Tarrant Texas Sample Note Purchase Agreement between Access Corp. and Ocean her Grin ten, N.V. is a legally binding contract that outlines the terms and conditions for the sale and purchase of promissory notes between the two parties. This agreement serves as a framework for the transaction and ensures both parties' rights and obligations are clearly defined. The Tarrant Texas Sample Note Purchase Agreement specifies important details such as the parties involved, the types of promissory notes being sold, the purchase price, payment terms, and any warranties or representations made by either party. Additionally, it may include provisions for default, dispute resolution, and governing laws to protect the parties' interests. Keywords: Tarrant Texas, Sample Note Purchase Agreement, Access Corp., Ocean her Grin ten, N.V., promissory notes, legally binding contract, terms and conditions, sale and purchase, framework, transaction, rights and obligations, parties involved, purchase price, payment terms, warranties, representations, default, dispute resolution, governing laws, interests. It's important to note that there may be different types of Tarrant Texas Sample Note Purchase Agreements between Access Corp. and Ocean her Grin ten, N.V., which can be tailored to meet the specific needs and requirements of the parties involved. Some variations may include: 1. Fixed-Term Note Purchase Agreement: This type of agreement establishes a fixed term during which the promissory notes will be purchased and sets a specific maturity date for each note. It helps in creating a structured timeline for payment and ensures a clear understanding of the investment. 2. Floating-Rate Note Purchase Agreement: In this agreement, the interest rate on the promissory notes is variable and tied to a specific benchmark, such as the LIBOR rate or the prime rate. This type of agreement allows for flexibility in interest payments, which can be adjusted periodically based on market conditions. 3. Standby Note Purchase Agreement: A standby note purchase agreement is typically used when the promissory notes will only be purchased if specified conditions are met, such as the occurrence of a particular event or the default of another party. It ensures that the purchase is contingent upon certain predetermined circumstances. These variations reflect the adaptability of Tarrant Texas Sample Note Purchase Agreements to accommodate different financial arrangements and preferences. It is crucial for the parties involved to carefully review and customize the agreement to fit their specific transaction and business needs.

Tarrant Texas Sample Note Purchase Agreement between Access Corp. and Oce-van der Grinten, N.V.

Description

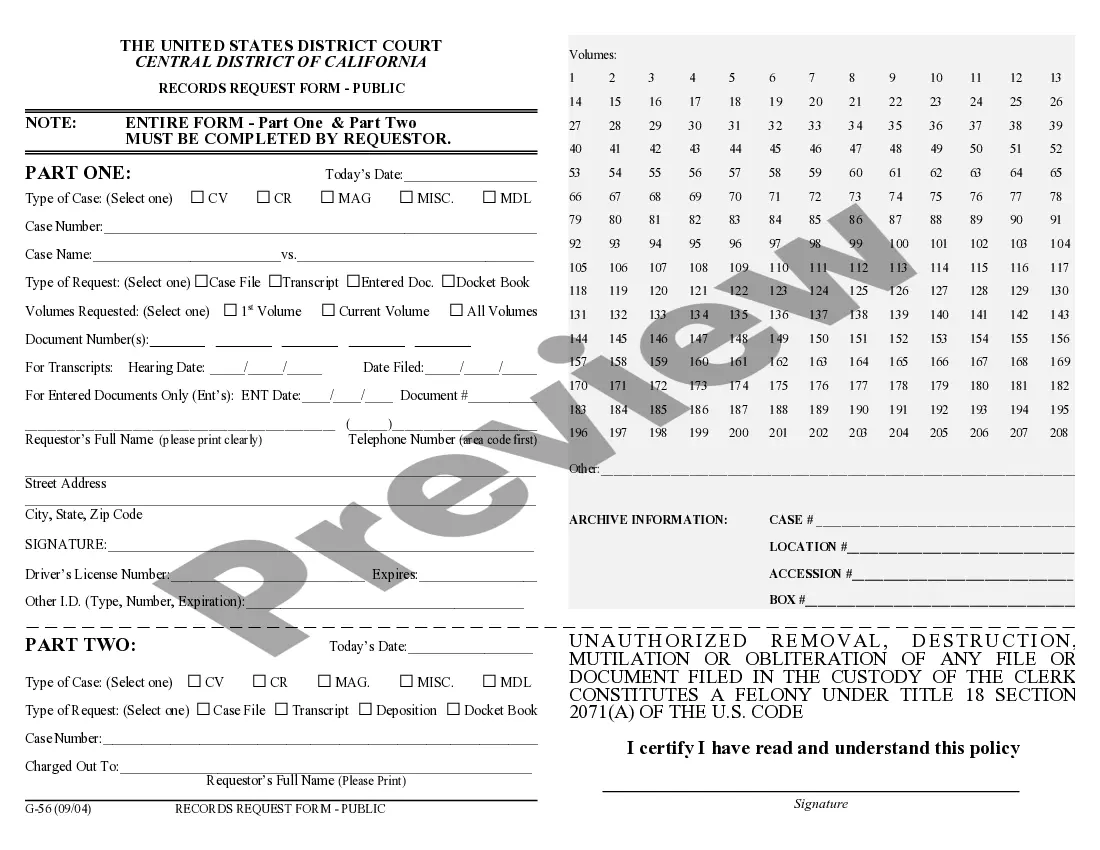

How to fill out Tarrant Texas Sample Note Purchase Agreement Between Access Corp. And Oce-van Der Grinten, N.V.?

Drafting paperwork for the business or personal demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to generate Tarrant Sample Note Purchase Agreement between Access Corp. and Oce-van der Grinten, N.V. without professional assistance.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Tarrant Sample Note Purchase Agreement between Access Corp. and Oce-van der Grinten, N.V. on your own, using the US Legal Forms web library. It is the biggest online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required document.

In case you still don't have a subscription, follow the step-by-step guide below to get the Tarrant Sample Note Purchase Agreement between Access Corp. and Oce-van der Grinten, N.V.:

- Look through the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are available.

- To find the one that fits your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any use case with just a couple of clicks!

Form popularity

FAQ

Stock Purchase Agreement: Everything You Need to Know Name of company. Purchaser's name. Par value of shares. Number of shares being sold. When/where the transaction takes place. Representations and warranties made by purchaser and seller. Potential employee issues, such as bonuses and benefits.

A convertible promissory note is a debt obligation in which a company borrows money from an investor in exchange for a promise of repayment and an option to convert the outstanding principal into equity of the company upon some triggering event. Notes have a maturity date and bear interest.

A contract for the sale and purchase of notes that allows a company (the seller) to raise money for general corporate purposes, to complete an acquisition or for other purposes. The purchasers of the notes invest in the company through their purchases of the notes.

A purchase agreement is a legal document that is signed by both the buyer and the seller. Once it is signed by both parties, it is a legally binding contract. The seller can only accept the offer by signing the document, not by just providing the goods.

A purchase money note, also called a purchase money mortgage, is an agreement between a seller and a buyer in which the mortgage is issued to buyer by the seller. This arrangement is also called owner financing.

A purchase money note, also called a purchase money mortgage, is an agreement between a seller and a buyer in which the mortgage is issued to buyer by the seller. This arrangement is also called owner financing.

Why should you use a convertible note purchase agreement? It can postpone the need for a valuation of the company. It can delay the issuance of certain series of equity, thereby postponing the significant legal costs of issuing stock, etc. and the possible dilution of the founders' equity and control.

A convertible note purchase agreement is an agreement between certain investors and a company that binds all the investors to the same terms and conditions for a particular round of convertible debt financing. Convertible debt is debt that can be converted into equity.

Convertible notes are debt instruments that include terms like a maturity date, an interest rate, etc., but that will convert into equity if a future equity round is raised. The conversion typically occurs at a discount to the price per share of the future round.

In real estate, a purchase agreement is a binding contract between a buyer and seller that outlines the details of a home sale transaction. The buyer will propose the conditions of the contract, including their offer price, which the seller will then either agree to, reject or negotiate.