A Chicago Illinois Voting Trust Agreement is a legal document that stipulates the conditions under which a shareholder transfers their voting rights to a designated voting trustee. This agreement ensures the preservation and execution of voting rights in a structured manner. In such an arrangement, the shareholder issues physical share certificates to the voting trustees for safekeeping, which allows the trustees to exercise voting rights on their behalf. There are several types of Chicago Illinois Voting Trust Agreements, namely: 1. Irrevocable Voting Trust Agreement: This type of agreement cannot be revoked or modified by the shareholder once it comes into effect. The shareholder permanently transfers their voting rights to the voting trustees, and typically, this trust agreement remains in force until a specified event occurs, such as a merger or acquisition. 2. Revocable Voting Trust Agreement: Unlike the irrevocable version, this type of agreement allows the shareholder to revoke or modify the trust arrangement at their discretion. The shareholder maintains some control over their voting rights and can terminate the agreement if they wish. 3. Statutory Voting Trust Agreement: This type of trust agreement is created based on the statutes defined by the state of Illinois. It follows specific legal requirements and formalities set by the state law to ensure its validity and enforceability. 4. Non-Statutory Voting Trust Agreement: As the name suggests, this trust agreement does not strictly adhere to the statutory guidelines defined by the state of Illinois. Instead, it incorporates customized terms and conditions agreed upon by the shareholder and the voting trustees. Non-statutory voting trust agreements provide more flexibility and tailored governance to suit the specific needs of the shareholders involved. By implementing a Chicago Illinois Voting Trust Agreement, shareholders can effectively transfer their voting rights to trusted individuals or entities while maintaining control over their shares. This arrangement ensures that the voting trustees exercise the shareholder's voting rights in accordance with their best interests and the company's objectives. The specific type of voting trust agreement chosen depends on the shareholder's preferences and the legal requirements of the state.

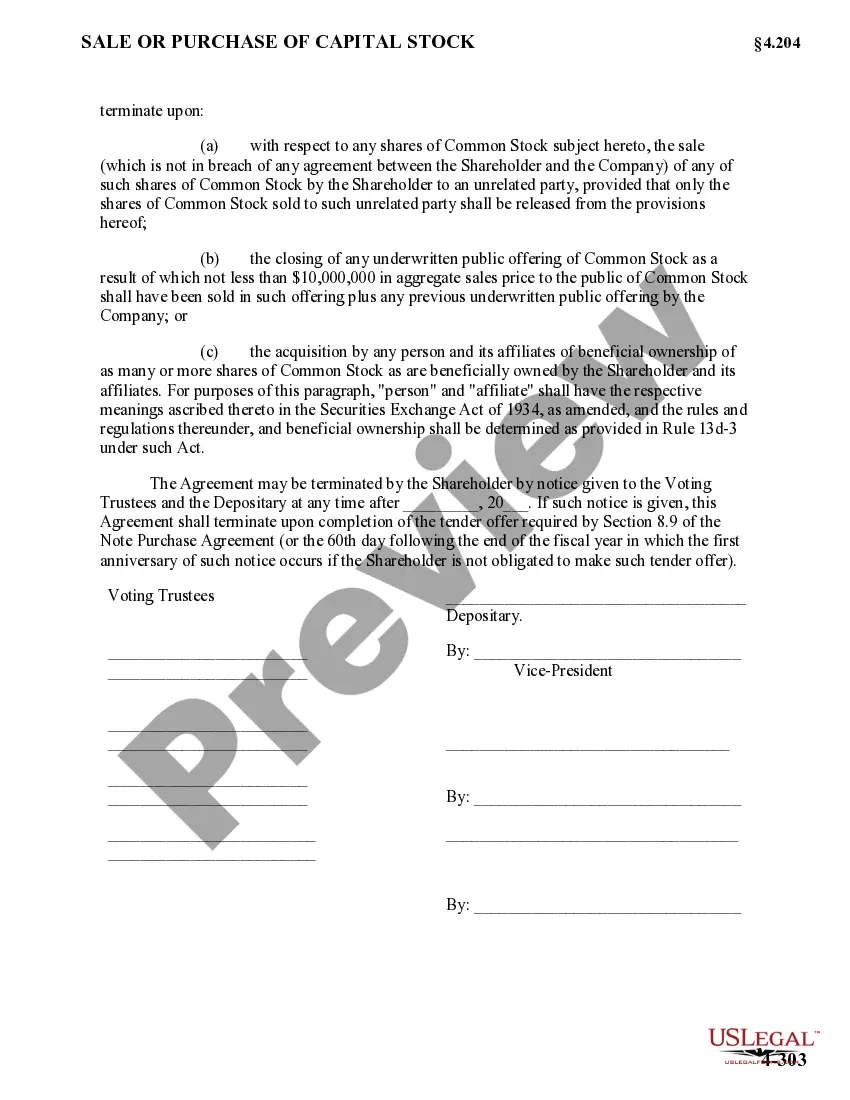

Chicago Illinois Voting Trust Agreement which provides that the shareholder has issued certificates in the care of the depositary in the name of the voting trustees

Description

How to fill out Chicago Illinois Voting Trust Agreement Which Provides That The Shareholder Has Issued Certificates In The Care Of The Depositary In The Name Of The Voting Trustees?

Whether you plan to start your business, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business case. All files are collected by state and area of use, so picking a copy like Chicago Voting Trust Agreement which provides that the shareholder has issued certificates in the care of the depositary in the name of the voting trustees is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few more steps to obtain the Chicago Voting Trust Agreement which provides that the shareholder has issued certificates in the care of the depositary in the name of the voting trustees. Adhere to the guidelines below:

- Make certain the sample meets your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the file once you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Chicago Voting Trust Agreement which provides that the shareholder has issued certificates in the care of the depositary in the name of the voting trustees in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!