Title: Understanding Houston, Texas: A Vibrant City with Promising Opportunities Introduction: Dear Stockholders, We hope this letter finds you in good health and high spirits. As we pave the way for the future growth and success of our company, we would like to address an important matter concerning the authorization and sale of preferred stock, as well as the implementation of stock transfer restrictions to protect valuable tax benefits. Houston, Texas: A Thriving Metropolitan Hub Houston, Texas is renowned for its vibrant economy, diverse culture, and endless opportunities. Situated in the coastal region of Texas, Houston serves as a major player in various industries such as energy, healthcare, aerospace, and technology. With a population of over 2.3 million people, the city boasts a highly educated workforce and a business-friendly environment that has attracted countless corporations and entrepreneurs alike. Authorization and Sale of Preferred Stock To further fortify our position in this thriving market, we have decided to pursue the authorization and sale of preferred stock. This strategic move enables us to raise additional capital from interested investors who may be seeking stable returns. Preferred stockholders enjoy certain privileges, including priority dividend payments and preference in the event of liquidation. This issuance of preferred stock will allow us to fuel our growth initiatives, undertake new projects, and seize emerging opportunities promptly. Stock Transfer Restrictions: Protecting Tax Benefits In order to protect the valuable tax benefits associated with our preferred stock, we have also implemented stock transfer restrictions. These restrictions are designed to ensure that our company maintains compliance with regulatory requirements, safeguarding our eligibility for various tax incentives. By closely controlling the transfer of stock, we can prevent undue dilution of our shareholder base and secure the tax advantages that enhance our financial strength. Types of "Houston, Texas Letter to Stockholders" regarding the aforementioned matters: 1. Houston, Texas Letter to Stockholders: Preferred Stock Authorization and Benefits Clarification 2. Houston, Texas Letter to Stockholders: Preferred Stock Sale and Forecasted Market Impact 3. Houston, Texas Letter to Stockholders: Stock Transfer Restriction Implementation and Tax Benefit Preservation 4. Houston, Texas Letter to Stockholders: Preferred Stock Offering — Opportunities for Future Expansion Conclusion: Houston, Texas continues to be a vibrant city filled with immense potential and prosperity. By authorizing and selling preferred stock while implementing stock transfer restrictions, we aim to secure the necessary resources to drive our company's growth while preserving the invaluable tax benefits associated with this strategic move. We remain confident in our ability to navigate the complexities of the market, leveraging the opportunities brought forth by Houston, Texas. Together, we will build a brighter and more prosperous future for our company and its dedicated stockholders. Thank you for your ongoing support. Sincerely, [Your Name] Chairman of the Board

Houston Texas Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits

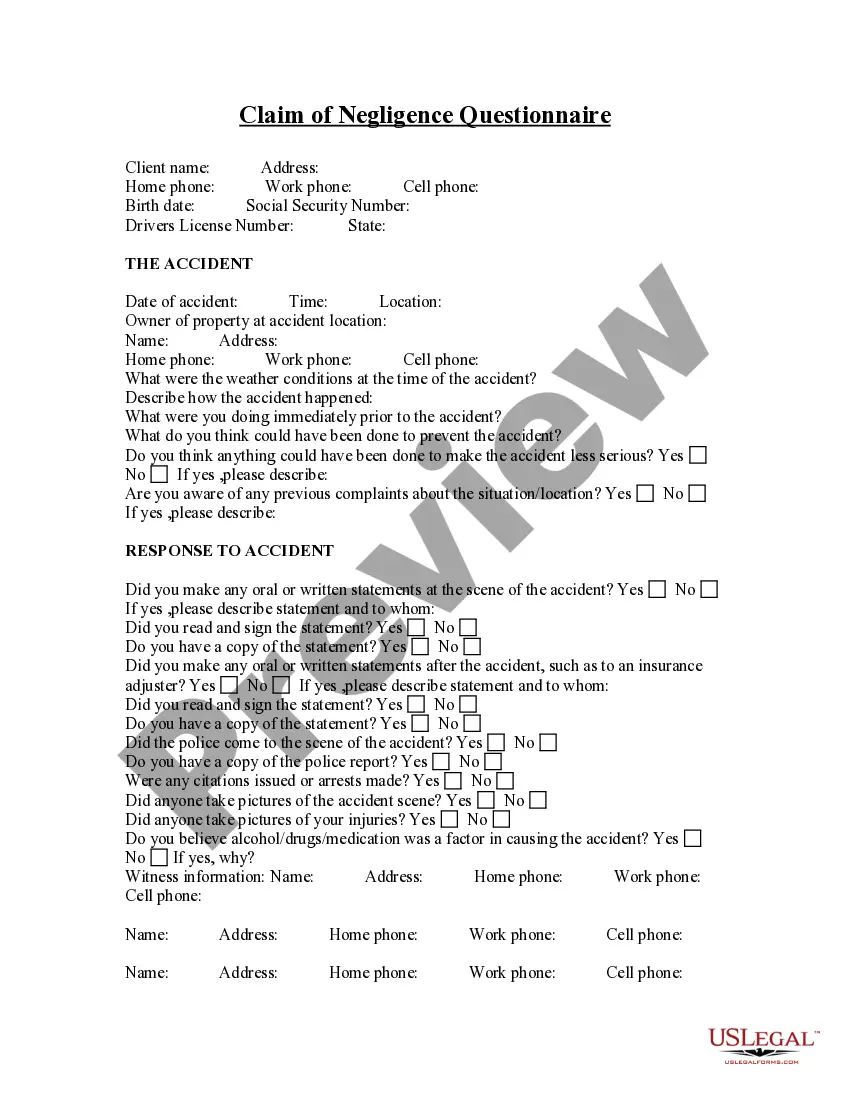

Description

How to fill out Houston Texas Letter To Stockholders Regarding Authorization And Sale Of Preferred Stock And Stock Transfer Restriction To Protect Tax Benefits?

If you need to find a trustworthy legal paperwork supplier to find the Houston Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits, consider US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed form.

- You can select from over 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, variety of supporting resources, and dedicated support make it simple to find and execute various documents.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

Simply select to search or browse Houston Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits, either by a keyword or by the state/county the form is intended for. After locating necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the Houston Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be immediately available for download once the payment is processed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes these tasks less pricey and more affordable. Create your first company, organize your advance care planning, create a real estate agreement, or complete the Houston Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits - all from the comfort of your sofa.

Join US Legal Forms now!