Phoenix, Arizona Authorization to Purchase 6 Percent Convertible Debentures: Exploring Investment Opportunities in the Valley of the Sun Are you looking for a lucrative investment opportunity in the vibrant city of Phoenix, Arizona? Look no further! The Phoenix Arizona Authorization to Purchase 6 Percent Convertible Debentures offers a promising chance for investors seeking potential growth and attractive returns. Phoenix, the capital of Arizona, is a bustling metropolis nestled in the Sonoran Desert. Known for its thriving economy, diverse culture, and picturesque landscapes, Phoenix has become a hotspot for investors and businesses alike. With a strong focus on technology, healthcare, and tourism, the city presents a wide range of investment prospects. One avenue worth exploring is the Phoenix Arizona Authorization to Purchase 6 Percent Convertible Debentures. These investment instruments provide an opportunity to secure a fixed interest rate of 6 percent while having the option to convert the debentures into equity shares at a later date. This flexibility allows investors to participate in the growth of promising companies, potentially earning substantial profits. Notably, there are different types of Phoenix Arizona Authorization to Purchase 6 Percent Convertible Debentures available to suit various investment preferences and risk appetites. Some key types include: 1. Traditional Convertible Debentures: These debentures offer a fixed interest rate of 6 percent per annum and can be converted into equity shares of the issuing company at a predetermined conversion price. Investors benefit from regular interest payments while having the potential to profit from the company's future success. 2. Callable Convertible Debentures: With this type of debenture, the issuing company retains the right to redeem or "call back" the debenture before its maturity date. This provides companies with the opportunity to save on interest expenses or refinance at more favorable rates. Investors, however, should carefully consider the call risk associated with these debentures before making their investment decision. 3. Exchangeable Convertible Debentures: These debentures offer investors the unique advantage of converting their debentures into shares of a different company, typically one with which the issuing company has a strategic relationship or investment stake. This option widens the investment scope and allows investors to diversify their portfolio beyond one specific company. 4. Zero-Coupon Convertible Debentures: Unlike traditional debentures, these do not issue periodic interest payments. Instead, investors buy the debentures at a discount to their face value and earn a return upon maturity. The debentures can be converted into equity shares, potentially bringing substantial capital gains to savvy investors. Investors considering the Phoenix Arizona Authorization to Purchase 6 Percent Convertible Debentures should conduct thorough due diligence on the issuing companies, evaluate their financial performance and growth prospects, and assess the market conditions. Additionally, they should consult with financial advisors to gain a comprehensive understanding of the risks and rewards associated with these investment instruments. In conclusion, the Phoenix Arizona Authorization to Purchase 6 Percent Convertible Debentures represents an enticing opportunity for investors seeking attractive returns in a promising market like Phoenix. With its multiple types of debentures, investors can choose the option that aligns with their investment objectives and risk appetite. By tapping into this market, investors have the potential to benefit from the city's flourishing economy and secure their financial future in the Valley of the Sun.

Phoenix Arizona Authorization to purchase 6 percent convertible debentures

Description

How to fill out Phoenix Arizona Authorization To Purchase 6 Percent Convertible Debentures?

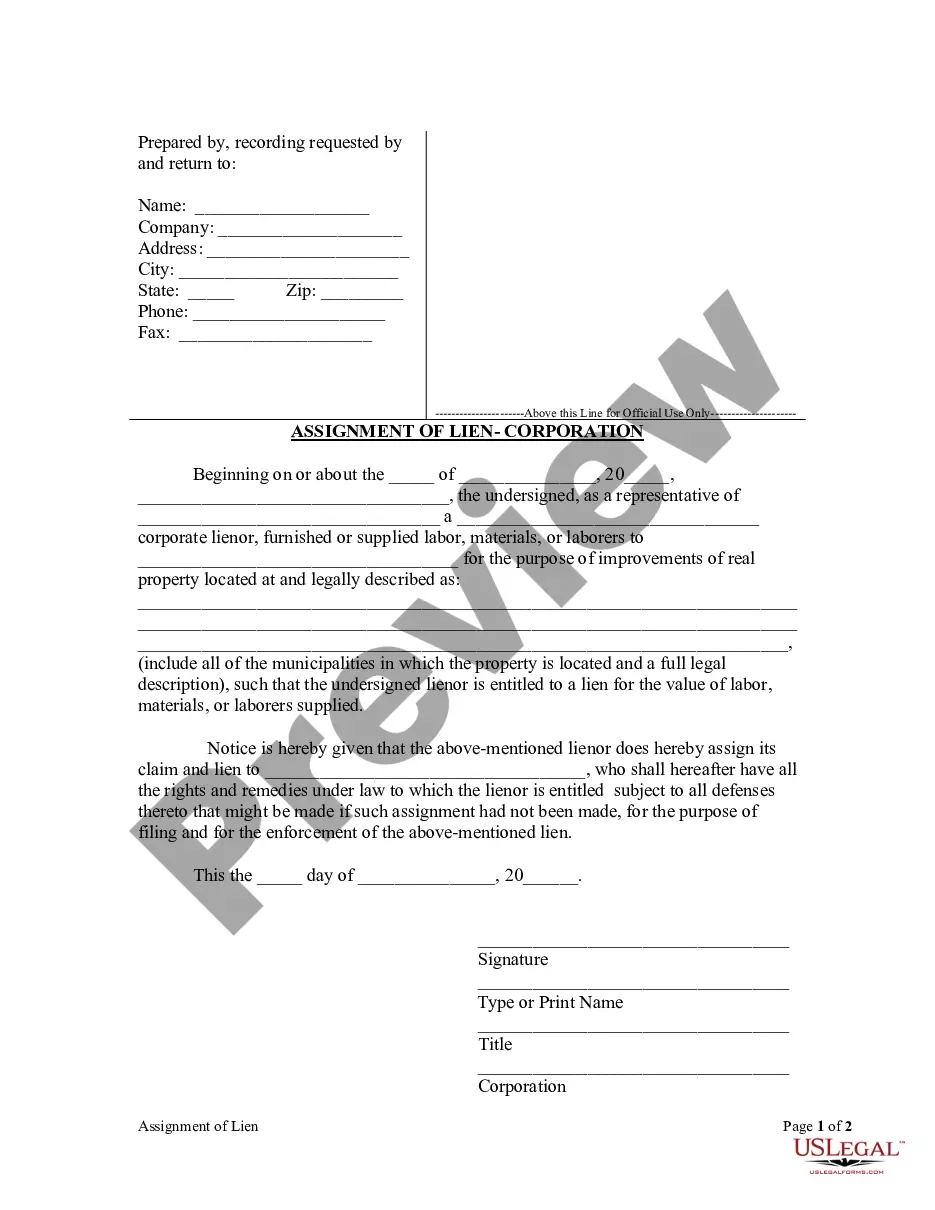

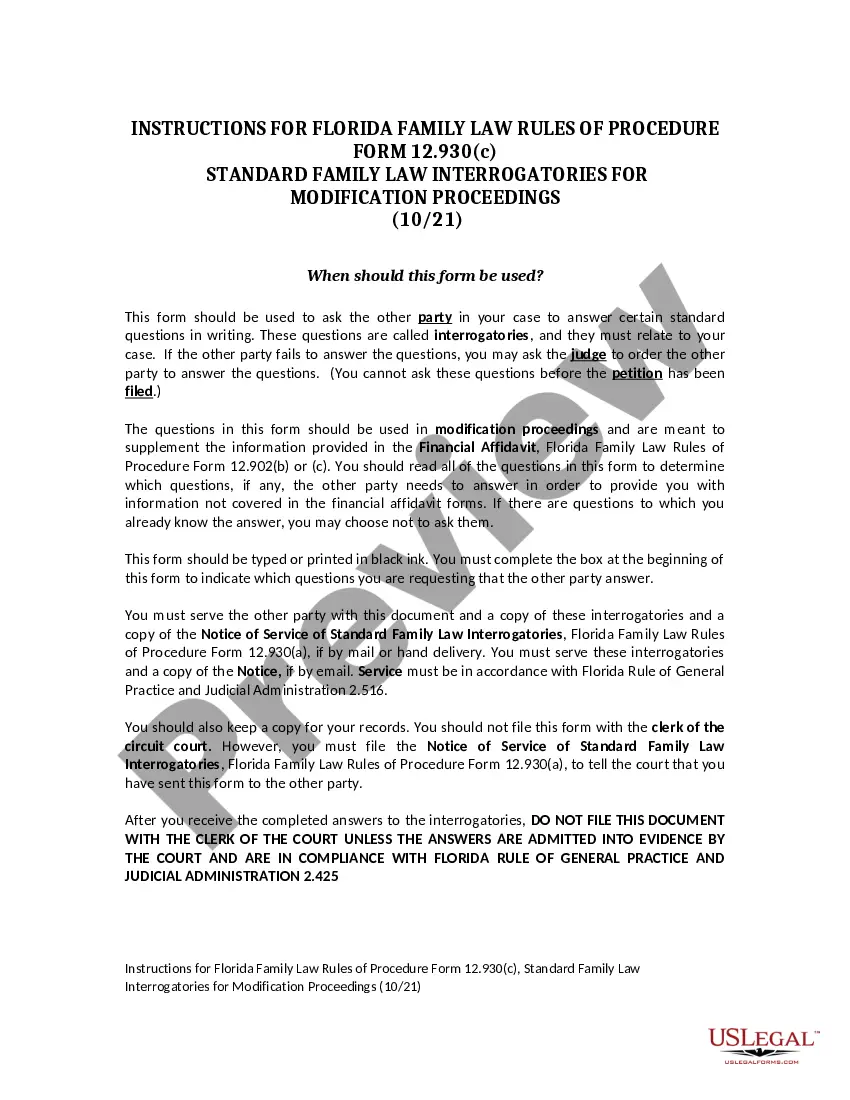

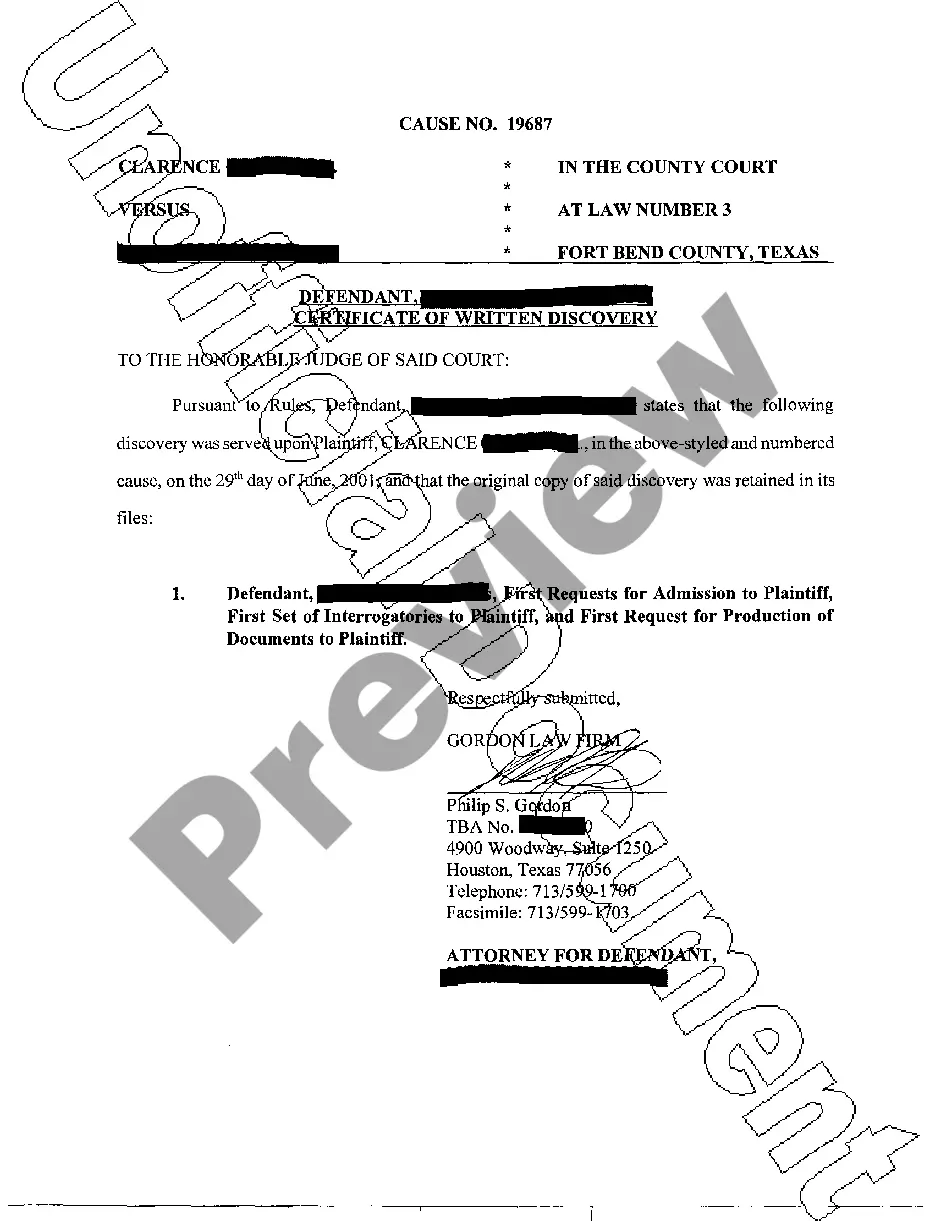

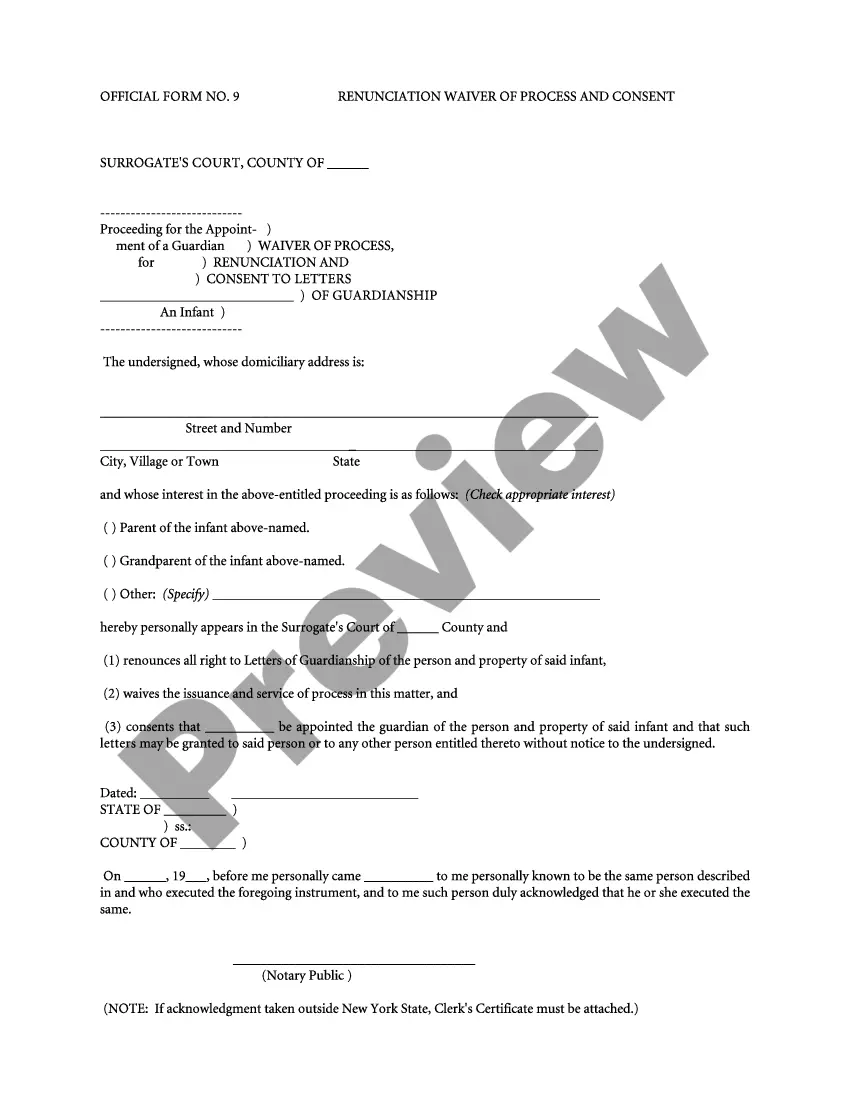

Preparing legal documentation can be burdensome. Besides, if you decide to ask an attorney to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Phoenix Authorization to purchase 6 percent convertible debentures, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Therefore, if you need the recent version of the Phoenix Authorization to purchase 6 percent convertible debentures, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Phoenix Authorization to purchase 6 percent convertible debentures:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Phoenix Authorization to purchase 6 percent convertible debentures and save it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!