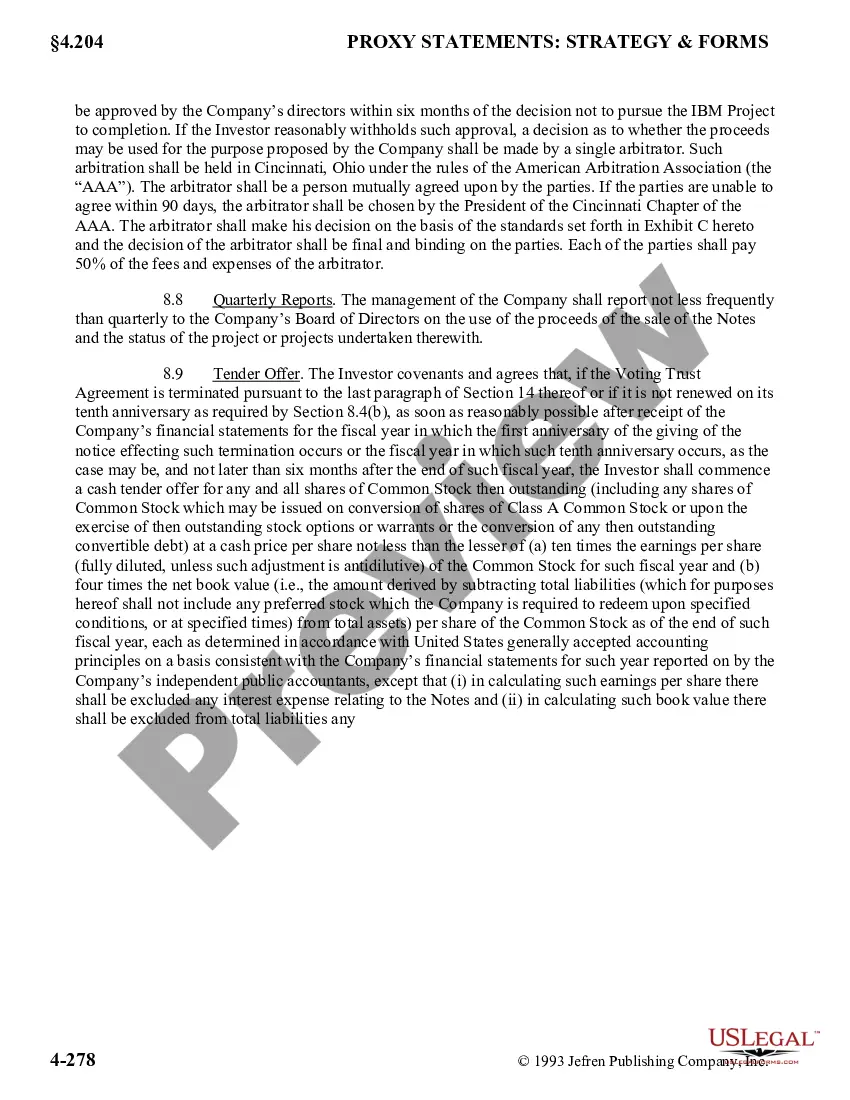

San Jose, California is a vibrant city located in the heart of Silicon Valley. Known for its thriving technology industry and diverse community, San Jose offers a multitude of opportunities for businesses and residents alike. As one of the largest cities in California, it serves as a hub for innovation, education, and culture. Access Corp. and Ocean her Grin ten, N.V. have entered into a Sample Note Purchase Agreement in San Jose, California. This legally binding document outlines the terms and conditions of the purchase and sale of promissory notes between the two companies. It is designed to protect the interests of both parties and establish a clear understanding of the transaction. The Sample Note Purchase Agreement includes important provisions such as the description of the promissory notes being acquired, the purchase price, payment terms, and any applicable interest rates. Additionally, it may outline conditions for default, remedies in case of non-payment or breaches, and provisions for dispute resolution. In the context of San Jose, there are various types of Sample Note Purchase Agreements that can be drafted between Access Corp. and Ocean her Grin ten, N.V., depending on the specific nature of the transaction. These might include: 1. Fixed-Rate Note Purchase Agreement: This type of agreement would establish a fixed interest rate for the promissory notes being sold, which remains constant throughout the repayment period. It provides stability and predictability in terms of payment obligations. 2. Variable-Rate Note Purchase Agreement: In contrast, a variable-rate agreement would allow for fluctuations in the interest rate attached to the promissory notes, based on an agreed-upon index or benchmark. This type of agreement offers flexibility and the potential for lower interest rates in certain market conditions. 3. Convertible Note Purchase Agreement: A convertible note agreement provides the option for the promissory notes to be converted into equity in the future, usually upon the occurrence of specific events or milestones. This type of agreement is often employed in startup financing, allowing investors to potentially benefit from the company's growth. Regardless of the specific type of Sample Note Purchase Agreement, it is crucial to consult legal professionals and ensure all relevant laws and regulations are considered when drafting and executing the agreement. Properly executed agreements help in minimizing risks, establishing clear expectations, and fostering a successful business relationship between Access Corp. and Ocean her Grin ten, N.V.

San Jose California Sample Note Purchase Agreement between Access Corp. and Oce-van der Grinten, N.V.

Description

How to fill out San Jose California Sample Note Purchase Agreement Between Access Corp. And Oce-van Der Grinten, N.V.?

Laws and regulations in every sphere differ throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the San Jose Sample Note Purchase Agreement between Access Corp. and Oce-van der Grinten, N.V., you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the San Jose Sample Note Purchase Agreement between Access Corp. and Oce-van der Grinten, N.V. from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the San Jose Sample Note Purchase Agreement between Access Corp. and Oce-van der Grinten, N.V.:

- Take a look at the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the template when you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

A convertible note is a form of short-term debt that converts into equity, typically in conjunction with a future financing round; in effect, the investor would be loaning money to a startup and instead of a return in the form of principal plus interest, the investor would receive equity in the company.

A bond purchase agreement is a contract that provides certain clauses that are executed on the date the new bond issue is priced. The terms and conditions of a BPA include: Terms of the bonds. Conditions that must be met before the purchase of the bonds by the underwriter.

A purchase agreement is a type of contract that outlines terms and conditions related to the sale of goods. As a legally binding contract between buyer and seller, the agreements typically relate to buying and selling goods rather than services. They cover transactions for nearly any type of product.

A convertible note purchase agreement is an agreement between certain investors and a company that binds all the investors to the same terms and conditions for a particular round of convertible debt financing. Convertible debt is debt that can be converted into equity.

What to include in a business sales contract. Name the parties. Clearly state the names and locations of the buyer and seller.List the assets.Define liabilities.Set sale terms.Include other agreements.Make your sales agreement digital.

A contract for the sale and purchase of notes that allows a company (the seller) to raise money for general corporate purposes, to complete an acquisition or for other purposes. The purchasers of the notes invest in the company through their purchases of the notes.

A form of liquidity for bonds, usually an agreement with a third party such as a bank in which the third party agrees to purchase variable rate demand obligations tendered for purchase in the event that they cannot be remarketed.

Unlike stocks, each bond contract has unique characteristics that define how repayment will occur. Every bond contract has at least five components: the borrower, price, date of maturity, value of maturity and coupon rate.

A simple money bond must contain the following: Name of the lender and the borrower. Address of the lender and the borrower. The amount being lent/borrowed. The purpose for which the amount is being borrowed. The time period for which the amount is being lent. The interest to be levied on the amount.

Convertible notes are debt instruments that include terms like a maturity date, an interest rate, etc., but that will convert into equity if a future equity round is raised. The conversion typically occurs at a discount to the price per share of the future round.