A Nassau New York Registration Rights Agreement between Alexander and Alexander Services, Inc. and Purchasers is a legal contract that outlines the rights and obligations of both parties in regard to the registration of securities. This agreement is designed to ensure transparency and fairness in the registration process. One type of Nassau New York Registration Rights Agreement is the Demand Registration, which grants the purchasers the right to request that Alexander and Alexander Services, Inc. registers their securities with the Securities and Exchange Commission (SEC) for public sale. In this scenario, the purchasers can trigger the registration process at their discretion, usually after a specific period has elapsed since the initial offering. Another type is the Piggyback Registration, which allows the purchasers to include their securities in a registration statement filed by Alexander and Alexander Services, Inc. This type of registration is often used when the company is already planning to register additional securities for other reasons, such as a public offering. The terms and conditions of the Agreement typically include provisions such as the registration expenses to be borne by the parties, the number of shares to be registered, the timeframes for registration, and any restrictions on the sale of the registered securities. By entering into a Nassau New York Registration Rights Agreement, Alexander and Alexander Services, Inc. demonstrates its commitment to providing its purchasers with access to the public markets for their securities. This agreement strengthens the relationship between the parties by establishing clear guidelines and protections for both sides. In summary, a Nassau New York Registration Rights Agreement between Alexander and Alexander Services, Inc. and Purchasers is a legally binding document that outlines the registration process for securities. The types of agreements include Demand Registration, which allows the purchasers to request registration at their discretion, and Piggyback Registration, which enables purchasers to include their securities in an already planned registration. Ultimately, this agreement ensures transparency, fairness, and proper regulation in the registration process.

Nassau New York Registration Rights Agreement between Alexander and Alexander Services, Inc. and Purchasers

Description

How to fill out Nassau New York Registration Rights Agreement Between Alexander And Alexander Services, Inc. And Purchasers?

Drafting paperwork for the business or individual needs is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to create Nassau Registration Rights Agreement between Alexander and Alexander Services, Inc. and Purchasers without professional assistance.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Nassau Registration Rights Agreement between Alexander and Alexander Services, Inc. and Purchasers by yourself, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required document.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Nassau Registration Rights Agreement between Alexander and Alexander Services, Inc. and Purchasers:

- Examine the page you've opened and check if it has the document you require.

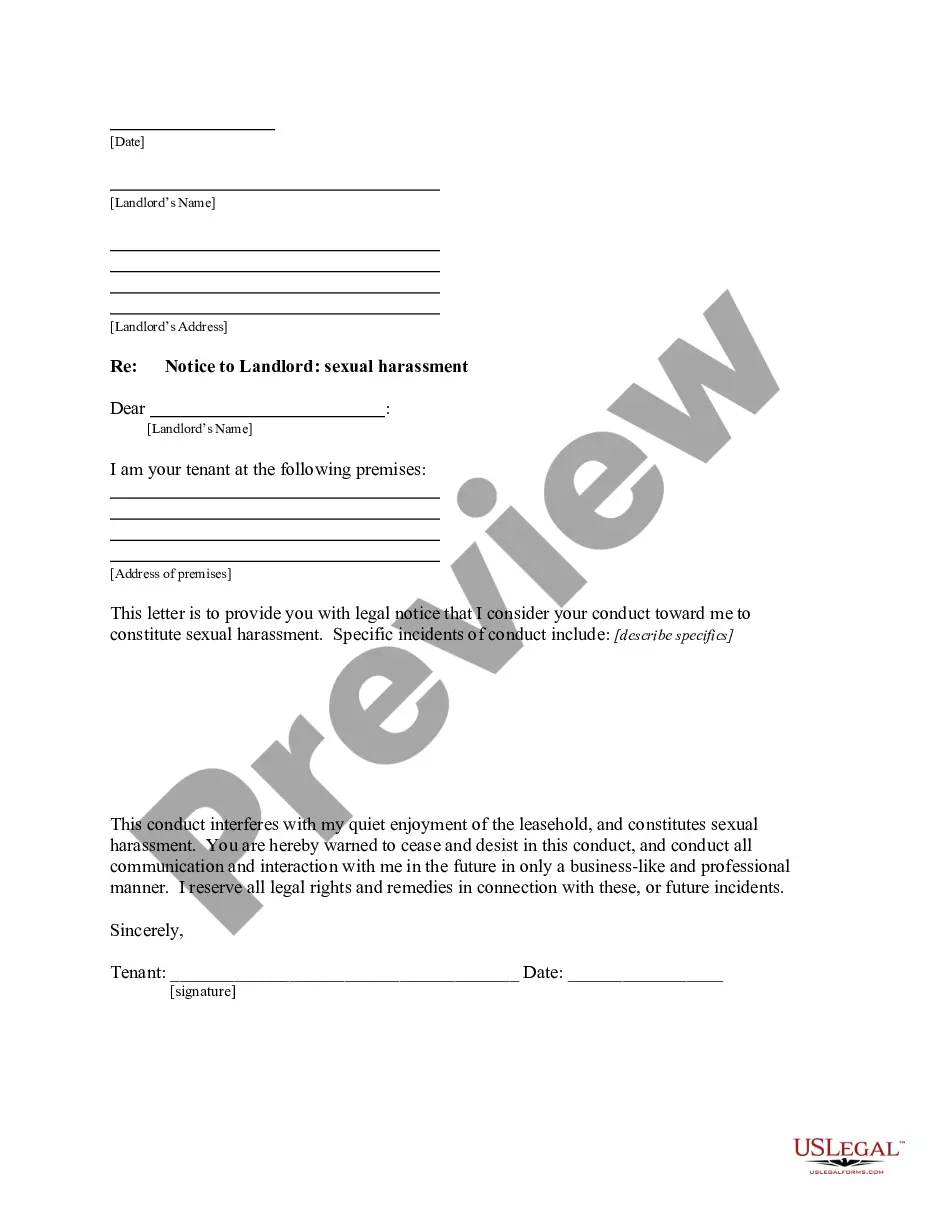

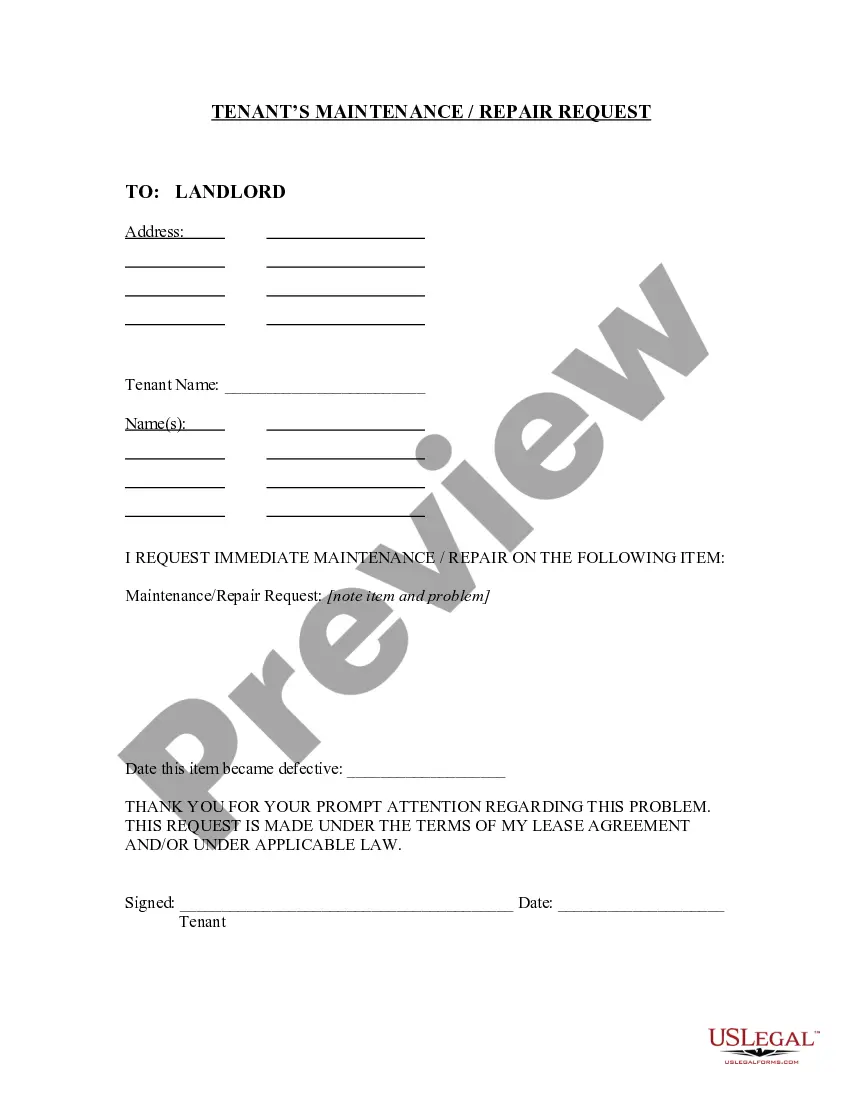

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that fits your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any situation with just a couple of clicks!