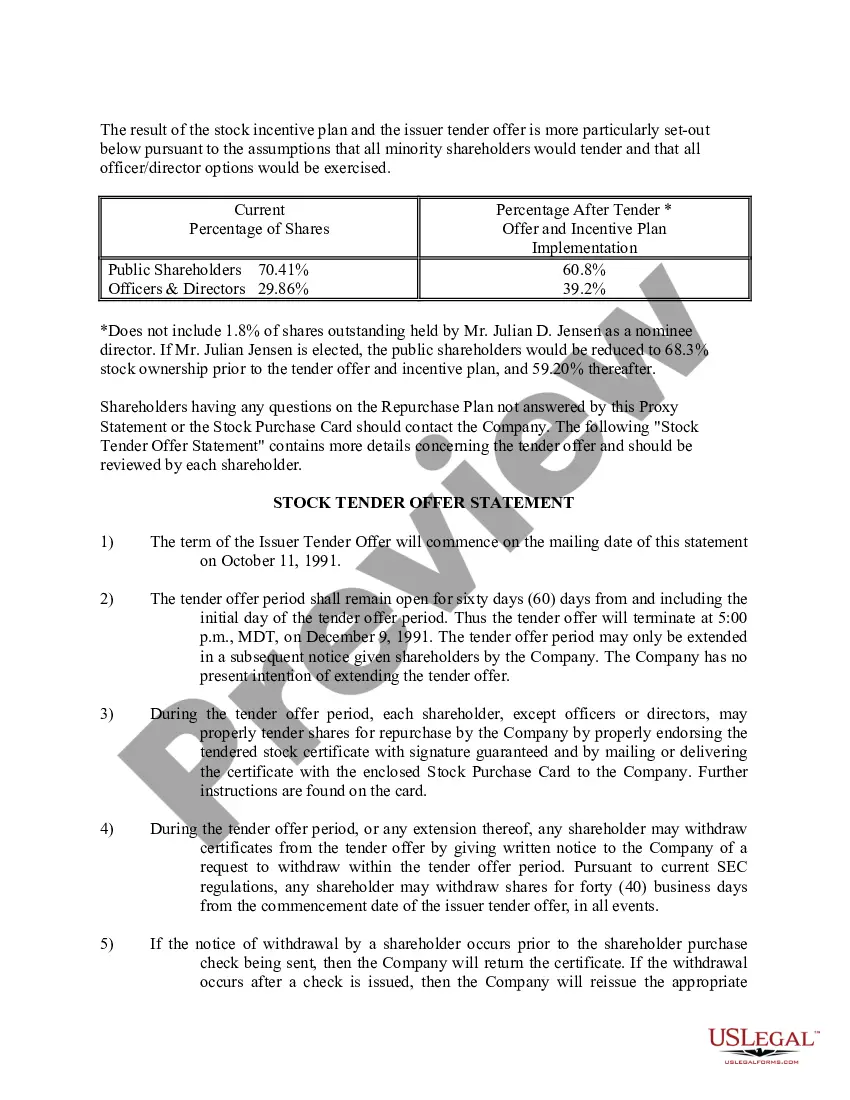

The Dallas Texas Stock Repurchase Plan of Croft Oil Company, Inc. is a strategic initiative implemented by the company to buy back its own shares from the open market. This plan allows Croft Oil Company, Inc. to repurchase its outstanding stock, reducing the number of shares available to the public. The Stock Repurchase Plan is designed to provide several benefits to the company, including enhancing shareholder value, increasing earnings per share, and signaling confidence in the company's financial stability and future prospects. By repurchasing shares, Croft Oil Company, Inc. can allocate excess capital to its stock investments, potentially generating a higher return for remaining stockholders. There are two common types of Stock Repurchase Plans: open market repurchases and tender offers. In an open market repurchase, Croft Oil Company, Inc. buys its stocks directly from the open market over a specific period, often at prevailing market prices. This type of repurchase is more flexible, allowing the company to repurchase shares gradually and opportunistically, utilizing excess cash flow or targeted funds. On the other hand, tender offers involve a public announcement by Croft Oil Company, Inc., inviting its shareholders to tender their shares within a specified timeframe and at a predetermined price. This type of repurchase plan may be used if the company aims to repurchase a substantial number of shares in a short period. Tender offers often come with a premium above the market price, providing an incentive for shareholders to participate. Implementing the Stock Repurchase Plan in Dallas, Texas specifically offers Croft Oil Company, Inc. advantageous opportunities due to the thriving business environment and dynamic local economy. Dallas is known for its robust energy sector, making it an ideal location for an oil company like Croft Oil Company, Inc. The availability of skilled workforce, favorable tax policies, and top-notch infrastructure further support the success of the Stock Repurchase Plan in this region. In conclusion, the Dallas Texas Stock Repurchase Plan of Croft Oil Company, Inc. is a strategic initiative aimed at buying back the company's own shares from the open market. By implementing this plan, Croft Oil Company, Inc. seeks to maximize shareholder value, increase earnings per share, and demonstrate confidence in its financial stability. The two common types of Stock Repurchase Plans, open market repurchases and tender offers, offer flexibility and attract shareholders accordingly. Dallas, Texas provides an excellent backdrop for this plan, given its energy sector prominence and supportive business environment.

Dallas Texas Stock Repurchase Plan of Croff Oil Company, Inc.

Description

How to fill out Dallas Texas Stock Repurchase Plan Of Croff Oil Company, Inc.?

Do you need to quickly create a legally-binding Dallas Stock Repurchase Plan of Croff Oil Company, Inc. or probably any other document to manage your personal or corporate affairs? You can select one of the two options: hire a professional to write a legal document for you or create it entirely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you get professionally written legal documents without having to pay sky-high prices for legal services.

US Legal Forms offers a rich collection of over 85,000 state-compliant document templates, including Dallas Stock Repurchase Plan of Croff Oil Company, Inc. and form packages. We offer documents for an array of use cases: from divorce papers to real estate documents. We've been out there for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the needed template without extra hassles.

- First and foremost, double-check if the Dallas Stock Repurchase Plan of Croff Oil Company, Inc. is tailored to your state's or county's regulations.

- If the document includes a desciption, make sure to verify what it's intended for.

- Start the search again if the form isn’t what you were looking for by utilizing the search box in the header.

- Choose the subscription that best fits your needs and proceed to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Dallas Stock Repurchase Plan of Croff Oil Company, Inc. template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to find and download legal forms if you use our services. Moreover, the paperwork we offer are reviewed by law professionals, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!