Kings New York is a financial institution that is currently offering an opportunity to investors in the form of 6 percent convertible debentures. These debentures are a type of bond that can be converted into shares of Kings New York stock, providing an additional potential benefit to the investor. The authorization to purchase these 6 percent convertible debentures allows individuals or organizations to invest in Kings New York and earn a fixed interest rate of 6 percent per year. This rate offers investors a steady and reliable return on their investment. Convertible debentures are a versatile investment option as they offer the possibility of converting the debentures into shares of stock in the future. This conversion feature can provide investors with an opportunity to benefit from potential capital appreciation if the value of Kings New York stock increases over time. The option to invest in 6 percent convertible debentures from Kings New York offers investors a variety of benefits. Firstly, the fixed interest rate of 6 percent ensures a predictable and consistent income stream. Additionally, the potential for future conversion into shares of stock provides the opportunity for additional earnings if the stock price appreciates. It is important to note that there may be different types of Kings New York Authorization to purchase 6 percent convertible debentures available. These types could include variations such as differing maturities, conversion terms, or additional terms and conditions. Potential investors should carefully review the specific details and terms of each offering to determine which option best suits their investment goals and risk tolerance. In summary, Kings New York's authorization to purchase 6 percent convertible debentures presents an attractive investment opportunity. Investors can enjoy a fixed interest rate, while also having the potential to convert their debentures into shares of Kings New York stock in the future. To make an informed investment decision, it is advisable for individuals to thoroughly analyze the different types of debentures available, considering their unique features and associated risks.

Kings New York Authorization to purchase 6 percent convertible debentures

Description

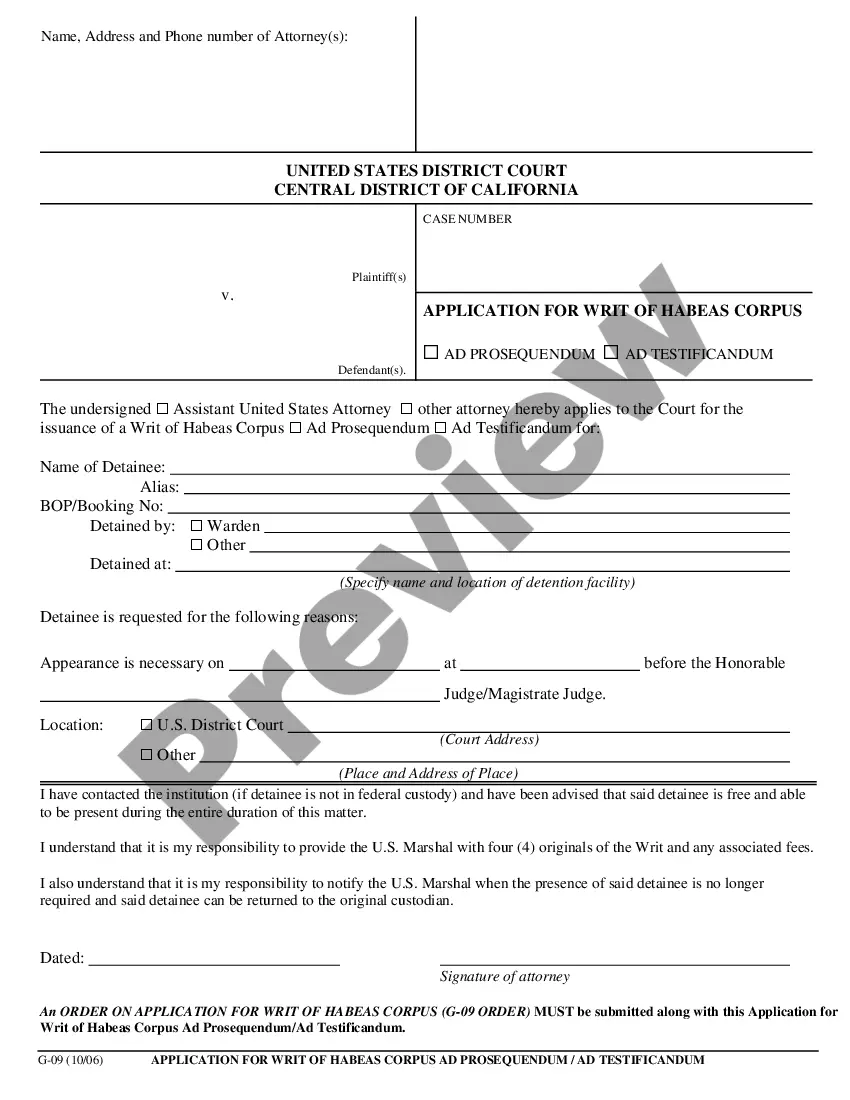

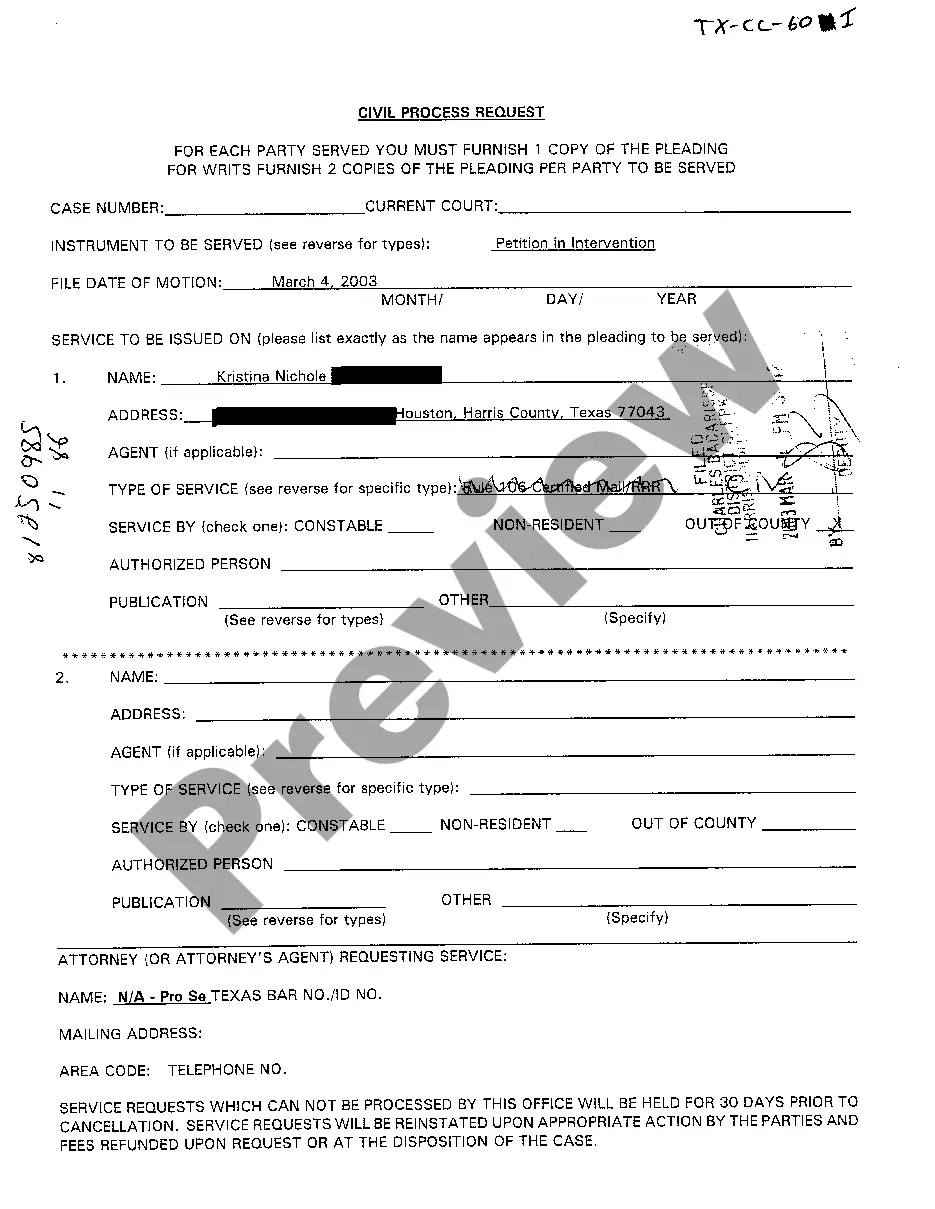

How to fill out Kings New York Authorization To Purchase 6 Percent Convertible Debentures?

How much time does it typically take you to create a legal document? Since every state has its laws and regulations for every life situation, finding a Kings Authorization to purchase 6 percent convertible debentures meeting all regional requirements can be stressful, and ordering it from a professional attorney is often expensive. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, collected by states and areas of use. Apart from the Kings Authorization to purchase 6 percent convertible debentures, here you can find any specific document to run your business or personal deeds, complying with your county requirements. Professionals verify all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can retain the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Kings Authorization to purchase 6 percent convertible debentures:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Kings Authorization to purchase 6 percent convertible debentures.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Most investors consider convertible debentures to be a more lucrative investment option than fixed deposits....Types of Convertible Debentures. ParametersFully Convertible DebenturesPartly Convertible DebenturesCapital baseTheir conversion leads to higher equity capital.Their conversion leads to lower equity capital.6 more rows

Procedure for issuing compulsorily convertible debentures Notice for holding a board meeting.Convening meeting of Company's board of directors.Hold extraordinary general meeting & Filing of MGT-14.Circulate offer letter.Filing of GNL -2.Convening meeting of company board of directors after receiving of application money.

There are several ways to invest in convertible bonds. If you want to buy individual bonds, you can do so through a brokerage with a bond desk and a specialist in convertibles. Many brokerages, however, don't offer direct investments in convertibles because they're less common.

Convertible bonds are bonds that are issued by corporations and that can be converted to shares of the issuing company's stock at the bondholder's discretion. Convertible bonds typically offer higher yields than common stock, but lower yields than straight corporate bonds.

You need to have the usual trading and a demat account to buy a non convertible debenture (NCD). The process to buy a NCD is the same as that for a share. You log into your trading account or ask your broker to buy you an NCD on your behalf. The manner in which you buy and the brokerage is the same as that for shares.

You need to have the usual trading and a demat account to buy a non convertible debenture (NCD). The process to buy a NCD is the same as that for a share. You log into your trading account or ask your broker to buy you an NCD on your behalf. The manner in which you buy and the brokerage is the same as that for shares.

As per Sec 71(1) of the Companies Act 2013, company may issue unsecured debentures with an option to convert such debentures into shares, either wholly or partly at the time of redemption.

A convertible debenture will usually return a lower interest rate since the debt holder has the option to convert the loan to stock, which is to the investors' benefit. Investors are thus willing to accept a lower rate of interest in exchange for the embedded option to convert into common shares.

Individual convertible bonds should be purchased through a broker that has a bond desk that specializes in the convertible markets. The do-it-yourself investor has the best opportunity for convertible investing through closed end funds--CEFs. Apply for and fund an online broker account if you do not have one.

Usually, companies issue debt in the form of bonds or equity in the form of shares of stock in order to raise capital. Some companies may use more debt than equity to raise capital for funding operations or vice versa. A convertible debenture can be transformed into equity shares after a specific period.