San Diego, California serves as the backdrop for the Stock Repurchase Plan of Croft Oil Company, Inc. This strategic initiative is designed to optimize the company's operations and enhance shareholder value. The Stock Repurchase Plan allows Croft Oil Company, Inc. to repurchase its own outstanding shares from the market, indicating the company's confidence in its long-term growth and profitability. Through the San Diego California Stock Repurchase Plan, Croft Oil Company, Inc. aims to employ various strategies to repurchase shares of its common stock. These repurchased shares can be utilized for multiple purposes, such as rewarding loyal shareholders, reducing outstanding shares, increasing earnings per share, and supporting stock options or employee stock purchase programs. The San Diego California Stock Repurchase Plan of Croft Oil Company, Inc. is designed to be flexible, ensuring the company can adapt to market conditions and seize opportunities for value creation. It provides Croft Oil Company, Inc. with the ability to repurchase its shares at prevailing market prices or through negotiated transactions, both on the open market or through privately arranged transactions. There are two primary types of San Diego California Stock Repurchase Plans that Croft Oil Company, Inc. may consider: open-market repurchases and privately negotiated repurchases. 1. Open-Market Repurchases: Croft Oil Company, Inc. can repurchase its shares from the open market, where shares are bought and sold through exchanges like the New York Stock Exchange or NASDAQ. This type of repurchase offers flexibility as it allows the company to repurchase shares when it deems the market conditions favorable. 2. Privately Negotiated Repurchases: In certain circumstances, Croft Oil Company, Inc. may engage in privately negotiated repurchases, where the company directly negotiates with specific shareholders or institutional investors to buy back their shares. Such repurchases might be preferred when the company aims to address specific shareholder needs or execute targeted capital allocation strategies. By implementing the San Diego California Stock Repurchase Plan, Croft Oil Company, Inc. demonstrates its commitment to enhancing shareholder value, capital efficiency, and confidence in its future performance. The plan provides the company with financial flexibility and a mechanism to return capital to shareholders while reinforcing its position in the energy sector.

San Diego California Stock Repurchase Plan of Croff Oil Company, Inc.

Description

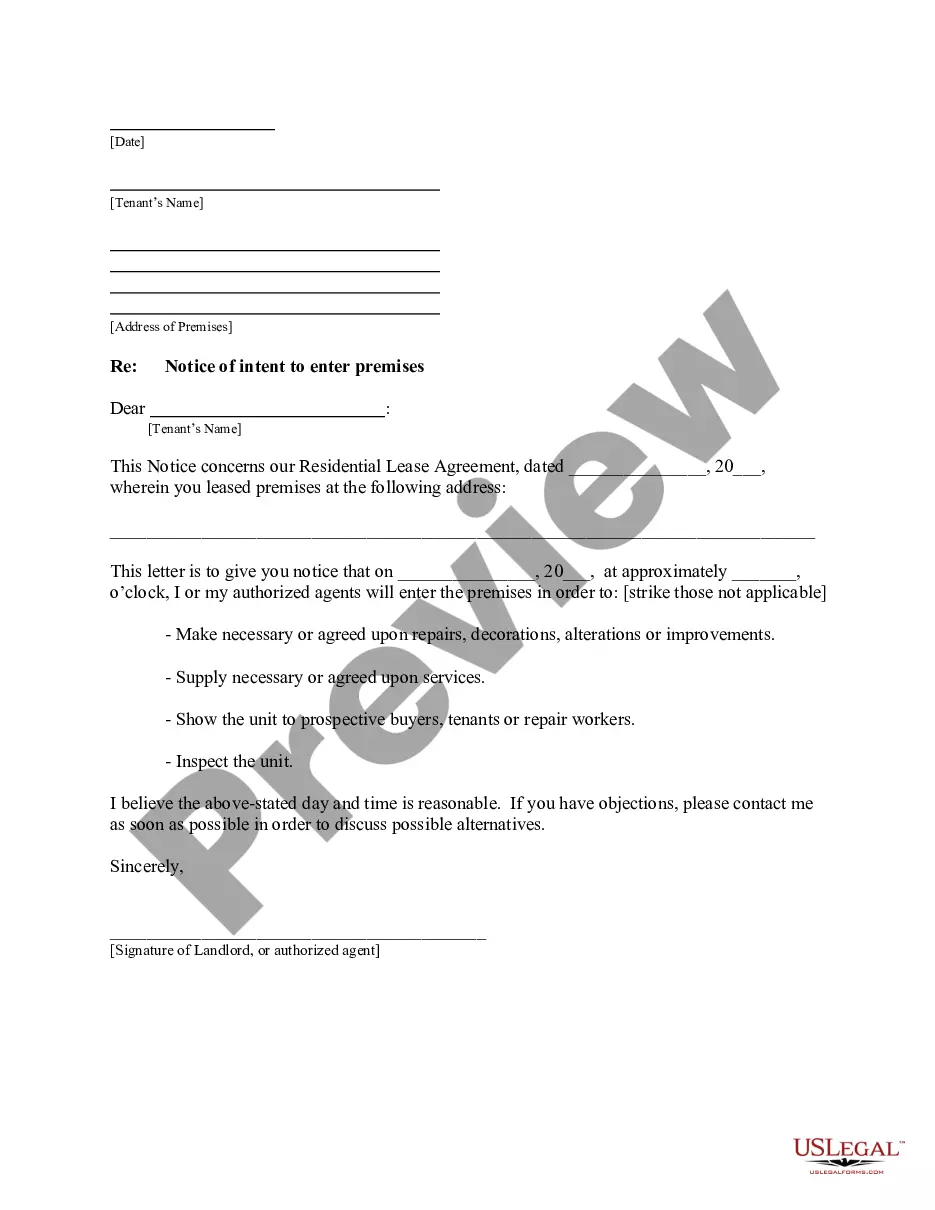

How to fill out San Diego California Stock Repurchase Plan Of Croff Oil Company, Inc.?

Do you need to quickly draft a legally-binding San Diego Stock Repurchase Plan of Croff Oil Company, Inc. or maybe any other form to manage your own or business matters? You can go with two options: hire a professional to draft a legal paper for you or create it entirely on your own. The good news is, there's another option - US Legal Forms. It will help you receive neatly written legal paperwork without paying sky-high fees for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-specific form templates, including San Diego Stock Repurchase Plan of Croff Oil Company, Inc. and form packages. We provide documents for an array of use cases: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and get the needed document without extra troubles.

- First and foremost, carefully verify if the San Diego Stock Repurchase Plan of Croff Oil Company, Inc. is tailored to your state's or county's laws.

- In case the form comes with a desciption, make sure to check what it's suitable for.

- Start the search again if the document isn’t what you were looking for by utilizing the search box in the header.

- Select the subscription that is best suited for your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the San Diego Stock Repurchase Plan of Croff Oil Company, Inc. template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. Additionally, the templates we provide are reviewed by industry experts, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!