The King Washington Voting Trust Agreement is a legally binding document that allows a shareholder to issue certificates to a trusted third party known as the voting trustee. This arrangement ensures that the voting rights associated with the shares are effectively managed and controlled by the trustee. By issuing the certificates in the care of the depository, the shareholder transfers the responsibility and authority of voting on behalf of the shares to the trustees. The certificates are held by the depository, who acts as a custodian, while the trustees exercise the voting rights according to the instructions of the shareholder. This type of agreement is commonly used in situations where a group of shareholders collectively want to consolidate their voting power or maintain the stability and continuity of decision-making within a company. It ensures that all shareholders' interests are represented and eliminates the need for individual shareholders to be physically present for every vote. Different variations or types of King Washington Voting Trust Agreements may exist depending on the specific terms and conditions agreed upon by the shareholder and the voting trustees. Some possible variations are: 1. Short-term Voting Trust Agreement: This type of agreement might be initiated for a specific period, such as during an important corporate event or shareholders' meeting. It is designed to temporarily consolidate voting power and is terminated once the particular event or meeting objectives have been achieved. 2. Long-term Voting Trust Agreement: In contrast to the short-term agreement, the long-term agreement is established for an extended duration. This type of arrangement could be useful when a group of shareholders wishes to maintain control over voting rights for an extended period, such as during succession planning or for strategic decision-making. 3. Revocable Voting Trust Agreement: This type of agreement allows the shareholder to revoke or modify the trust arrangement at any point in time. It provides flexibility to adapt to changing circumstances or if the shareholder wishes to regain direct control over the voting rights associated with their shares. 4. Irrevocable Voting Trust Agreement: Unlike the revocable agreement, the irrevocable voting trust agreement does not allow the shareholder to revoke or modify the terms once it has been established. This type of agreement is typically used in situations where the shareholder intends to relinquish control over the voting rights associated with their shares permanently. It is important to note that the specific details and variations of King Washington Voting Trust Agreements may differ based on the jurisdiction and the preferences of the involved parties. Consulting with legal professionals and understanding the specific terms outlined in each agreement is essential for shareholders considering such arrangements.

King Washington Voting Trust Agreement which provides that the shareholder has issued certificates in the care of the depositary in the name of the voting trustees

Description

How to fill out King Washington Voting Trust Agreement Which Provides That The Shareholder Has Issued Certificates In The Care Of The Depositary In The Name Of The Voting Trustees?

Whether you intend to open your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business occasion. All files are collected by state and area of use, so picking a copy like King Voting Trust Agreement which provides that the shareholder has issued certificates in the care of the depositary in the name of the voting trustees is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of additional steps to obtain the King Voting Trust Agreement which provides that the shareholder has issued certificates in the care of the depositary in the name of the voting trustees. Adhere to the instructions below:

- Make certain the sample fulfills your individual needs and state law regulations.

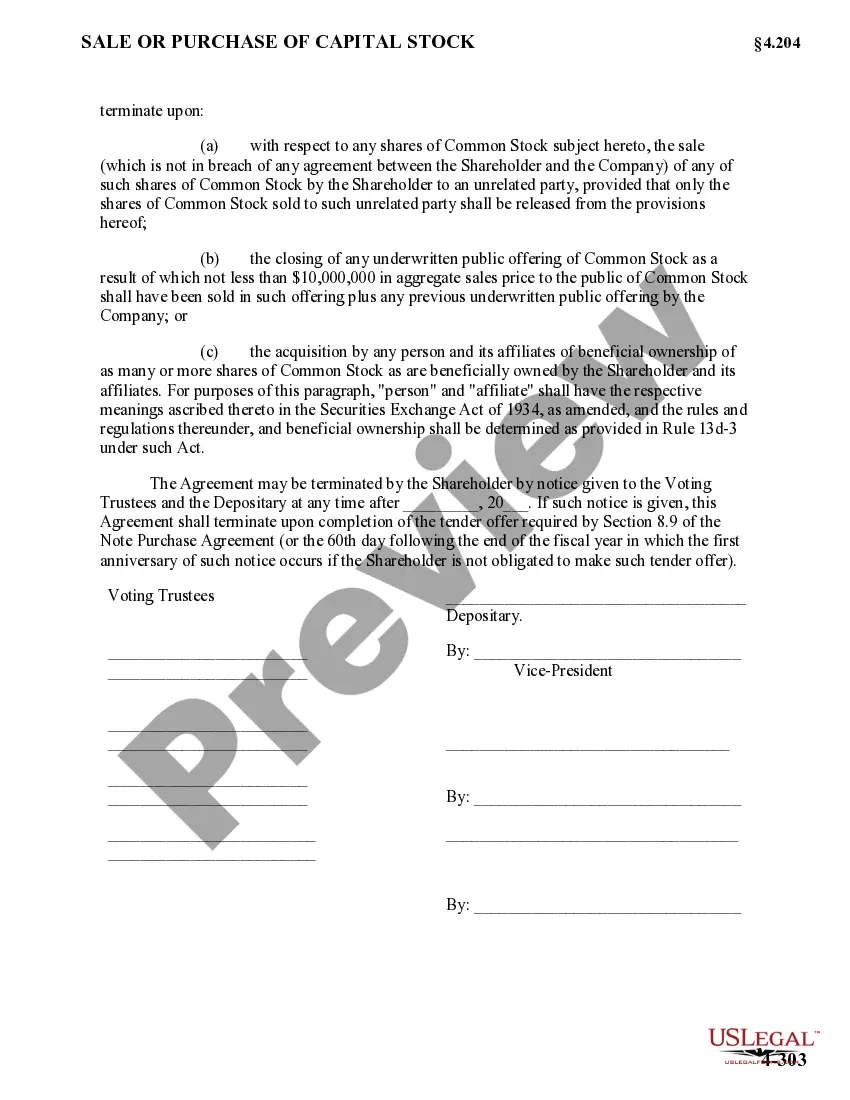

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to get the file once you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the King Voting Trust Agreement which provides that the shareholder has issued certificates in the care of the depositary in the name of the voting trustees in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!