Fairfax Virginia Terms of Class One Preferred Stock: Fairfax, Virginia is a bustling city located in the heart of Northern Virginia. Known for its rich history and vibrant community, it offers a diverse range of opportunities for businesses and investors alike. One of the popular investment options that plays a significant role in Fairfax, Virginia, is Class One Preferred Stock. Class One Preferred Stock is a type of corporate security issued by companies to raise capital. It is often considered a hybrid between common stock and corporate bonds. Investors who purchase Class One Preferred Stock become shareholders in the company, but they hold a different class of shares compared to common stockholders. Preferred stockholders are entitled to several advantages, such as priority dividend payments and a higher claim on company assets in the event of liquidation. In the case of Fairfax Virginia, there are several variations of Class One Preferred Stock available. These variations may include: 1. Cumulative Class One Preferred Stock: This type of preferred stock ensures that any unpaid dividends accumulate and must be paid to shareholders before any dividends are distributed to common stockholders. 2. Non-cumulative Class One Preferred Stock: Unlike cumulative preferred stock, non-cumulative preferred stock does not accumulate unpaid dividends. If dividends are missed, they are no longer payable to shareholders. 3. Convertible Class One Preferred Stock: This form of preferred stock provides the option for shareholders to convert their shares into a predetermined number of common stock shares. Conversion is typically done at the discretion of the shareholder. 4. Callable Class One Preferred Stock: Callable preferred stock means that the issuing company reserves the right to repurchase the shares from shareholders at a specified price and time. This offers flexibility to the company to redeem the shares if favorable market conditions arise. 5. Floating Rate Class One Preferred Stock: This type of preferred stock has variable dividends, which are tied to a benchmark interest rate such as LIBOR (London Interbank Offered Rate) or the U.S. Treasury rate. The dividend payment adjusts periodically according to the fluctuations in the benchmark rate. Investing in Class One Preferred Stock can provide investors with a stable income stream through consistent dividend payments and other associated benefits. However, it is crucial for potential investors to thoroughly understand the terms and conditions associated with each type of preferred stock being offered. In conclusion, Fairfax Virginia offers various types of Class One Preferred Stock options. Investors can choose from cumulative or non-cumulative stock, convertible or callable stock, as well as floating rate options. These variations provide flexibility for investors based on their risk tolerance, income preferences, and investment goals. It is advisable for investors to consult with financial advisors or thoroughly research each offering before making investment decisions in the Fairfax, Virginia market.

Fairfax Virginia Terms of Class One Preferred Stock

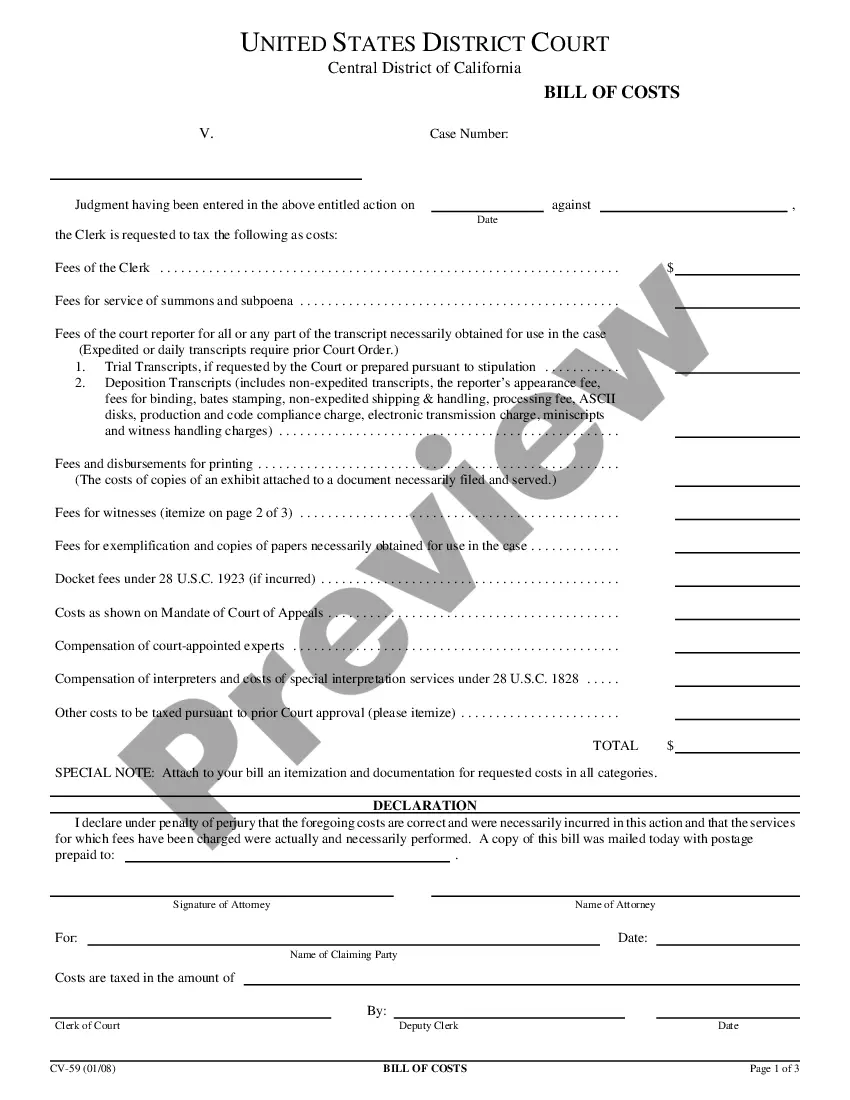

Description

How to fill out Fairfax Virginia Terms Of Class One Preferred Stock?

Draftwing forms, like Fairfax Terms of Class One Preferred Stock, to take care of your legal affairs is a tough and time-consumming task. A lot of cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can take your legal issues into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents crafted for various cases and life situations. We make sure each document is compliant with the laws of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Fairfax Terms of Class One Preferred Stock template. Simply log in to your account, download the template, and customize it to your requirements. Have you lost your document? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is fairly simple! Here’s what you need to do before downloading Fairfax Terms of Class One Preferred Stock:

- Ensure that your document is compliant with your state/county since the regulations for writing legal paperwork may differ from one state another.

- Learn more about the form by previewing it or going through a brief description. If the Fairfax Terms of Class One Preferred Stock isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to begin using our website and download the form.

- Everything looks good on your side? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your form is good to go. You can try and download it.

It’s easy to find and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!