Harris Texas Authorization to Purchase 6 Percent Convertible Debentures: The Harris Texas Authorization to purchase 6 percent convertible debentures is a financial instrument used by the government of Harris County, Texas, to raise funds for various development projects and investments. This authorization empowers the county to issue debentures with a fixed interest rate of 6 percent, which can be converted into equity or common stock of the issuing entity at a later date. These debentures, being convertible in nature, provide investors with the option to convert their debt investment into ownership stakes in the issuing entity. This feature offers investors the potential for higher returns if the company's stock price increases, making these debentures an attractive investment option for those seeking both fixed income and potential equity appreciation. It is important to note that the Harris Texas Authorization to purchase 6 percent convertible debentures is not a single, specific offering but rather a general authorization granted to the county to issue such debentures as and when needed. This allows the county flexibility in terms of the timing, amount, and specific terms of the debenture offerings. Some potential variations or types of Harris Texas Authorization to purchase 6 percent convertible debentures could include: 1. Infrastructure Development Debentures: This type of debenture issuance may focus on financing the construction or improvement of essential infrastructure projects in Harris County, such as roads, bridges, schools, or hospitals. The funds raised enable the county to undertake crucial development initiatives and enhance the quality of life for its residents. 2. Environmental Sustainability Debentures: Harris County may issue these debentures to finance environmentally focused projects aimed at preserving natural resources, improving waste management systems, or promoting renewable energy initiatives. Investors attracted to sustainability and green investing may find these debentures particularly appealing. 3. Economic Development Debentures: This category of debenture issuance could serve to stimulate economic growth within Harris County. The funds raised might be allocated towards attracting businesses, promoting entrepreneurship, or supporting job creation initiatives, thus bolstering the local economy and fostering prosperity. 4. Public Services Debentures: Harris County may issue debentures earmarked for financing essential public services such as healthcare facilities, emergency response infrastructure, or community centers. These debentures provide an avenue for investors to support and contribute to the improvement of public services in the county. In conclusion, the Harris Texas Authorization to purchase 6 percent convertible debentures enables Harris County to raise funds for various projects and investments. This financing instrument allows investors to earn a fixed interest rate while offering the option for conversion into equity. The flexibility of this authorization enables the county to tailor debenture offerings to specific development needs, potentially covering areas such as infrastructure, environmental sustainability, economic growth, or public services.

Harris Texas Authorization to purchase 6 percent convertible debentures

Description

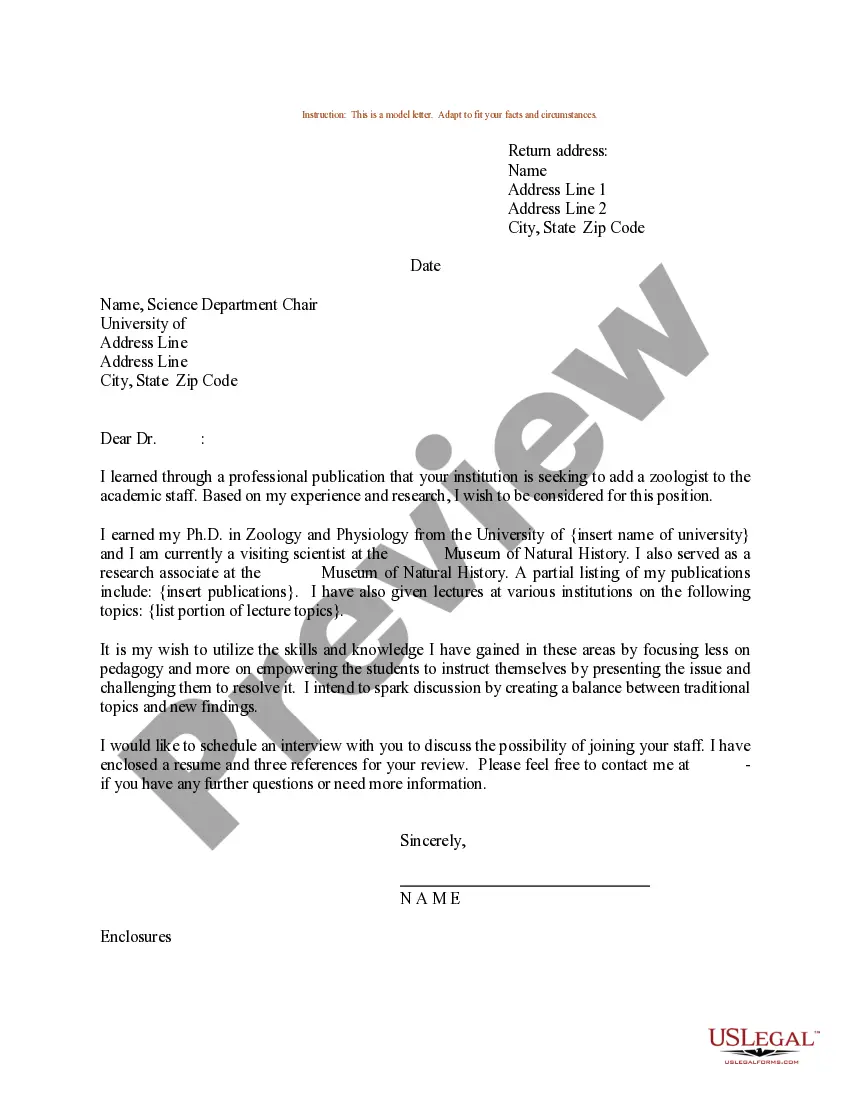

How to fill out Harris Texas Authorization To Purchase 6 Percent Convertible Debentures?

Draftwing forms, like Harris Authorization to purchase 6 percent convertible debentures, to take care of your legal matters is a tough and time-consumming process. Many cases require an attorney’s participation, which also makes this task not really affordable. However, you can get your legal matters into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms intended for different cases and life circumstances. We ensure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Harris Authorization to purchase 6 percent convertible debentures template. Go ahead and log in to your account, download the template, and personalize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly easy! Here’s what you need to do before downloading Harris Authorization to purchase 6 percent convertible debentures:

- Ensure that your form is compliant with your state/county since the regulations for creating legal paperwork may vary from one state another.

- Find out more about the form by previewing it or going through a quick intro. If the Harris Authorization to purchase 6 percent convertible debentures isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to begin utilizing our website and download the form.

- Everything looks good on your side? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and enter your payment details.

- Your template is good to go. You can try and download it.

It’s an easy task to find and buy the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!