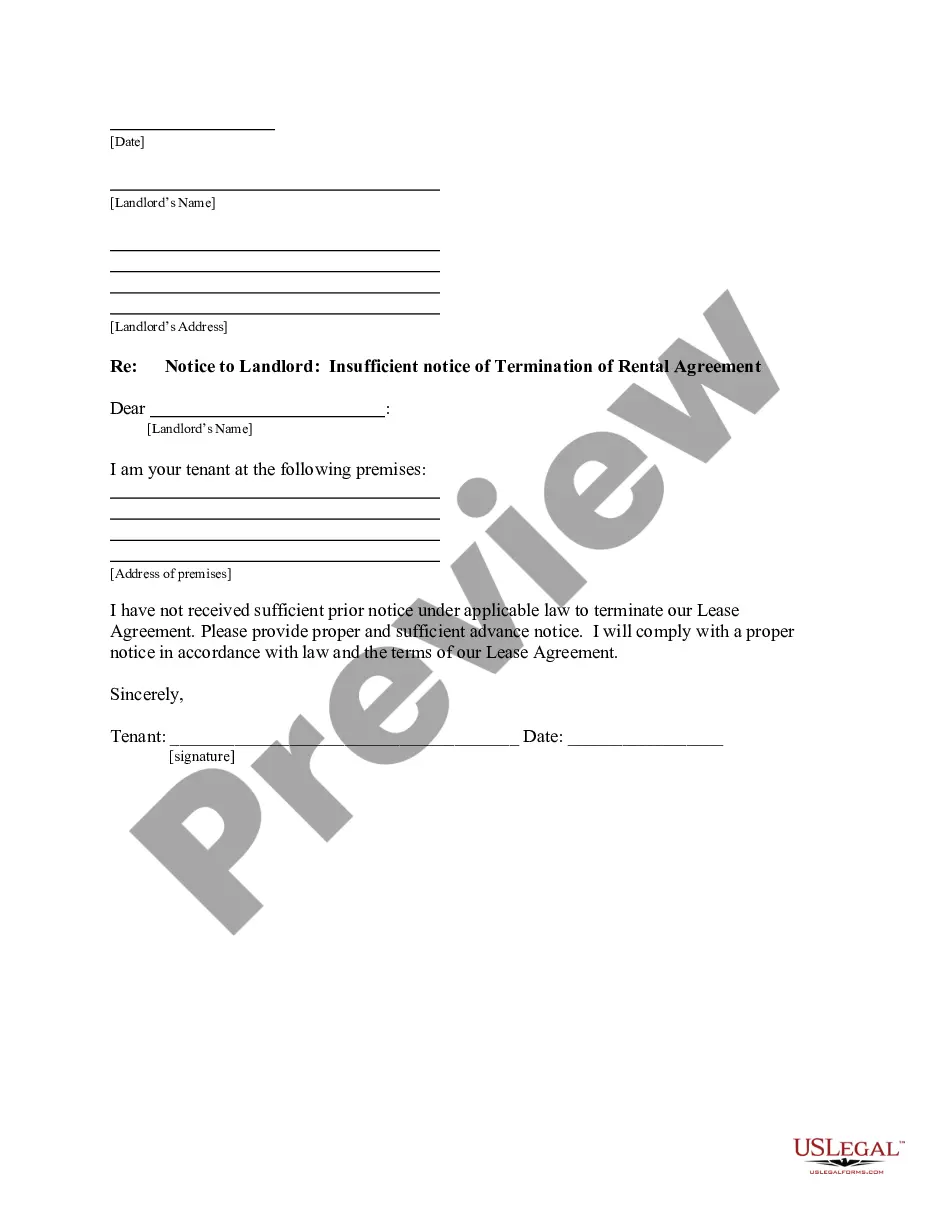

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form satisfies your needs.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Select the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Alameda Authorization to purchase 6 percent convertible debentures on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!