Riverside California Authorization to Purchase 6 Percent Convertible Debentures: A Detailed Description Riverside, California, a vibrant city located in the Inland Empire region of Southern California, offers various opportunities for investors looking to diversify their portfolios. One such venture is the authorization to purchase 6 percent convertible debentures, which allows investors to capitalize on the economic growth and potential of this thriving city. Issued by the Riverside city government, the authorization enables investors to purchase debentures, a type of bond, at a fixed interest rate of 6 percent. These debentures are unique due to their convertibility feature, allowing investors to convert them into equity shares or other financial instruments over a specific period, adding flexibility and potential benefits to their investment strategy. The Riverside California Authorization to Purchase 6 Percent Convertible Debentures provides investors with a reliable source of income through the fixed interest rate. With the 6 percent return on investment, investors can enjoy regular and predictable cash flow while participating in the city's economic development. Investing in these debentures also offers investors an opportunity to support Riverside's growth initiatives. The funds generated from the debenture issuance are utilized for numerous projects aimed at improving the city's infrastructure, enhancing public services, and fostering economic development. By investing in Riverside's authorization to purchase 6 percent convertible debentures, investors can actively contribute to the city's progress and indirectly benefit from the ensuing expansion and increased property value. When considering Riverside's authorization, it's important to note that there are different types of 6 percent convertible debentures available, each with its own characteristics and advantages: 1. Municipal Debentures: These debentures are exclusively issued by the city government of Riverside, offering investors tax advantages by exempting them from federal income tax and, in some cases, state income tax. This tax exemption enhances the overall return on investment and makes the debentures a compelling investment choice for individuals seeking tax-efficient investment opportunities. 2. Corporate Debentures: In addition to municipal debentures, Riverside may also authorize corporate debentures issued by local businesses. These corporate debentures offer investors the chance to diversify their portfolio by investing in industries operating within the city. The convertibility feature allows investors to potentially acquire equity shares in these businesses, offering the possibility of capital appreciation and higher long-term returns. Overall, the Riverside California Authorization to Purchase 6 Percent Convertible Debentures presents investors with an attractive investment opportunity for both individuals seeking stable income and those looking to contribute to the growth of the city. With various types available, including municipal and corporate debentures, investors can tailor their investments to meet their financial goals and preferences. By taking part in this authorization, investors can actively support the development and progress of Riverside while benefiting from the returns and potential capital appreciation these debentures offer.

Riverside California Authorization to purchase 6 percent convertible debentures

Description

How to fill out Riverside California Authorization To Purchase 6 Percent Convertible Debentures?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Riverside Authorization to purchase 6 percent convertible debentures, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for future use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Riverside Authorization to purchase 6 percent convertible debentures from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Riverside Authorization to purchase 6 percent convertible debentures:

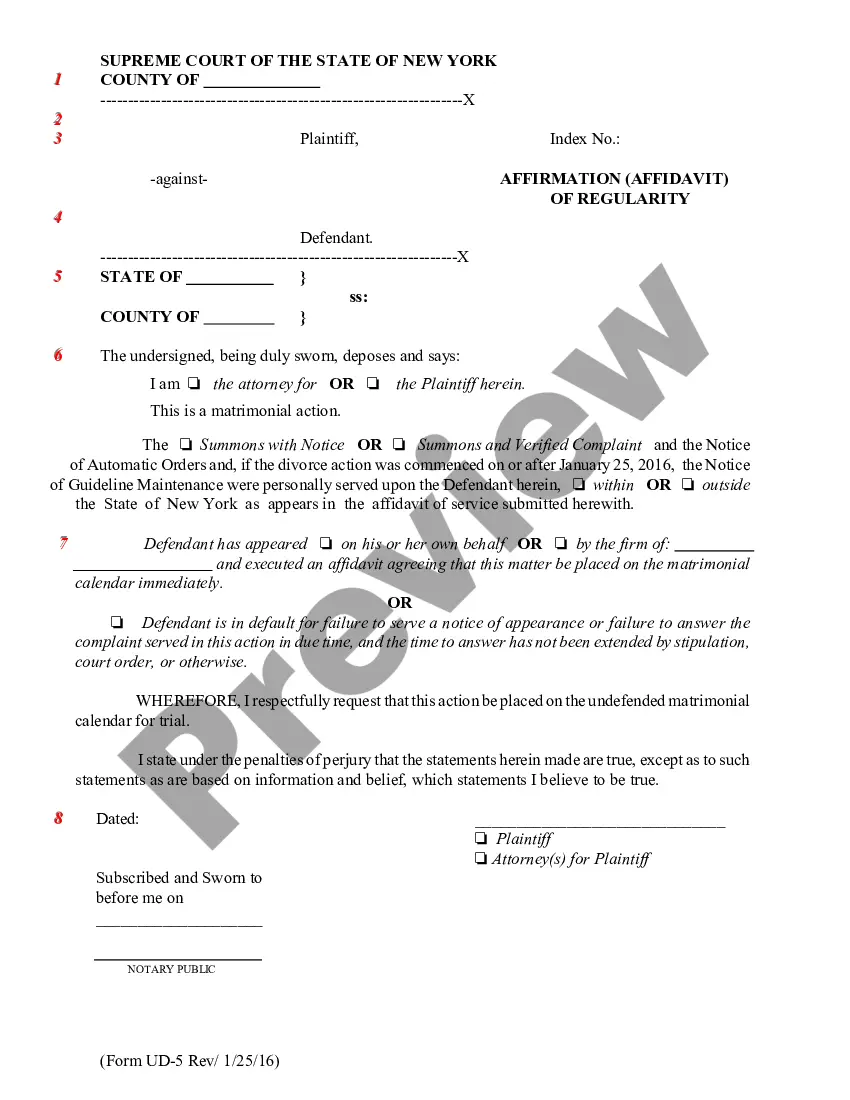

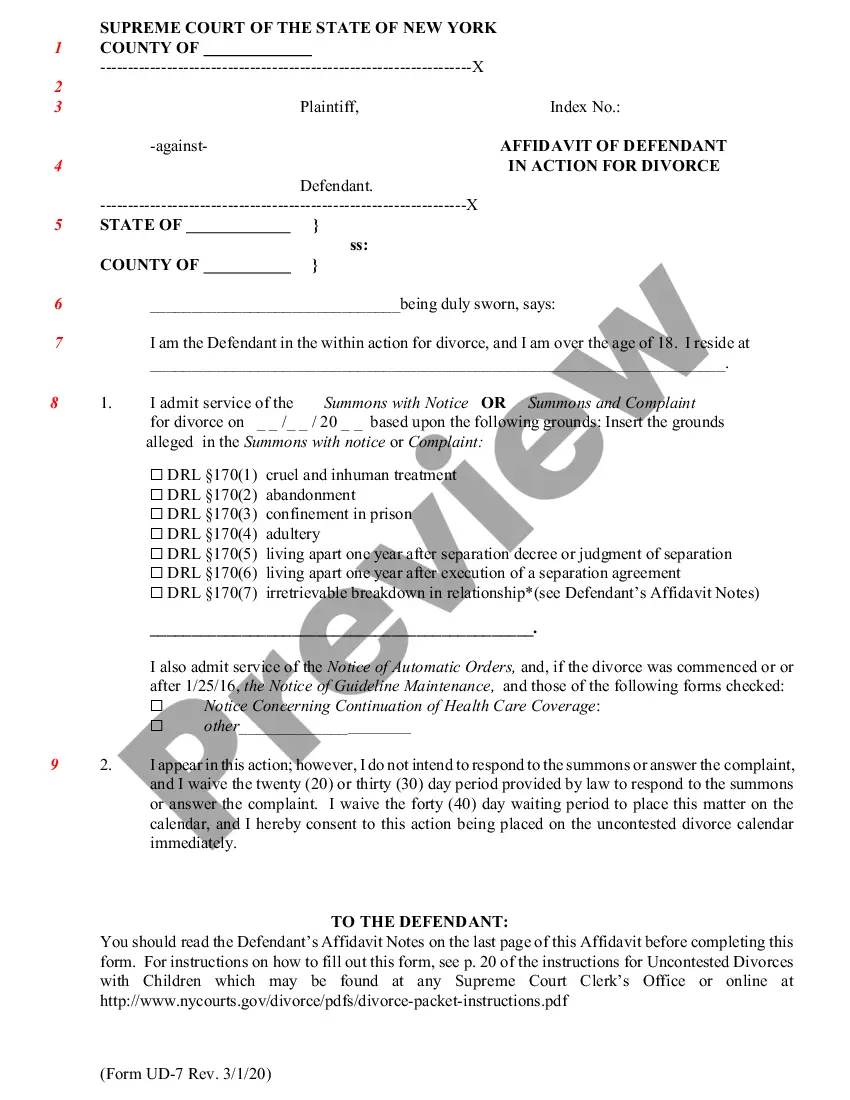

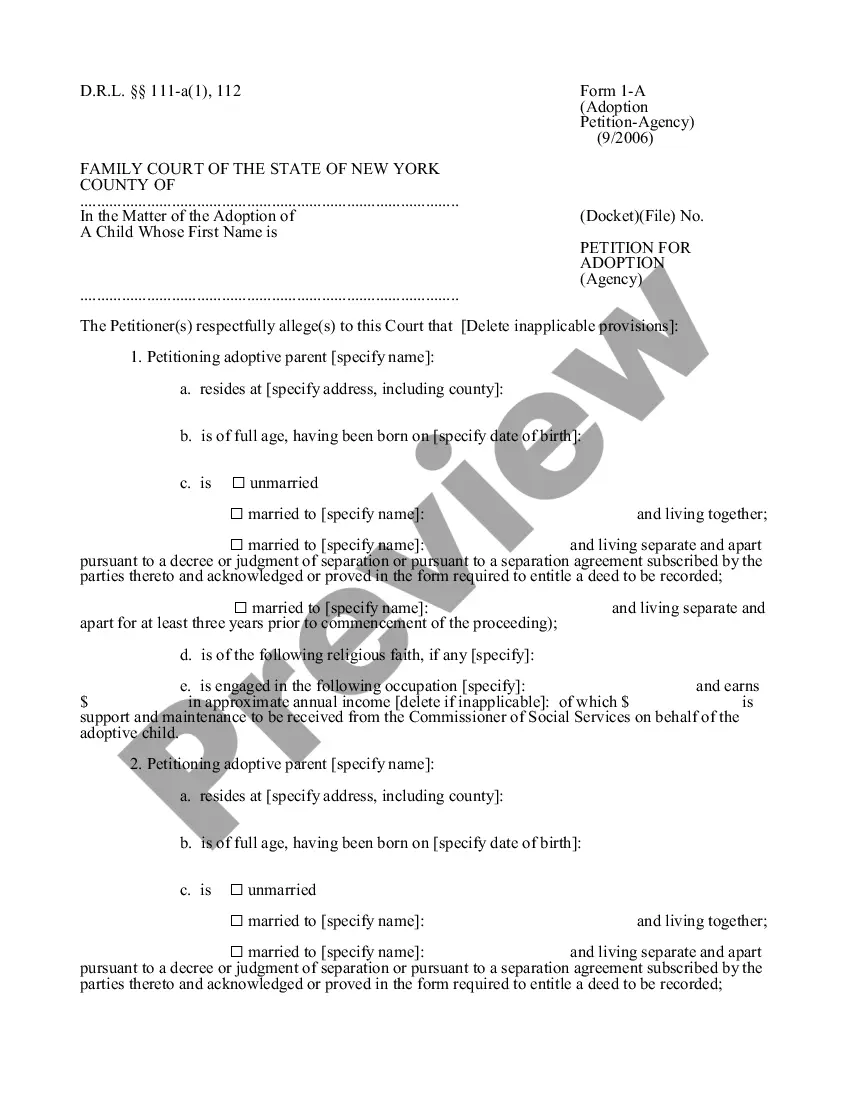

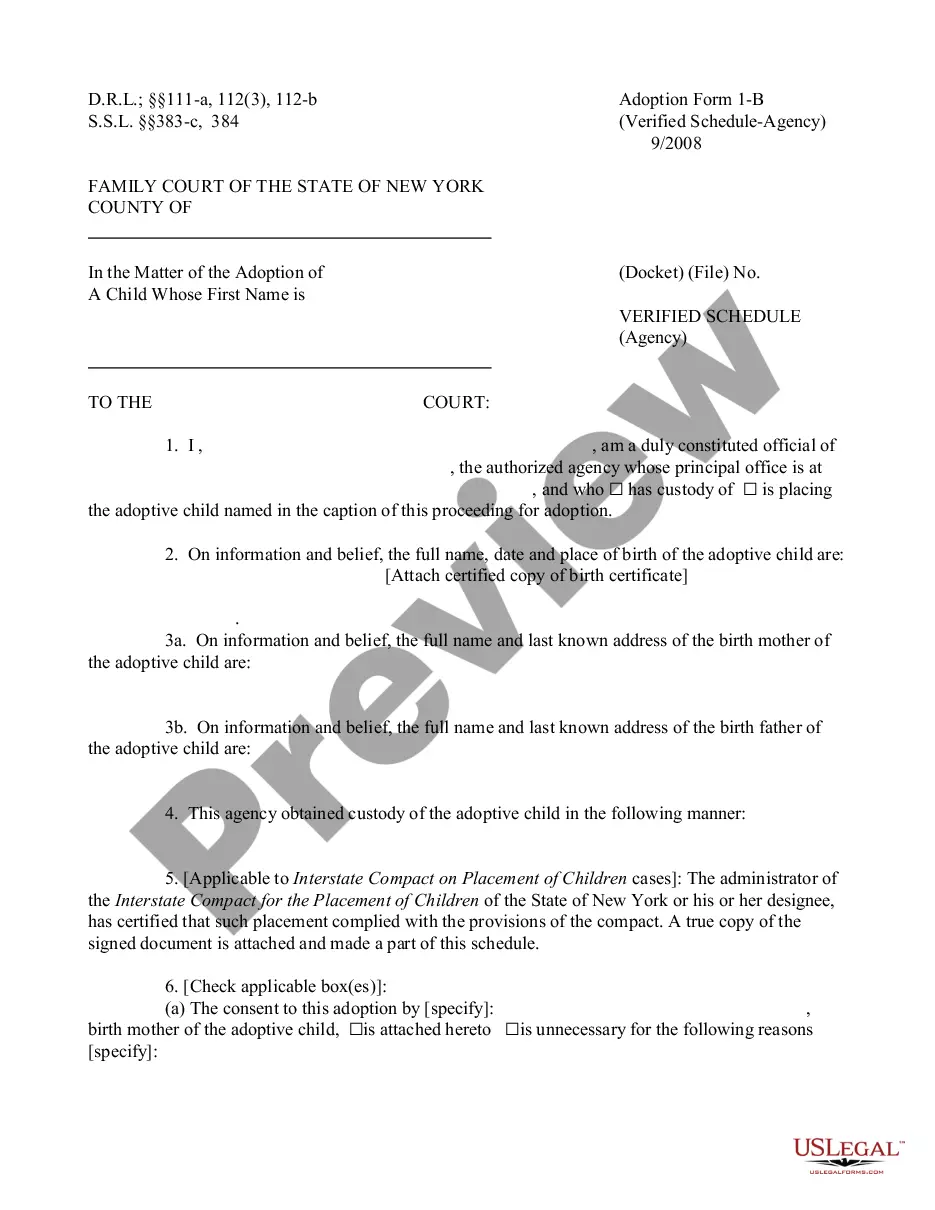

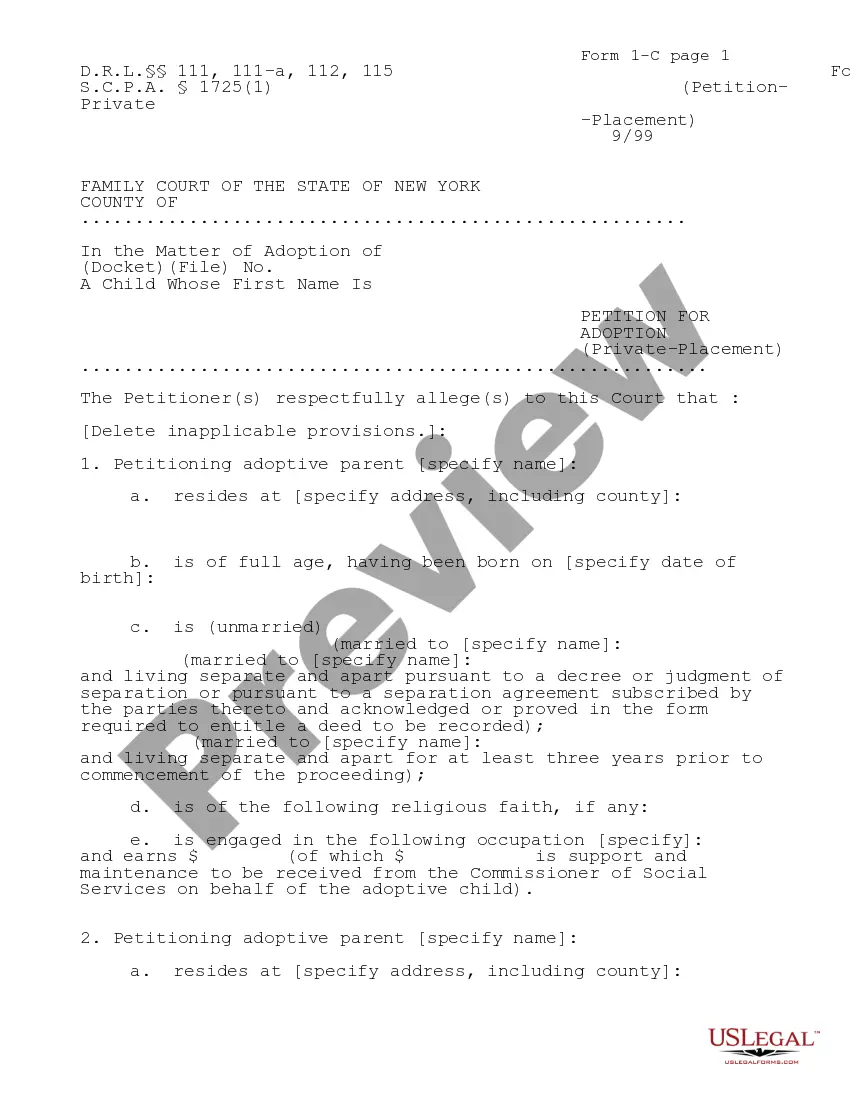

- Examine the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template when you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!