San Diego California Form of Note is a legal document used in real estate transactions, specifically in the state of California. It serves as evidence of a loan agreement between a lender and a borrower. This detailed description will provide insights into the purpose, structure, terms, and types of San Diego California Form of Note. The primary purpose of the San Diego California Form of Note is to outline the terms and conditions of a loan, including the principal amount borrowed, interest rate, repayment terms, and any additional fees or costs associated with the loan. It legally binds the borrower to repay the lender according to the specified terms. The structure of the San Diego California Form of Note typically begins with a preamble stating the parties involved (lender and borrower), followed by an acknowledgment of the loan amount received by the borrower. It then outlines the repayment schedule, detailing the number of payments, payment frequency, and due dates. Additionally, it includes information on the interest rate, late payment penalties, and any prepayment options or penalties. There are different types of San Diego California Form of Note tailored to specific loan arrangements. Some common types include: 1. Promissory Note: This is the most basic and common form of the San Diego California Form of Note. It establishes the borrower's promise to repay the loan amount and specifies the interest rate, repayment schedule, and any other relevant terms. 2. Secured Note: In this type of note, the borrower pledges collateral (such as real estate or vehicles) to secure the loan. If the borrower fails to repay the loan, the lender has the right to seize the collateral. 3. Unsecured Note: Unlike a secured note, this type does not require collateral. The lender relies on the borrower's creditworthiness and trust. These notes usually have higher interest rates to compensate for the increased risk undertaken by the lender. 4. Adjustable-Rate Note: This type of note features an interest rate that may fluctuate over the loan term. The interest rate is tied to an index, such as the market rate, and it adjusts periodically according to the terms specified in the note. 5. Balloon Note: A balloon note has a fixed interest rate and repayment schedule for a certain period (e.g., five years). However, it requires a lump-sum payment of the remaining principal at the end of the term. In conclusion, the San Diego California Form of Note is a crucial legal document in real estate transactions. It defines the terms and conditions of a loan agreement and binds the borrower to repay the lender accordingly. Different types of San Diego California Form of Note accommodate various loan arrangements, catering to specific needs and circumstances.

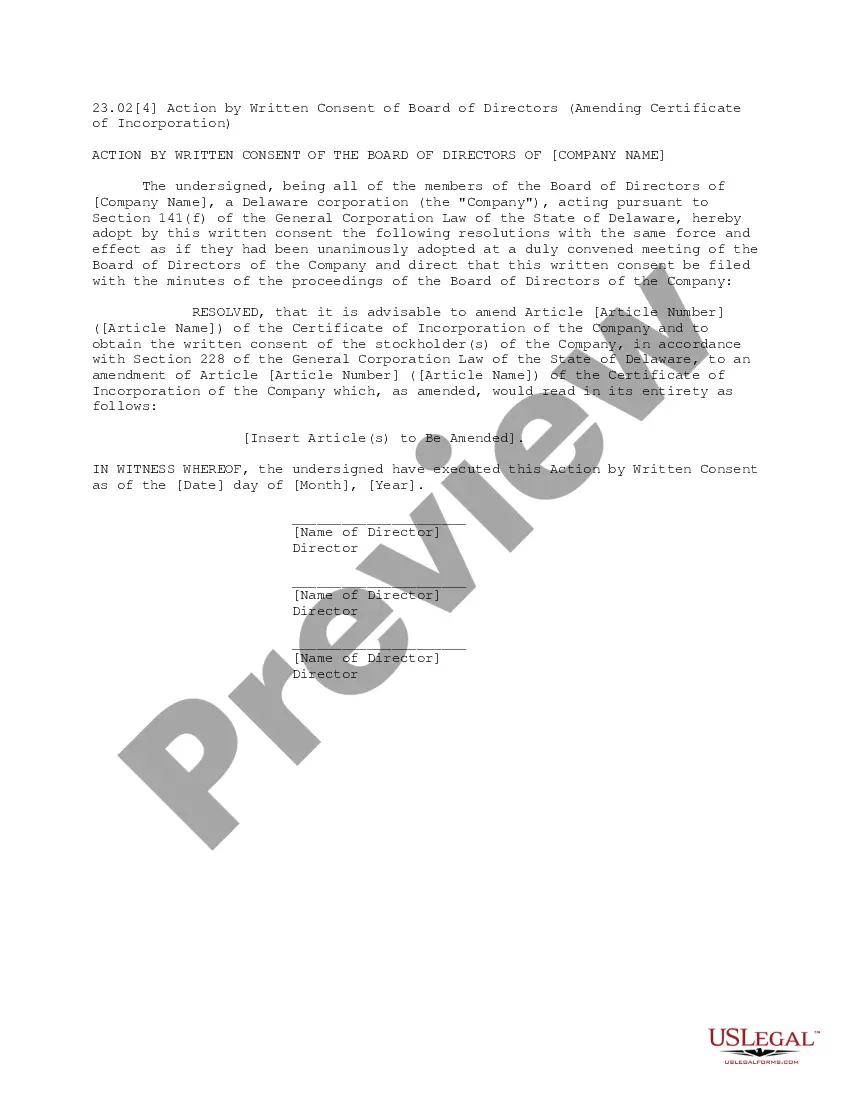

San Diego California Form of Note

Description

How to fill out San Diego California Form Of Note?

If you need to get a trustworthy legal form supplier to find the San Diego Form of Note, look no further than US Legal Forms. No matter if you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can search from over 85,000 forms arranged by state/county and case.

- The intuitive interface, number of learning materials, and dedicated support make it simple to locate and execute different documents.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply select to search or browse San Diego Form of Note, either by a keyword or by the state/county the form is intended for. After locating required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the San Diego Form of Note template and take a look at the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Register an account and select a subscription option. The template will be instantly available for download as soon as the payment is processed. Now you can execute the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes this experience less pricey and more reasonably priced. Create your first business, arrange your advance care planning, draft a real estate contract, or complete the San Diego Form of Note - all from the convenience of your home.

Join US Legal Forms now!

Form popularity

FAQ

Most estates are settled though probate in about 9 to 18 months, assuming there is no litigation involved. Servicing clients throughout San DiegoCounty and Southern California, Rodriguez Law Offices can help walk you and your family through the California probate process.

To file probate in San Diego, you must do the following: file your formal probate electronically. serve notice to electronic assignment on all parties (this may include potential heirs and proper beneficiaries) blue-back the original will and death certificate for the deceased.

Guide to Los Angeles Superior Court Probate Notes - YouTube YouTube Start of suggested clip End of suggested clip If your probate notes aren't cleared then you'll have to return to the Los Angeles Superior CourtMoreIf your probate notes aren't cleared then you'll have to return to the Los Angeles Superior Court for another probate hearing the downside there is the time involved in waiting for that next hearing.

(d) Special notice may be requested of: (1) Any one or more of the matters in subdivision (c) by describing the matter or matters. (2) All the matters in subdivision (c) by referring generally to "the matters described in subdivision (c) of Section 2700 of the Probate Code" or by using words of similar meaning.

Probate examiner notes are summaries prepared by the probate examiner after reviewing a petition for probate. The notes are presented to the probate judge to help them make a decision during petition review. More specifically, probate notes identify the parties involved in the matter and the relief they seek.

It is the probate examiner's responsibility to: Review your initial petition for probate and any supporting documents to make sure that it complies with all applicable laws and court rules.

The California Probate Code governs what happens to the property of a person after they die or become incapacitated.

Probate Examiner Notes (Probate Notes) are summaries prepared by the probate examiner after reviewing your petition. This summary is transmitted to the probate judge and may assist him/her during their review of the matter.

Interesting Questions

More info

If you have any questions, please contact the Tech Support Center at techsupportcampuslogic.com.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.