Fulton Georgia Terms of Class One Preferred Stock refers to specific provisions and conditions associated with the issuance and ownership of preferred stock in Fulton County, Georgia. Preferred stock is a form of ownership in a corporation that typically offers certain preferential rights and privileges over common stockholders. In Fulton, Georgia, Class One Preferred Stock represents the highest tier of preferred stock within a company. Let's delve into the key features and keywords associated with Fulton Georgia Terms of Class One Preferred Stock: 1. Dividend Priority: Class One Preferred Stockholders generally have a higher priority in receiving dividends compared to common stockholders. This implies that if the company declares dividends, Class One Preferred Stockholders will be entitled to receive dividend payments before the common stockholders. 2. Fixed Dividend Rate: Fulton Georgia Class One Preferred Stock may offer a fixed dividend rate, predetermined at the time of issuance. The dividend rate refers to the percentage of the stock's face value that investors receive as annual dividend payments. 3. Cumulative Dividends: Class One Preferred Stock may have the feature of cumulative dividends. This means that if the company fails to declare or pay dividends in a particular year, the unpaid dividends will accumulate and be paid at a later date before any dividends are distributed to common stockholders. 4. Liquidation Preference: Class One Preferred Stockholders generally have a preferential claim on the company's assets in the event of liquidation or bankruptcy. They are entitled to receive their investment back before common stockholders in case of winding up or dissolution of the company. 5. Convertibility: Certain types of Class One Preferred Stock may carry the option for conversion into common stock. Conversion typically occurs at a predetermined conversion ratio or formula, allowing preferred stockholders to become common stockholders, potentially benefiting from future growth in the company. 6. Redemption Rights: Fulton Georgia Class One Preferred Stock may also come with redemption rights. This means that the issuer has the right to redeem or repurchase the preferred shares from investors at a specific time and price specified in the terms. It's important to note that the specific terms and conditions of Fulton Georgia Class One Preferred Stock may vary across different companies or within different industries. Companies might have multiple classes of preferred stock, such as Class Two Preferred Stock or Class Three Preferred Stock, with each class having different rights and priorities as specified in the company's articles of incorporation or bylaws.

Fulton Georgia Terms of Class One Preferred Stock

Description

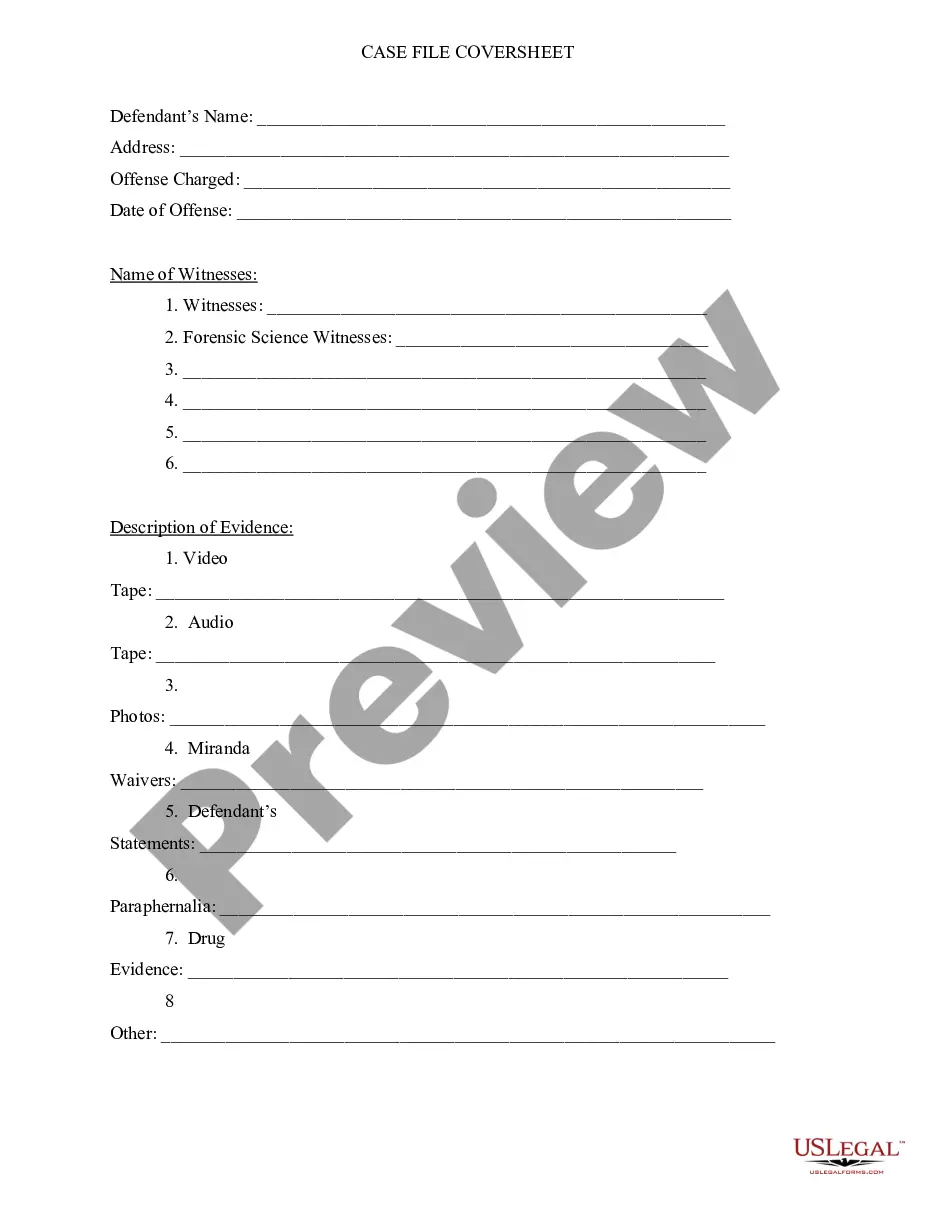

How to fill out Fulton Georgia Terms Of Class One Preferred Stock?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and many other life situations demand you prepare official paperwork that differs from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and download a document for any personal or business objective utilized in your region, including the Fulton Terms of Class One Preferred Stock.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Fulton Terms of Class One Preferred Stock will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to obtain the Fulton Terms of Class One Preferred Stock:

- Ensure you have opened the proper page with your regional form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the appropriate subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Fulton Terms of Class One Preferred Stock on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

Here's an easy formula for calculating the value of preferred stock: Cost of Preferred Stock = Preferred Stock Dividend (D) / Preferred Stock Price (P). Par value of one share of preferred stock equals the amount upon which the dividend is calculated.

It can be calculated by dividing the annual interest or dividend payment amount by the current market price of the security and multiplying the result by 100. For example, a preferred with a $25 par or face value with a fixed coupon rate of 6.5% pays an annual interest or dividend payment of $1.625.

Preferreds are issued with a fixed par value and pay dividends based on a percentage of that par, usually at a fixed rate. Just like bonds, which also make fixed payments, the market value of preferred shares is sensitive to changes in interest rates. If interest rates rise, the value of the preferred shares falls.

Wells Fargo & Company is a financial holding company and a bank holding company....Wells Fargo & Co (New) 8.00% Non-Cumulative Perpetual Class A Preferred Stock, Series J (WFC.PRJ) Series:JShares Offered:80,000,000Overallotment:12,000,000Liquidation Preference:$25Original Coupon:8.00%8 more rows

All repayments need to be subtracted from the free cash flow to equity whereas any cash raised by new issue of preferred shares must be added to the cash flows.

The simultaneous buying and selling of a security at two different prices in two different markets, resulting in profits without risk. Perfectly efficient markets present no arbitrage opportunities. Perfectly efficient markets seldom exist, but, arbitrage opportunities are often precluded because of transactions costs.

If the company has preferred dividends, we must subtract the value of the dividends paid out to preferred shareholders, because preferred dividends are treated debt-like.

The coupon rate multiplied by the par value (the issue price) of a share gives you the amount you can expect to receive annually. For example, a preferred stock with a $25 par value and an 8% coupon would pay an investor dividends of $2.00 per share over the course of the year.

It can be calculated by dividing the annual interest or dividend payment amount by the current market price of the security and multiplying the result by 100.

Calculate the Yield The yield is equal to the annual dividend divided by the current price. Suppose a preferred stock has an annual dividend of $3 per share and is trading at $60 per share. The yield equals $3 divided by $60, or 0.05. Multiply by 100 to convert to the percentage yield of 5 percent.