In Maricopa, Arizona, the local authorities have authorized the purchase of 6 percent convertible debentures. Convertible debentures are a type of financial instrument that combines the features of both debt and equity. They are issued by corporations or governments to raise capital and offer investors the option to convert their debentures into a predetermined number of shares of the issuing entity's common stock at a specific price. The Maricopa Arizona Authorization to purchase 6 percent convertible debentures provides an opportunity for investors to potentially earn a fixed interest rate of 6 percent on their investment, while also having the option to convert the debentures into shares of the issuing company. This flexibility appeals to investors who anticipate future growth in the company's stock price and want to benefit from any potential appreciation. Additionally, the Maricopa Arizona Authorization may include specific provisions such as the duration of the debenture, the conversion price, conversion ratio, and any applicable redemption rights. These details are crucial for potential investors in making informed decisions about whether to participate in this investment opportunity. It's important to note that there may be different types of Maricopa Arizona Authorization to purchase 6 percent convertible debentures. These variations can include differences in the issuing entity, the specific terms and conditions, and the market in which the debenture is listed. For instance, there might be government-issued debentures aimed at financing infrastructure projects within Maricopa, promoting the growth and development of the local community. Alternatively, private corporations operating in Maricopa may issue convertible debentures to expand their business operations, acquire assets, or reduce their debt obligations. Investors interested in Maricopa Arizona Authorization to purchase 6 percent convertible debentures should conduct thorough research to understand the specific terms and risks associated with each offering. This may include analyzing the financial health of the issuing entity, evaluating their growth potential, and assessing the prevailing market conditions. Overall, the Maricopa Arizona Authorization to purchase 6 percent convertible debentures creates an opportunity for investors to diversify their portfolio, earn fixed interest income, and potentially benefit from future capital appreciation through the conversion option.

Maricopa Arizona Authorization to purchase 6 percent convertible debentures

Description

How to fill out Maricopa Arizona Authorization To Purchase 6 Percent Convertible Debentures?

If you need to get a trustworthy legal form supplier to get the Maricopa Authorization to purchase 6 percent convertible debentures, look no further than US Legal Forms. Whether you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can select from more than 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of learning resources, and dedicated support team make it simple to find and complete various papers.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

Simply type to look for or browse Maricopa Authorization to purchase 6 percent convertible debentures, either by a keyword or by the state/county the form is created for. After finding the necessary form, you can log in and download it or retain it in the My Forms tab.

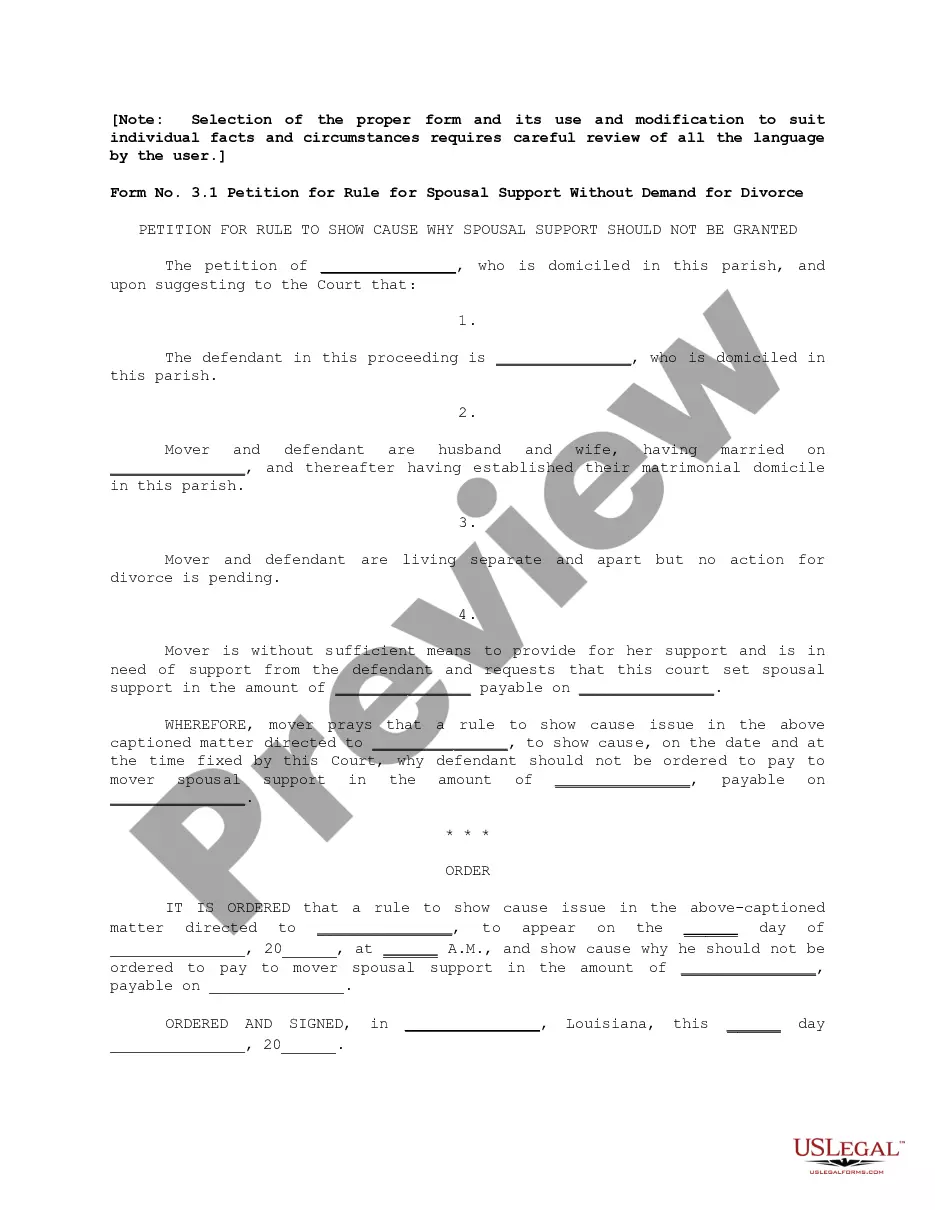

Don't have an account? It's simple to get started! Simply locate the Maricopa Authorization to purchase 6 percent convertible debentures template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and click Buy now. Register an account and select a subscription plan. The template will be immediately ready for download as soon as the payment is processed. Now you can complete the form.

Taking care of your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes these tasks less expensive and more affordable. Create your first business, organize your advance care planning, draft a real estate contract, or complete the Maricopa Authorization to purchase 6 percent convertible debentures - all from the comfort of your sofa.

Sign up for US Legal Forms now!