The Harris Texas Stock Repurchase Plan is an integral part of Croft Oil Company, Inc.'s financial strategy, designed to repurchase its own outstanding shares in the market. This plan provides an opportunity for the company to invest in its own stock, foster shareholder value, and capitalize on market conditions. Here is a detailed description of the Harris Texas Stock Repurchase Plan offered by Croft Oil Company, Inc., along with its various types: 1. Open Market Repurchase: Under this type of stock repurchase plan, Croft Oil Company, Inc. buys its own shares from the open market. The company uses excess cash or borrows funds to acquire the shares, creating a demand for its stock and potentially increasing its market price. This type of repurchase plan allows for flexibility as shares are repurchased over time at prevailing market prices. 2. Tender Offer Repurchase: In a tender offer repurchase plan, Croft Oil Company, Inc. announces a desire to repurchase a specific number of its outstanding shares at a predetermined price directly from its shareholders. Shareholders interested in selling their shares to the company within the designated timeframe and at the offered price accept the tender offer. 3. Accelerated Stock Buyback (ASB): The ASB is a specialized type of repurchase plan where Croft Oil Company, Inc. enters into an agreement with an investment bank. The bank buys many the company's shares in the open market on its behalf. By doing so, the company can quickly repurchase a significant portion of its shares, providing an immediate positive impact on earnings per share and potentially boosting investor confidence. 4. Targeted Repurchase: This type of repurchase plan allows Croft Oil Company, Inc. to specifically target shareholders, typically large institutional investors or insiders, to repurchase their holdings. By targeting specific shareholders, the company aims to consolidate ownership and increase management control. The Harris Texas Stock Repurchase Plan empowers Croft Oil Company, Inc. to strategically manage its capital structure while utilizing excess cash. By repurchasing its own stock, the company can signal to the market that it believes its shares are undervalued, instilling confidence among investors. Additionally, the repurchased shares can be retired, reducing the number of outstanding shares and potentially increasing earnings per share, making the remaining shares more valuable. The Harris Texas Stock Repurchase Plan of Croft Oil Company, Inc. demonstrates the company's commitment to maximizing shareholder value, enhancing its financial position, and utilizing different types of repurchase strategies based on prevailing market conditions. Whether through open market repurchases, tender offers, accelerated buybacks, or targeted repurchases, Croft Oil Company, Inc. leverages this plan to optimize its stock price and positively impact its overall performance.

Harris Texas Stock Repurchase Plan of Croff Oil Company, Inc.

Description

How to fill out Harris Texas Stock Repurchase Plan Of Croff Oil Company, Inc.?

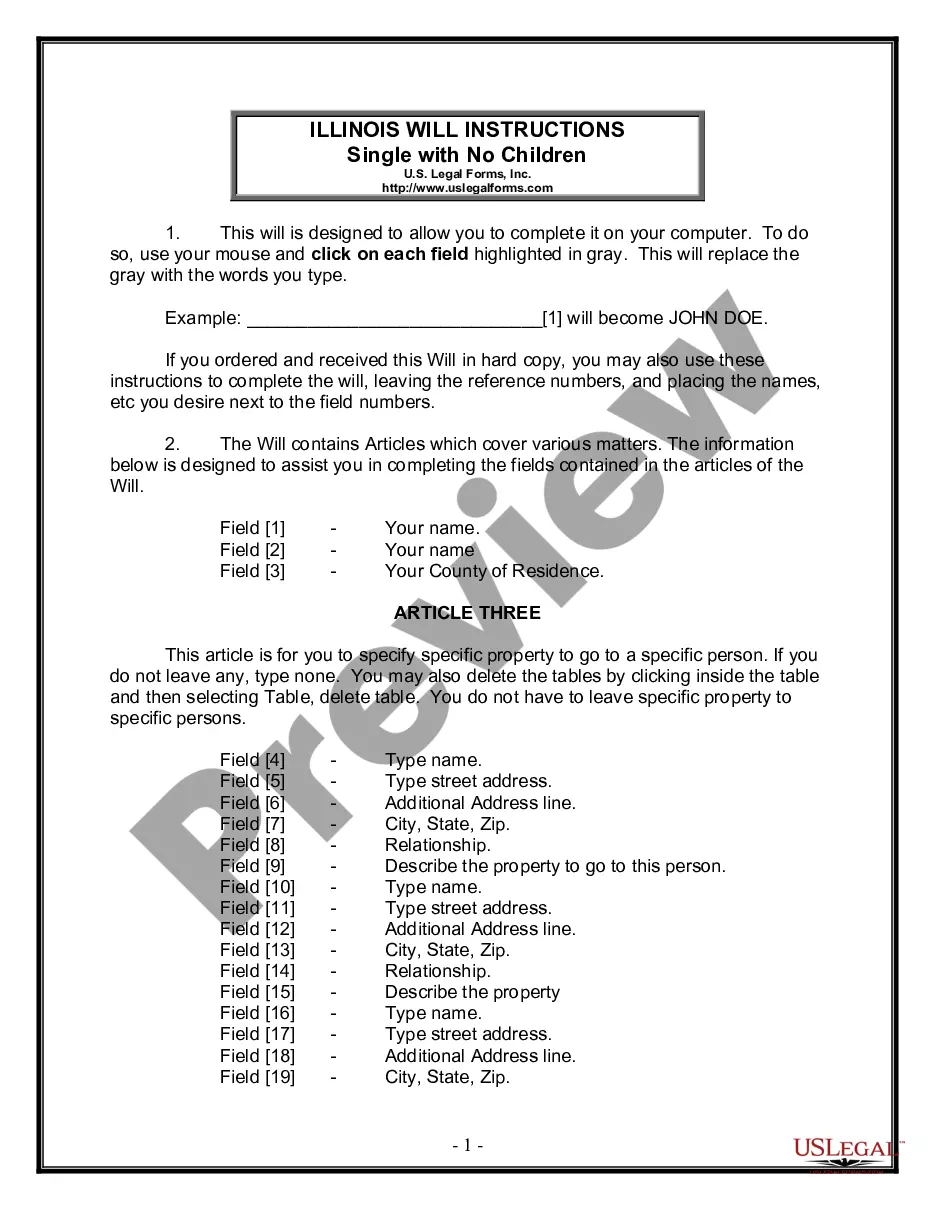

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from the ground up, including Harris Stock Repurchase Plan of Croff Oil Company, Inc., with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different types varying from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find information materials and guides on the website to make any activities associated with paperwork completion simple.

Here's how to purchase and download Harris Stock Repurchase Plan of Croff Oil Company, Inc..

- Go over the document's preview and description (if available) to get a basic information on what you’ll get after getting the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state regulations can affect the validity of some records.

- Examine the similar document templates or start the search over to find the correct file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment method, and buy Harris Stock Repurchase Plan of Croff Oil Company, Inc..

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Harris Stock Repurchase Plan of Croff Oil Company, Inc., log in to your account, and download it. Needless to say, our website can’t replace a legal professional completely. If you need to cope with an exceptionally complicated situation, we recommend getting an attorney to examine your document before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Join them today and get your state-compliant paperwork effortlessly!

Form popularity

FAQ

To calculate repurchase rate, divide the number of customers who have purchased more than once by the total number of customers over the same time period.

By contrast, under the par value method, share buybacks are recorded by debiting the treasury stock account by the shares' total par value. The cash account is credited for the amount paid to purchase the treasury stock.

The following entries may be required to record buyback of shares: (a) For issue of debentures of other specified securities (excluding shares of the kind to be bought back) for buyback purpose: Bank A/c Dr. (with nominal value of shares bought back) Dr.

You will label the debit (the amount you paid to buy back the stock) as "treasury stock." Underneath, notate a credit for the same amount in cash. Using the example of 10,000 shares from step one, you will label a debit of $150,000 as "treasury stock," and a credit for the same amount as "cash."

The current rules require companies to disclose, by month, the total number of shares repurchased during the period, the average price paid per share, the total number of shares purchased under a publicly announced repurchase plan or program and the maximum number (or approximate dollar value) of shares that may yet be

It's sometimes called a share repurchase. The company buys shares of its own stock at the market price, thereby reducing the number of shares that are outstanding. Since the value of the company stays the same, the result of a buyback is usually an increase in the share price.

The company can make the journal entry for repurchase of common stock by debiting the treasury stock account and crediting the cash account. Treasury stock is a contra account to the capital account (e.g. common stock) in the equity section of the balance sheet.

A stock buyback, or share repurchase, is when a company repurchases its own stock, reducing the total number of shares outstanding. In effect, buybacks re-slice the pie of profits into fewer slices, giving more to remaining investors.

Procedure for Buyback of Shares India Step 1: Convene the Board Meeting.Step 2: Approval for EGM.Step 3: Send the notice for EGM.Step 4: Passing of Special Resolution for Buy-Back of Shares.Step 5: File SH-8.Step 6: Declaration of Solvency.Step 7: Letter of Offer to the Shareholders.Step 8: Acceptance of Offer.

Investors interested in finding out how much a company has spent on share repurchases can find the information in their quarterly earnings reports.