Lima, Arizona — Approval of Amendment to Articles of Incorporation to Permit Certain Uses of Distributions from Capital Surplus In the vibrant town of Lima, Arizona, important developments have taken place regarding the local business community. One such development worth mentioning is the recent approval of an amendment to the articles of incorporation, allowing for specific uses of distributions from the capital surplus of corporations operating within the Lima area. The amendment to the articles of incorporation aims to provide corporations with more flexibility in utilizing their capital surplus for various purposes, fostering growth, investment, and community development. This favorable change allows corporations to invest in key projects, which can have a positive impact on the local economy and community well-being. Keyword: Lima, Arizona The approval of the amendment to the articles of incorporation opens up exciting possibilities for corporations in Lima, Arizona. Now, companies can strategically allocate their capital surplus in ways that optimize their business operations and benefit the local community simultaneously. Keyword: Approval of amendment to articles of incorporation The long-awaited approval of this amendment signifies the recognition of the dynamic business landscape in Lima, Arizona. This decision illustrates the authorities' commitment to fostering an environment where corporations can thrive and contribute to the community's overall advancement. Keyword: Capital surplus Corporations with a capital surplus can now leverage these extra funds in a variety of new ways due to this amendment. Instead of keeping excess reserves idle, they can utilize their capital surplus for activities like expanding operations, investing in research and development, implementing updated technology infrastructure, or even initiating philanthropic endeavors. Keyword: Distributions The approval includes guidelines on how corporations can distribute surplus funds, ensuring responsibility and efficiency. These distributions are subject to prudent financial management practices, ensuring they do not compromise the financial stability and viability of the company itself. Keyword: Uses of distributions from capital surplus Under the amended articles of incorporation, corporations can allocate their distributions from capital surplus for activities beyond traditional business operations. This flexibility widens the range of options available while adhering to legal and regulatory requirements. Potential uses may include community development projects, sponsoring local events, scholarships, grants, partnerships with nonprofit organizations, or supporting social welfare initiatives. Overall, the approval of the amendment to the articles of incorporation in Lima, Arizona is a significant milestone for the local business community. It encourages innovative thinking, responsible financial management, and community engagement, benefiting both corporations and the inhabitants of Lima alike. This progressive step positions Lima as an attractive place for businesses to operate while fostering sustainable growth, development, and a harmonious relationship between organizations and the community they serve.

Pima Arizona Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus

Description

How to fill out Pima Arizona Approval Of Amendment To Articles Of Incorporation To Permit Certain Uses Of Distributions From Capital Surplus?

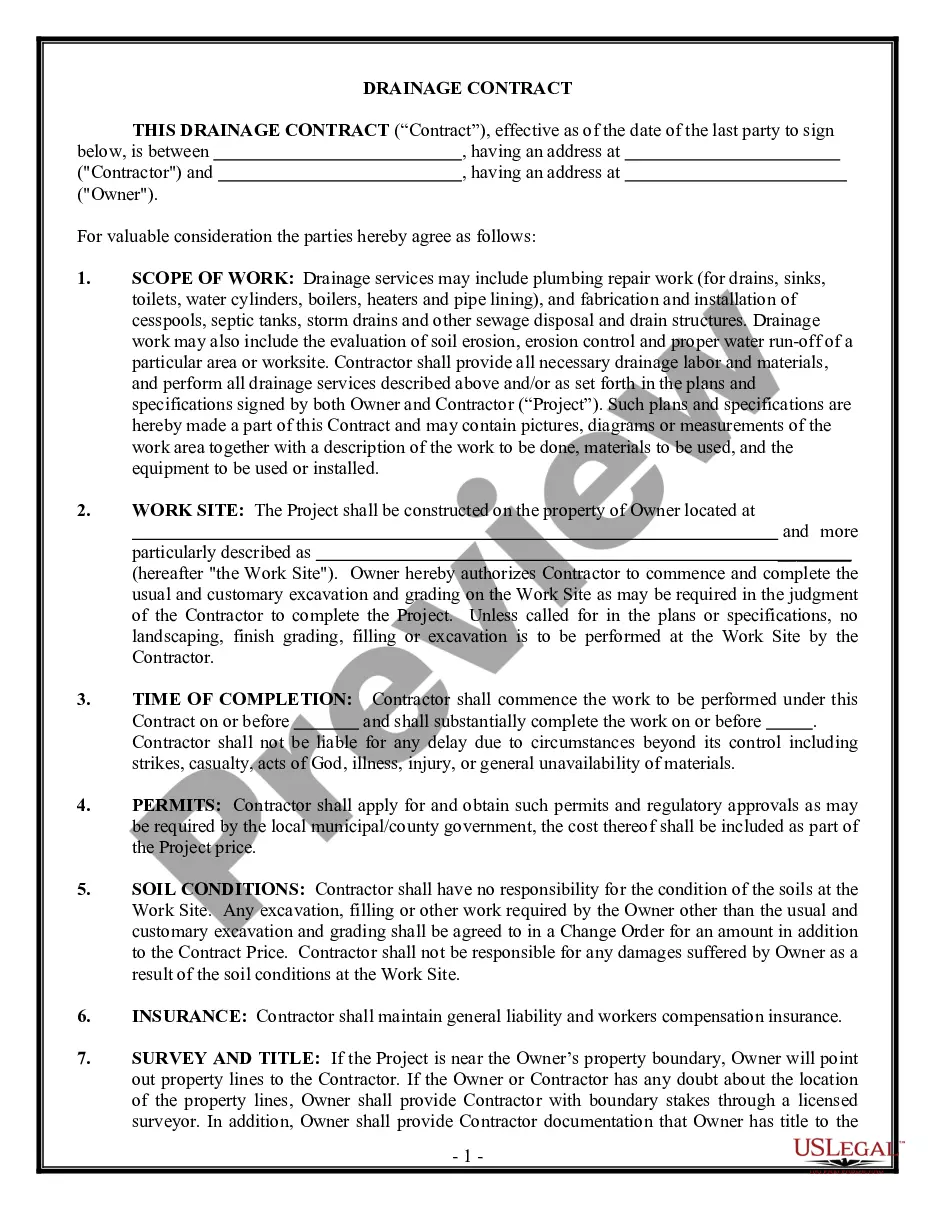

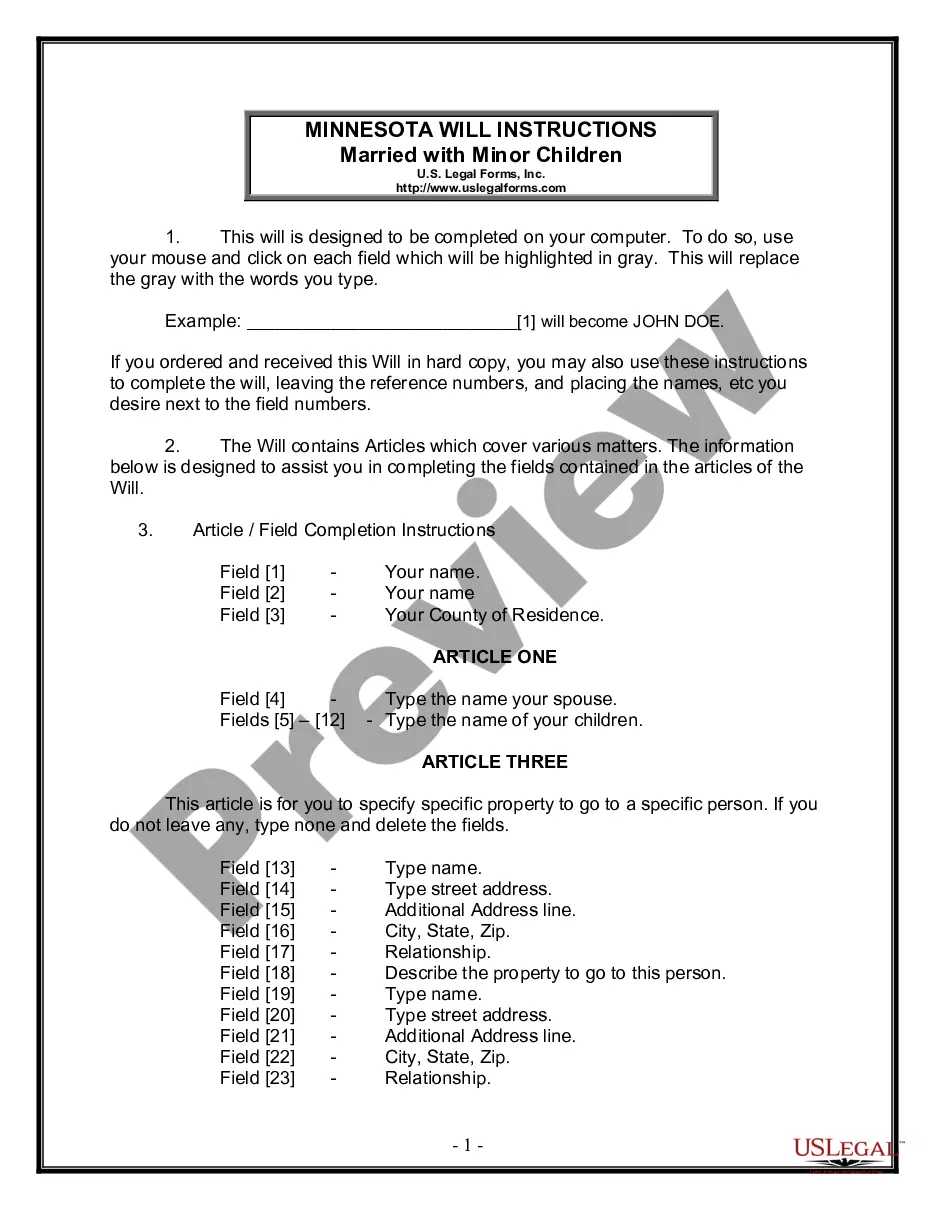

Preparing legal paperwork can be difficult. Besides, if you decide to ask an attorney to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Pima Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case accumulated all in one place. Therefore, if you need the recent version of the Pima Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Pima Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Pima Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus and download it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Depending on the state in which the business is incorporated, unanimous agreement from all the shareholders may be required to change the articles of incorporation. Most states have changed this older, common law rule, and now only require a majority of shareholders to agree to change the articles of incorporation.

? Unless otherwise prescribed by this Code or by special law, and for legitimate purposes, any provision or matter stated in the articles of incorporation may be amended by a majority vote of the board of directors or trustees and the vote or written assent of the stockholders representing at least two-thirds (2/3) of

The most common reason that businesses change the articles of incorporation is to change members' information. It is important to amend the articles of incorporation for any major changes to avoid legal consequences.

How to Amend Articles of Incorporation Review the bylaws of the corporation.A board of directors meeting must be scheduled.Write the proposed changes.Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

To amend (change, add or delete) provisions contained in the Articles of Incorporation, it is necessary to prepare and file with the California Secretary of State a Certificate of Amendment of Articles of Incorporation in compliance with California Corporations Code sections 900-910.

First, any amendment to a corporation's certificate of incorporation must be initiated by the corporation's board of directors and requires the board's assent. A certificate amendment may not be initiated by stockholders.

? Unless otherwise prescribed by this Code or by special law, and for legitimate purposes, any provision or matter stated in the articles of incorporation may be amended by a majority vote of the board of directors or trustees and the vote or written assent of the stockholders representing at least two-thirds (2/3) of

To amend (change, add or delete) provisions contained in the Articles of Incorporation, it is necessary to prepare and file with the California Secretary of State a Certificate of Amendment of Articles of Incorporation in compliance with California Corporations Code sections 900-910.

To submit amendments AND restated articles of incorporation, use the Amended and Restated Articles of Incorporation (Form DC-5).