Title: Fairfax Virginia Letter to Stockholders: Authorization and Sale of Preferred Stock and Stock Transfer Restriction to Protect Tax Benefits Introduction: Dear Fairfax Virginia Stockholders, We are writing to inform you about important updates regarding the authorization and sale of preferred stock and the implementation of stock transfer restrictions aimed at preserving tax benefits. The following letter provides detailed information on these matters, outlining how these actions will positively impact Fairfax Virginia and its shareholders. Section 1: Authorization and Sale of Preferred Stock 1.1 Introduction to Preferred Stock: Preferred stock represents a class of ownership in Fairfax Virginia that holds priority in terms of dividends and liquidation. This stock differs from common stock and is issued with specific rights and privileges. 1.2 Purpose and Benefits of Preferred Stock Issuance: By authorizing and selling preferred stock, Fairfax Virginia aims to raise additional capital to fund expansion initiatives, increase liquidity, or undertake strategic acquisitions. The sale of preferred stock provides advantages such as diversification of funding sources and the potential for higher dividends for stockholders. 1.3 Different Types of Preferred Stock: Fairfax Virginia may issue multiple series or classes of preferred stock, each with distinct characteristics. These classes can be categorized based on variables such as dividend rates, conversion features, and seniority in liquidation. Section 2: Stock Transfer Restriction to Protect Tax Benefits 2.1 Importance of Tax Benefits: Maintaining tax benefits is crucial for Fairfax Virginia's financial health. By implementing stock transfer restrictions, we can safeguard these benefits and enhance long-term shareholder value. 2.2 Purpose and Objective of Stock Transfer Restriction: The stock transfer restriction aims to prevent unintended ownership changes that could result in the loss of valuable tax benefits. This restriction helps ensure that Fairfax Virginia remains compliant with relevant tax regulations and maximizes tax savings for the benefit of all shareholders. 2.3 Types of Stock Transfer Restrictions: a) Rights of First Refusal: This provision grants existing stockholders the right to purchase shares before they are offered to external parties, ensuring control over ownership changes. b) Lock-up Periods: Fairfax Virginia may impose a lock-up period on newly issued preferred stock, during which stock transfers are restricted. This period allows for stabilization and prevents immediate trading that could disrupt market conditions. Conclusion: In conclusion, by authorizing and selling preferred stock, Fairfax Virginia aims to raise additional capital and strengthen shareholder value. Concurrently, the implementation of stock transfer restrictions serves to safeguard valuable tax benefits and ensure compliance with tax regulations. These actions reflect our commitment to maintaining a stable and prosperous future for Fairfax Virginia and its esteemed stockholders. Please review this letter and feel free to reach out to us for any further clarifications or concerns. We appreciate your ongoing support and the trust you have bestowed upon us. Sincerely, [Your Name] [Your Title] [Fairfax Virginia]

Fairfax Virginia Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits

Description

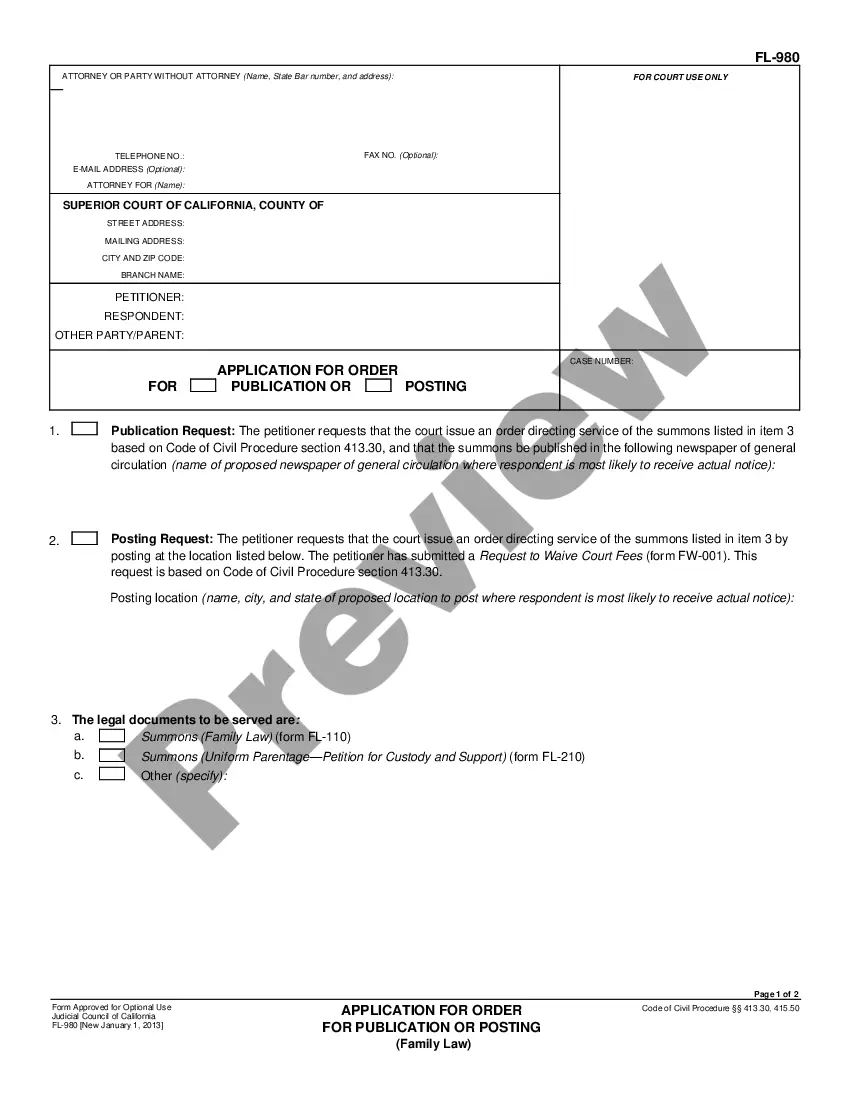

How to fill out Fairfax Virginia Letter To Stockholders Regarding Authorization And Sale Of Preferred Stock And Stock Transfer Restriction To Protect Tax Benefits?

Laws and regulations in every sphere differ throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Fairfax Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Fairfax Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits from the My Forms tab.

For new users, it's necessary to make some more steps to get the Fairfax Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits:

- Analyze the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document once you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Transferring a Stock Certificate The owner must endorse the stock by signing it in the presence of a guarantor, which can be their bank or broker. 2 There may also be a form on the back of the certificate, which relates to the transferring of ownership.

The Holder may transfer some or all of its Preferred Shares without the consent of the Company. Transfer of Preferred Shares. A Holder may transfer some or all of its Preferred Shares without the consent of the Corporation, subject to compliance with the Securities Act of 1933, as amended.

One of the first things to bear in mind is a delivery instruction slip or DIS. You would need to fill in the details of the shares you wish to transfer or gift, the account of the recipient and hand it over to the depository participant or DP, who will then transfer the shares.

How to transfer stock between brokers Start the process by filling out a transfer initiation form with your new broker.Your new broker communicates with your old broker to set up the transfer. Your old broker must validate the transfer information, reject it, or amend it within three business days.

There are no tax implications for the recipient when the shares are transferred, but you may face a gift tax if the value of the stock transfer exceeds a certain amount.

Dear Sir(s) This is to inform you that I,???????.. , the Shareholder of ???????..shares in your Company, request you to transfer my ???????? Equity Shares held in the Company for a total consideration of Rs ???????? (Rupees ???????..

Here are the steps for transferring shares of stock in a corporation: Gather the necessary documents.Get an endorsement of the share.Deliver the stock certificate with a Deed showing the proof of transfer.Record the transfer in the books.

The main disadvantage of owning preference shares is that the investors in these vehicles don't enjoy the same voting rights as common shareholders. This means that the company is not beholden to preferred shareholders the way it is to traditional equity shareholders.

Fill out the recipient/new shareholders name, address, Tax ID/ Social Security number and phone number. Certificate Issuance: Designate the total number of shares to be transferred to the new shareholder and any special instructions you wish to be included.

Dear Sir(s) This is to inform you that I,???????.. , the Shareholder of ???????..shares in your Company, request you to transfer my ???????? Equity Shares held in the Company for a total consideration of Rs ???????? (Rupees ???????..