Harris Texas Terms of Class One Preferred Stock Overview: In Harris Texas, Class One Preferred Stock refers to a type of security that is typically issued by corporations to raise capital. It is considered a high-ranking stock class and holds certain advantages over common stock. The Terms of Class One Preferred Stock outlines the rights, features, and protections associated with this specific class of stock. Keywords: Harris Texas, Terms of Class One Preferred Stock, high-ranking stock class, preferred stock, corporations, capital raising, rights, features, protections. Types of Harris Texas Terms of Class One Preferred Stock: 1. Cumulative Preferred Stock: This type of Class One Preferred Stock entitles the shareholders to receive any unpaid dividends accumulated over the years. In case the corporation fails to distribute dividends in any given period, the dividends will accumulate and be paid out in future periods before any common stock dividends are disbursed. 2. Convertible Preferred Stock: This category of Class One Preferred Stock grants the shareholder the option to convert their preferred shares into a predetermined number of common shares. This conversion typically occurs at the discretion of the shareholder and can offer potential upside if the value of the common shares increases. 3. Participating Preferred Stock: With Participating Preferred Stock, shareholders are entitled to receive additional dividends after the common stock shareholders have received their allocated dividends. This means that if the company performs exceptionally well, preferred shareholders may receive extra dividends on top of their predetermined dividend rate. 4. Non-Participating Preferred Stock: In contrast to Participating Preferred Stock, this type of Class One Preferred Stock does not provide shareholders with additional dividends beyond their predetermined dividend rate. Once the preferred shareholders receive their allocated dividends, any additional dividends are solely distributed to common stockholders. 5. Redeemable Preferred Stock: Redeemable Preferred Stock allows the corporation to repurchase the preferred shares from the shareholders at a predetermined price and within a specified timeframe. This feature provides flexibility to the company in managing its capital structure. 6. Adjustable Rate Preferred Stock: This type of Class One Preferred Stock carries a dividend rate that is subject to change based on a pre-determined formula or a specified benchmark, such as the prime lending rate. The dividend payment may fluctuate periodically to align with market conditions. 7. Callable Preferred Stock: Callable Preferred Stock grants the issuing corporation the right to redeem the shares from the shareholders at a predetermined price, often after a specific waiting period. This feature allows the corporation to call back the preferred shares earlier than their maturity date. Keywords: Cumulative Preferred Stock, Convertible Preferred Stock, Participating Preferred Stock, Non-Participating Preferred Stock, Redeemable Preferred Stock, Adjustable Rate Preferred Stock, Callable Preferred Stock.

Harris Texas Terms of Class One Preferred Stock

Description

How to fill out Harris Texas Terms Of Class One Preferred Stock?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare formal documentation that differs from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any personal or business purpose utilized in your county, including the Harris Terms of Class One Preferred Stock.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Harris Terms of Class One Preferred Stock will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to get the Harris Terms of Class One Preferred Stock:

- Ensure you have opened the proper page with your local form.

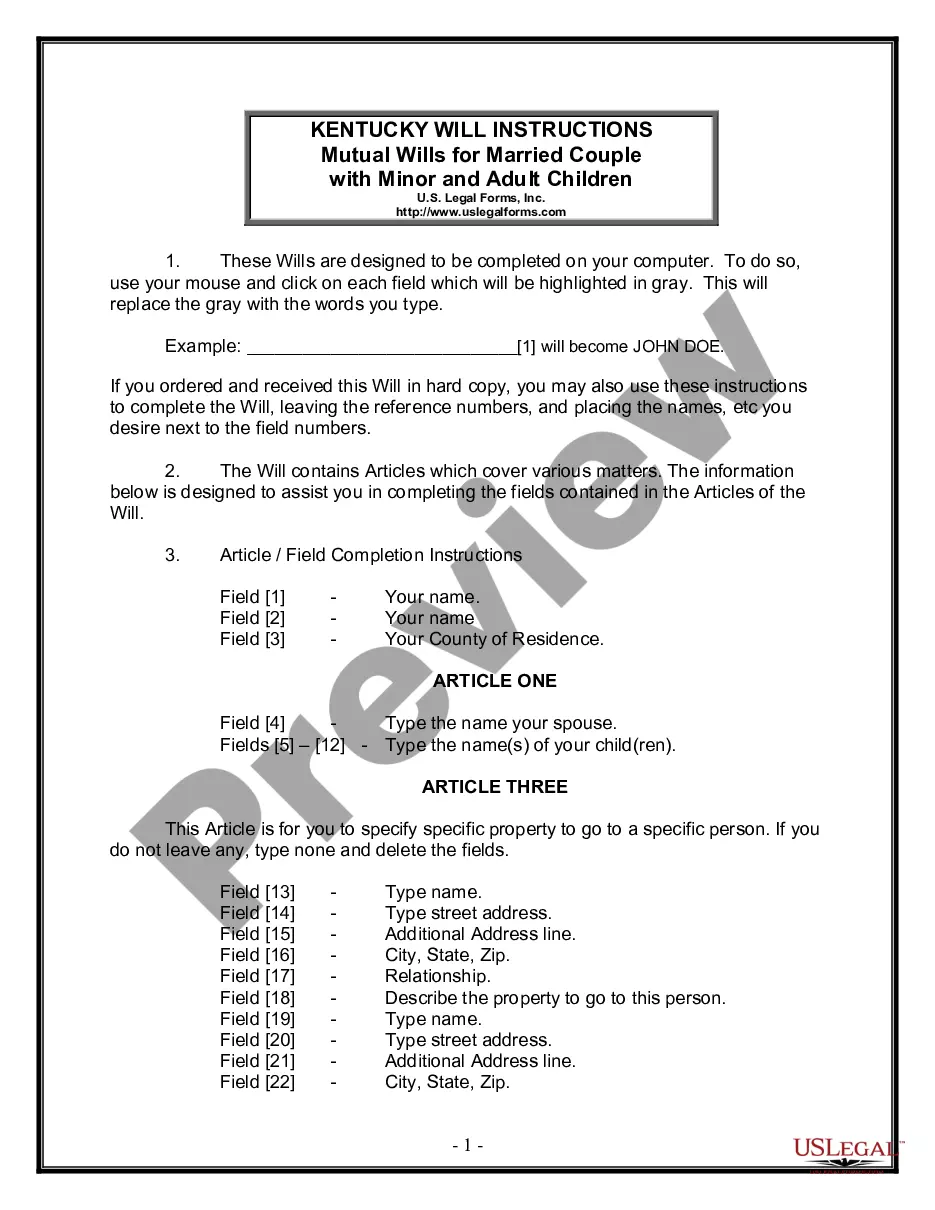

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Harris Terms of Class One Preferred Stock on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!