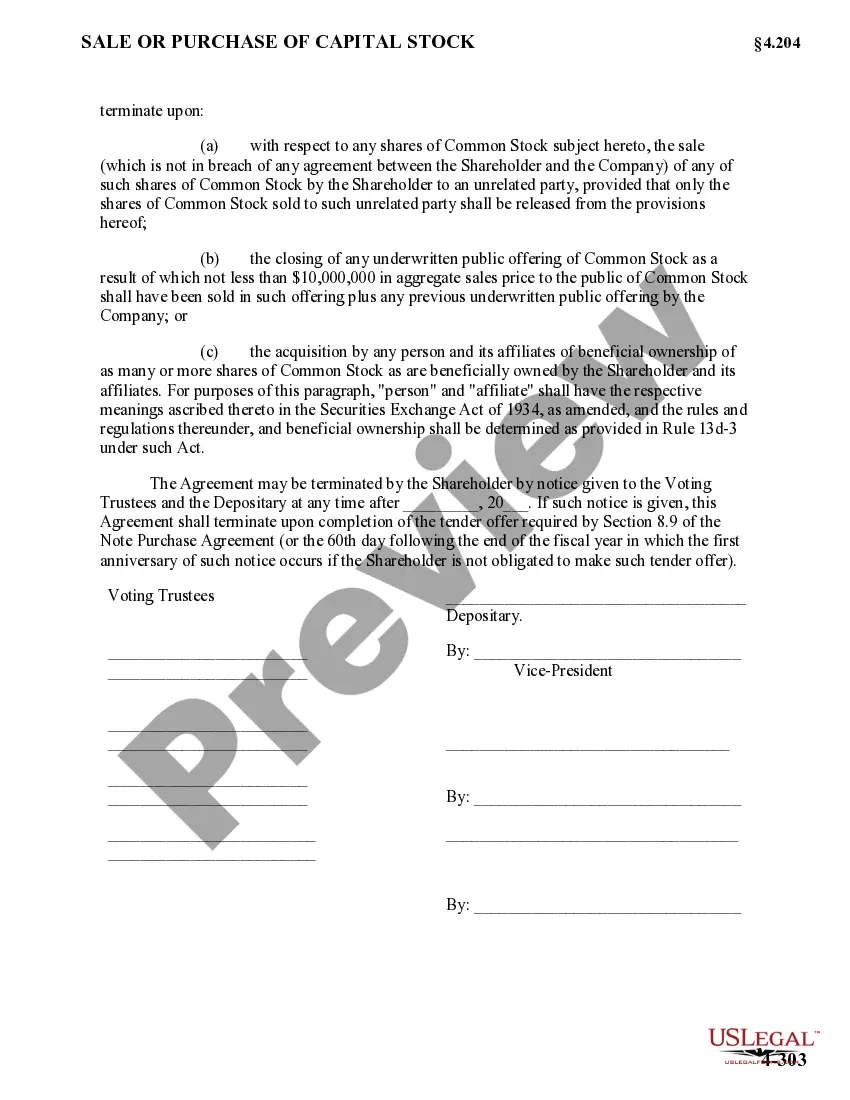

The Maricopa Arizona Voting Trust Agreement is a legal document that outlines the specific terms and conditions for delegating voting rights of shareholders to designated voting trustees. This agreement is commonly used to ensure efficient management of shares held in a trust by consolidating voting powers in the hands of a few individuals who act in the best interest of the shareholders. The primary purpose of the Maricopa Arizona Voting Trust Agreement is to provide a mechanism for shareholders to effectively exercise their rights through voting trustees, rather than individually. The arrangement is particularly useful when many shareholders are involved, making it impractical for each shareholder to participate in voting matters individually. Under this agreement, the shareholder issues share certificates to the depository, who holds them in the name of the voting trustees. The depository acts as a custodian of the shares, safeguarding them and ensuring their proper management. The voting trustees, appointed by the shareholders, are typically individuals who possess expertise and knowledge relevant to the company's operations. There might be different types of Maricopa Arizona Voting Trust Agreements based on specific provisions and requirements. Some common types include: 1. Revocable Voting Trust: This type of agreement allows the shareholder to revoke or modify the trust arrangement at any time. It provides flexibility, especially when circumstances change, and the shareholder wishes to regain control over their voting rights. 2. Irrevocable Voting Trust: In contrast, this type of agreement binds the shareholder to delegate their voting rights to the voting trustees for a defined period, usually not subject to revocation. It ensures stability and continuity in decision-making processes. 3. Holding Trust Agreement: This type of trust agreement is often utilized when shareholders wish to pool their shares together for joint voting purposes. Holding trust agreements are commonly employed in situations where a unified voice is desired, such as during mergers and acquisitions. These are just a few examples of the potential variations that may exist within the Maricopa Arizona Voting Trust Agreement. Understanding the specific terms and provisions of each type is crucial for shareholders when considering whether to participate in a voting trust arrangement. It is advised to consult legal professionals specializing in corporate law and trust management to ensure compliance and proper understanding of the agreement's implications.

Maricopa Arizona Voting Trust Agreement which provides that the shareholder has issued certificates in the care of the depositary in the name of the voting trustees

Description

How to fill out Maricopa Arizona Voting Trust Agreement Which Provides That The Shareholder Has Issued Certificates In The Care Of The Depositary In The Name Of The Voting Trustees?

Draftwing documents, like Maricopa Voting Trust Agreement which provides that the shareholder has issued certificates in the care of the depositary in the name of the voting trustees, to take care of your legal affairs is a difficult and time-consumming task. Many cases require an attorney’s involvement, which also makes this task expensive. However, you can get your legal affairs into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal documents created for different cases and life situations. We make sure each form is compliant with the laws of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Maricopa Voting Trust Agreement which provides that the shareholder has issued certificates in the care of the depositary in the name of the voting trustees form. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as easy! Here’s what you need to do before getting Maricopa Voting Trust Agreement which provides that the shareholder has issued certificates in the care of the depositary in the name of the voting trustees:

- Ensure that your template is compliant with your state/county since the regulations for creating legal documents may vary from one state another.

- Learn more about the form by previewing it or going through a brief intro. If the Maricopa Voting Trust Agreement which provides that the shareholder has issued certificates in the care of the depositary in the name of the voting trustees isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to begin using our service and get the form.

- Everything looks great on your side? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your template is ready to go. You can try and download it.

It’s easy to locate and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!