[Your Name] [Your Title/Position] [Company Name] [Company Address] [City, State, Zip Code] [Email Address] [Phone Number] [Date] [Recipient Name] [Recipient Title/Position] [Board of Directors] [Company Name] [Company Address] [City, State, Zip Code] Subject: Fairness Opinion on [Company Name] Proposed Transaction Dear [Recipient Name], I hope this letter finds you in good health and spirits. As an esteemed member of the Board of Directors at [Company Name], I would like to provide you with a comprehensive fairness opinion regarding the proposed transaction between [Company Name] and the relevant parties involved. Introduction: Mecklenburg County, located in the state of North Carolina, is a vibrant region driven by a dynamic economy and a rich cultural heritage. It serves as an ideal location for businesses aiming to establish a strong foothold in the Southeastern United States. In light of the proposed transaction, it is crucial to assess the fairness of the terms for all stakeholders involved and provide an unbiased opinion. Overview of the Proposed Transaction: [Provide a brief summary or description of the proposed transaction, including the companies/individuals involved, the nature of the transaction (merger, acquisition, etc.), and any pertinent financial or legal aspects.] Types of Fairness Opinions: In the context of the proposed transaction, there are primarily three types of fairness opinions that can be considered: 1. Unaffiliated Fairness Opinion: An unaffiliated fairness opinion is conducted by an independent third-party financial advisory firm with expertise in valuation and corporate finance. This opinion is unbiased and impartial, ensuring transparency and protecting the interests of all stakeholders involved. 2. Company-Appointed Fairness Opinion: A company-appointed fairness opinion is conducted when the board engages a financial advisory firm that is affiliated with the company. While this opinion may still provide valuable insights, it is essential to consider potential conflicts of interest that could arise. 3. Shareholder-Appointed Fairness Opinion: A shareholder-appointed fairness opinion is obtained when a significant shareholder or group of shareholders engages a separate financial advisory firm to assess the fairness of the proposed transaction. This opinion represents the perspective of the shareholders and can help ensure their rights are adequately evaluated. Deliverables of a Fairness Opinion: A comprehensive fairness opinion typically includes the following key components: 1. Executive Summary: Provides a concise overview of the opinion, including a summary of methodology and key findings. 2. Transaction Background: Details the rationale, context, and key milestones leading to the proposed transaction. 3. Financial Analysis: Conducts a detailed analysis of financial metrics, including valuation techniques and relevant industry benchmarks, to determine the fairness of the proposed transaction. 4. Application of Appropriate Methodologies: Utilizes various financial models and methodologies, such as discounted cash flow analysis, comparable company analysis, and precedent transaction analysis, to assess the fairness of the transaction price. 5. Comparative Analysis: Compares the proposed transaction against similar transactions in the market to evaluate whether the terms align with prevailing market dynamics and industry standards. 6. Risk Assessment: Identifies and evaluates potential risks, synergies, and any other material factors affecting the transaction's fairness. 7. Qualifications and Assumptions: Discloses any assumptions made during the analysis and highlights any limitations or uncertainties that may impact the opinion's validity. Conclusion: The purpose of this letter is to provide you with an understanding of the importance of a fairness opinion in the context of the proposed transaction. We believe that obtaining an unbiased and comprehensive fairness opinion will ensure transparency, enhance confidence among stakeholders, and ultimately facilitate the decision-making process. Should you have any questions or require further information, please do not hesitate to reach out. Our team of experienced professionals is committed to delivering an accurate and insightful fairness opinion that aligns with the best interests of [Company Name] and its shareholders. Thank you for your time and consideration. Sincerely, [Your Name] [Your Title/Position] [Company Name]

Mecklenburg North Carolina Letter to Board of Directors - Fairness Opinion

Description

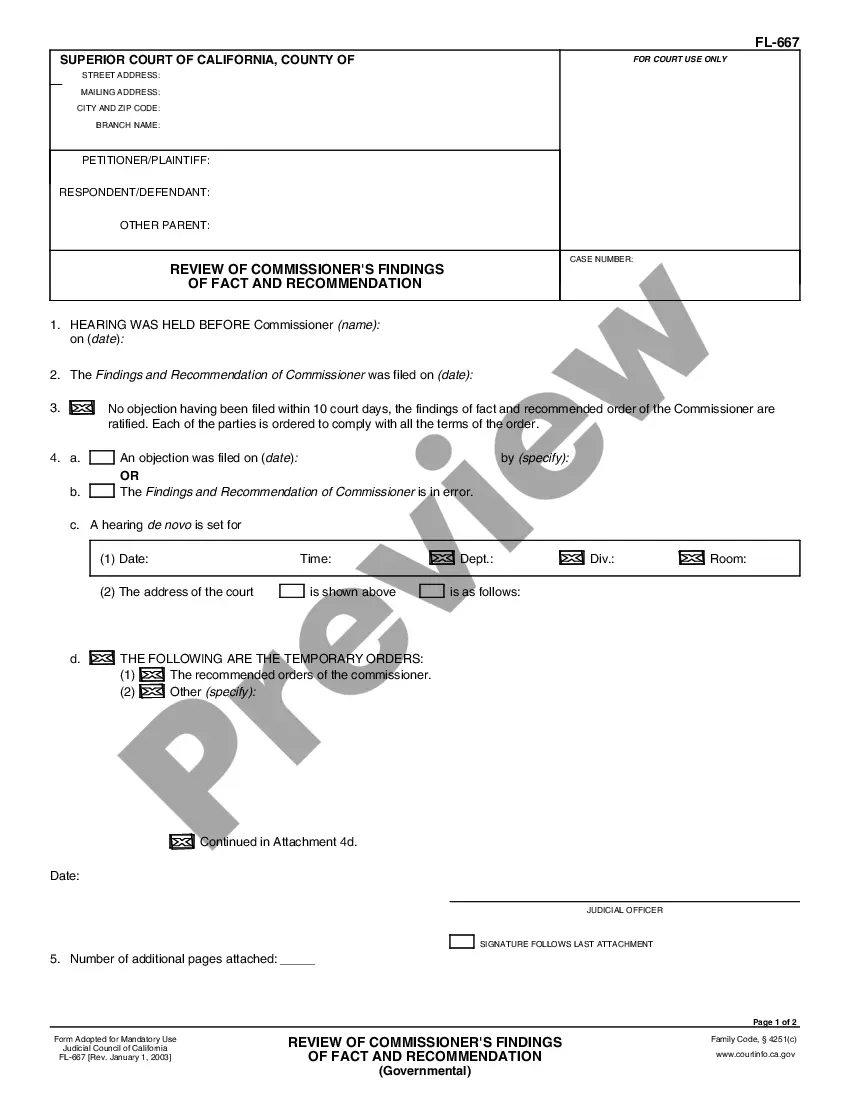

How to fill out Mecklenburg North Carolina Letter To Board Of Directors - Fairness Opinion?

Creating paperwork, like Mecklenburg Letter to Board of Directors - Fairness Opinion, to take care of your legal affairs is a tough and time-consumming task. Many circumstances require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can take your legal matters into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms created for different scenarios and life situations. We make sure each form is compliant with the regulations of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Mecklenburg Letter to Board of Directors - Fairness Opinion template. Simply log in to your account, download the template, and customize it to your needs. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before getting Mecklenburg Letter to Board of Directors - Fairness Opinion:

- Make sure that your document is specific to your state/county since the regulations for creating legal documents may vary from one state another.

- Find out more about the form by previewing it or going through a quick intro. If the Mecklenburg Letter to Board of Directors - Fairness Opinion isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to begin using our website and download the document.

- Everything looks great on your end? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and enter your payment information.

- Your form is good to go. You can try and download it.

It’s an easy task to locate and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!