Chicago Illinois Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus

Description

How to fill out Approval Of Amendment To Articles Of Incorporation To Permit Certain Uses Of Distributions From Capital Surplus?

A documentation process invariably accompanies any legal action you undertake.

Launching a company, submitting or accepting a job proposal, transferring ownership, and numerous other life situations necessitate that you prepare official paperwork that varies across the nation.

That is why consolidating everything in one location is incredibly beneficial.

US Legal Forms is the largest online repository of current federal and state-specific legal documents.

Select the appropriate subscription plan, then Log In or register for an account. Choose the preferred payment method (via credit card or PayPal) to proceed. Select the file format and save the Chicago Approval of amendment to articles of incorporation to allow specific uses of distributions from capital surplus on your device. Use it as necessary: print it or complete it electronically, sign it, and submit it where required. This is the easiest and most reliable method to acquire legal documents. All the templates offered by our library are professionally crafted and validated for compliance with local laws and regulations. Prepare your documentation and manage your legal matters effectively with US Legal Forms!

- Here, you can effortlessly locate and download a form for any personal or business purpose used in your area, including the Chicago Approval of amendment to articles of incorporation to allow specific uses of distributions from capital surplus.

- Finding templates on the site is remarkably easy.

- If you already possess a subscription to our collection, Log In to your account, search for the form using the search bar, and click Download to save it on your device.

- After this, the Chicago Approval of amendment to articles of incorporation to allow specific uses of distributions from capital surplus will be available for additional use in the My documents section of your account.

- If you are engaging with US Legal Forms for the first time, follow this easy instruction to obtain the Chicago Approval of amendment to articles of incorporation to allow specific uses of distributions from capital surplus.

- Ensure you have accessed the correct page for your local form.

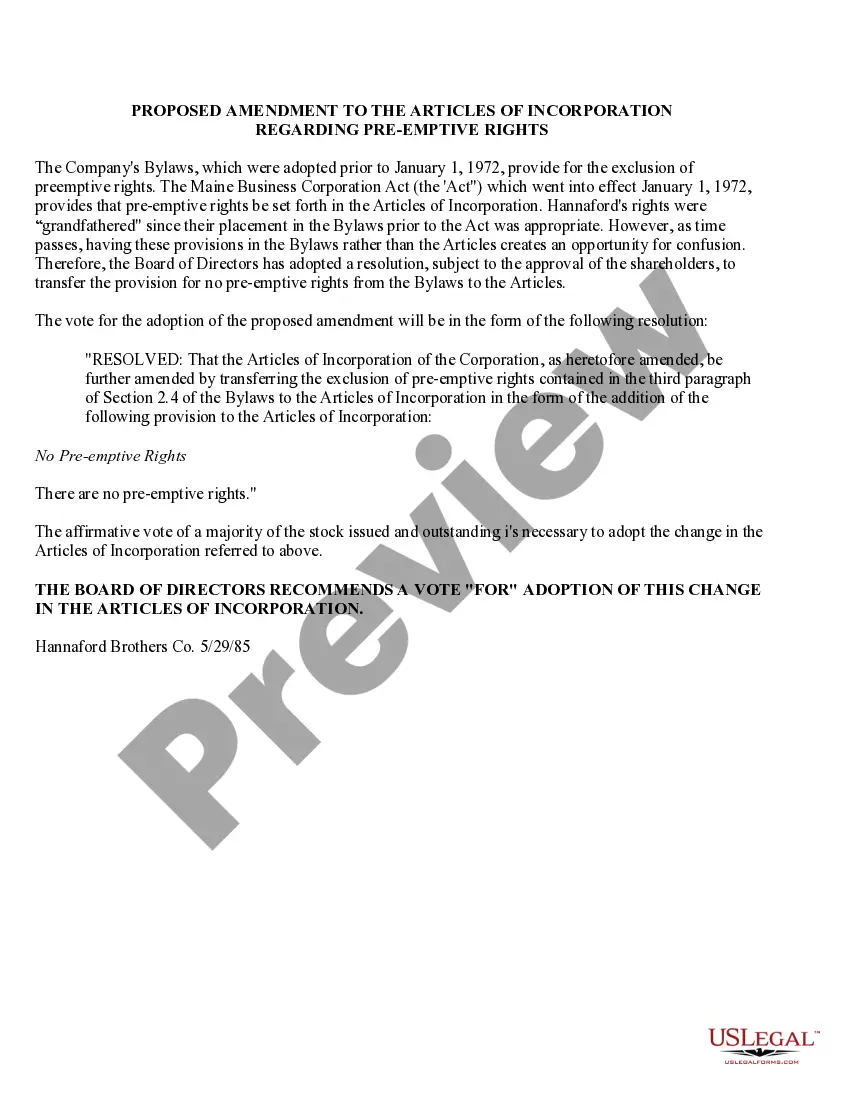

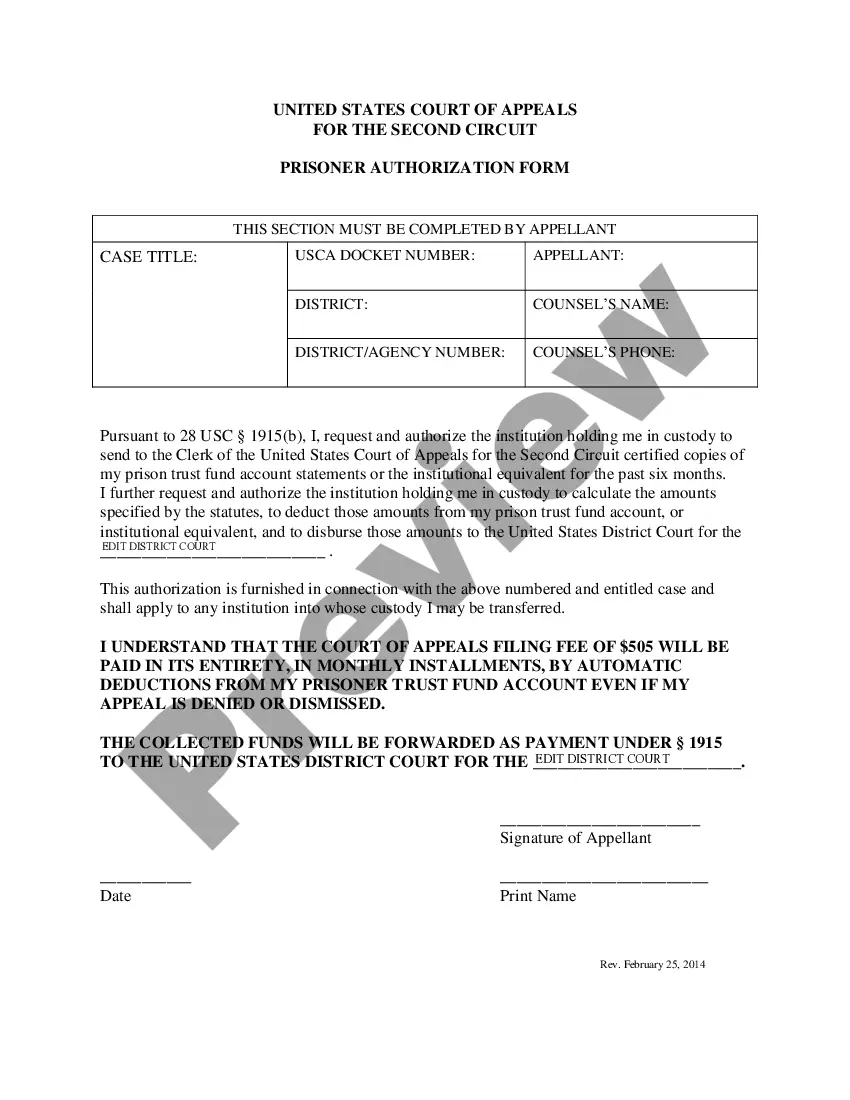

- Utilize the Preview feature (if available) and examine the sample.

- Review the description (if applicable) to confirm that the form meets your requirements.

- Search for an alternative document via the search option if the sample does not suit you.

- Click Buy Now when you identify the desired template.

Form popularity

FAQ

Writing an amendment format requires a clear structure, starting with the title and the corporation's legal name. Next, outline the specific changes made to the Articles of Incorporation, particularly emphasizing the provisions related to capital surplus distributions. You can find useful resources and templates at uslegalforms to ensure your amendment complies with the requirements for Chicago Illinois Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus.

Filling out the articles of Amendment form involves clearly stating the current name and status of your corporation. Specify the changes you wish to make, focusing on how they relate to the distribution of capital surplus. By utilizing uslegalforms, you can access templates and instructions that streamline completing the form for Chicago Illinois Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus.

To amend the Articles of Incorporation, you must draft the amendment and ensure it complies with Illinois law regarding capital surplus distributions. Submit the amendment to the appropriate state office along with any required fees. Seeking assistance from uslegalforms can simplify this process, helping you understand the requirements for Chicago Illinois Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus.

When you fill out articles of amendment for Chicago Illinois Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus, begin by providing the current information about your corporation, including its name and the existing articles. Clearly state the proposed amendments and how they affect the capital surplus distributions. Ensure that all sections are completed accurately and consider using a platform like uslegalforms for guidance.

Yes, articles of incorporation can indeed be amended to reflect changes in a business’s structure or operations. The amendment must comply with state regulations, and in Illinois, you must submit the appropriate form detailing your amendment. For matters like the Chicago Illinois Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus, it is wise to consult a platform like US Legal Forms to ensure compliance and accuracy in your submission.

Yes, Articles of Organization can be changed through a formal amendment process. This involves filing an Amendment of Articles of Organization with the state, which includes the desired changes. It is important to understand the Chicago Illinois Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus as it may impact the changes you wish to implement. Using resources like US Legal Forms can simplify this process.

Filling out an Amendment of Articles of Organization requires careful attention to detail. Begin by obtaining the official form through the Illinois Secretary of State's website or a reliable source like US Legal Forms. Clearly specify the changes intended, particularly how the amendment aligns with the Chicago Illinois Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus. Ensure you sign and date the document before submission to avoid delays.

The processing time for Articles of Incorporation in Illinois typically ranges from a few days to several weeks. This duration largely depends on the workload of the Secretary of State's office and whether your submission has all the correct information. For faster processing, consider using expedited services, if available. Obtaining the Chicago Illinois Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus can enhance your overall timeline.

Amending Articles of Incorporation in Illinois requires you to file an amendment form with the Secretary of State. Prepare the form by specifying the changes you wish to make, such as adding new provisions or altering existing ones. It's essential to have the amendment approved by your board of directors and, if necessary, your shareholders. Additionally, understanding the Chicago Illinois Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus can help guide you through this process.

To obtain an Articles of Incorporation document, contact the Illinois Secretary of State and request a certified copy of your filing. You may need to provide your business name or filing number for quick access to your records. Additionally, it is recommended to keep a personal copy of this document for your records. The process may also play a role in your eligibility for the Chicago Illinois Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus.