Dear Stockholders of Santa Clara California, We are writing to inform you about the authorization and sale of preferred stock and stock transfer restriction that has been put in place to protect our tax benefits here in Santa Clara, California. As a technology-driven company operating in this vibrant region renowned for its innovation, we believe it is important for our stockholders to stay informed about these developments. The authorization and sale of preferred stock is a critical step towards maintaining our competitive edge and ensuring a steady flow of capital for our business activities. Preferred stock offers certain advantages, such as priority in receiving dividends and assets in the event of liquidation. This additional funding will allow us to invest in research and development, accelerate our growth, and stay at the forefront of technological advancements. To safeguard the tax benefits enjoyed by our company, we have implemented stock transfer restrictions. These restrictions are designed to prevent the transfers of stock that could potentially harm our benefit status by triggering adverse tax consequences. By controlling the transfer of stock, we can better manage and protect the benefits Santa Clara California provides us, including tax incentives, credits, and exemptions. Different types of Santa Clara California Letter to Stockholders regarding the authorization and sale of preferred stock and stock transfer restrictions may include: 1. Announcement of Preferred Stock Authorization: This letter aims to inform stockholders about the authorization of preferred stock, emphasizing its benefits and the potential impact on the company's future growth plans. 2. Stock Transfer Restriction Notification: This letter focuses on notifying stockholders about the newly implemented stock transfer restrictions and the rationale behind their establishment. It emphasizes the importance of ensuring compliance with these restrictions to maintain our tax benefits. 3. Explanation of Tax Benefits and Preferred Stock: This letter delves into the tax benefits Santa Clara California offers to company operating in the region. It highlights how preferred stock issuance aligns with these benefits and contributes to our overall tax strategy. We hope that this detailed description provides you with a comprehensive understanding of the authorization and sale of preferred stock, as well as the stock transfer restrictions in place to protect our tax benefits here in Santa Clara, California. We value your continued support as we strive to maximize our company's potential and drive sustainable growth. Wishing you all the best in your investment journey with us. Sincerely, [Your Name] [Your Position] [Company Name]

Santa Clara California Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits

Description

How to fill out Santa Clara California Letter To Stockholders Regarding Authorization And Sale Of Preferred Stock And Stock Transfer Restriction To Protect Tax Benefits?

Laws and regulations in every sphere differ throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Santa Clara Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for different life and business occasions. All the documents can be used many times: once you pick a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Santa Clara Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Santa Clara Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits:

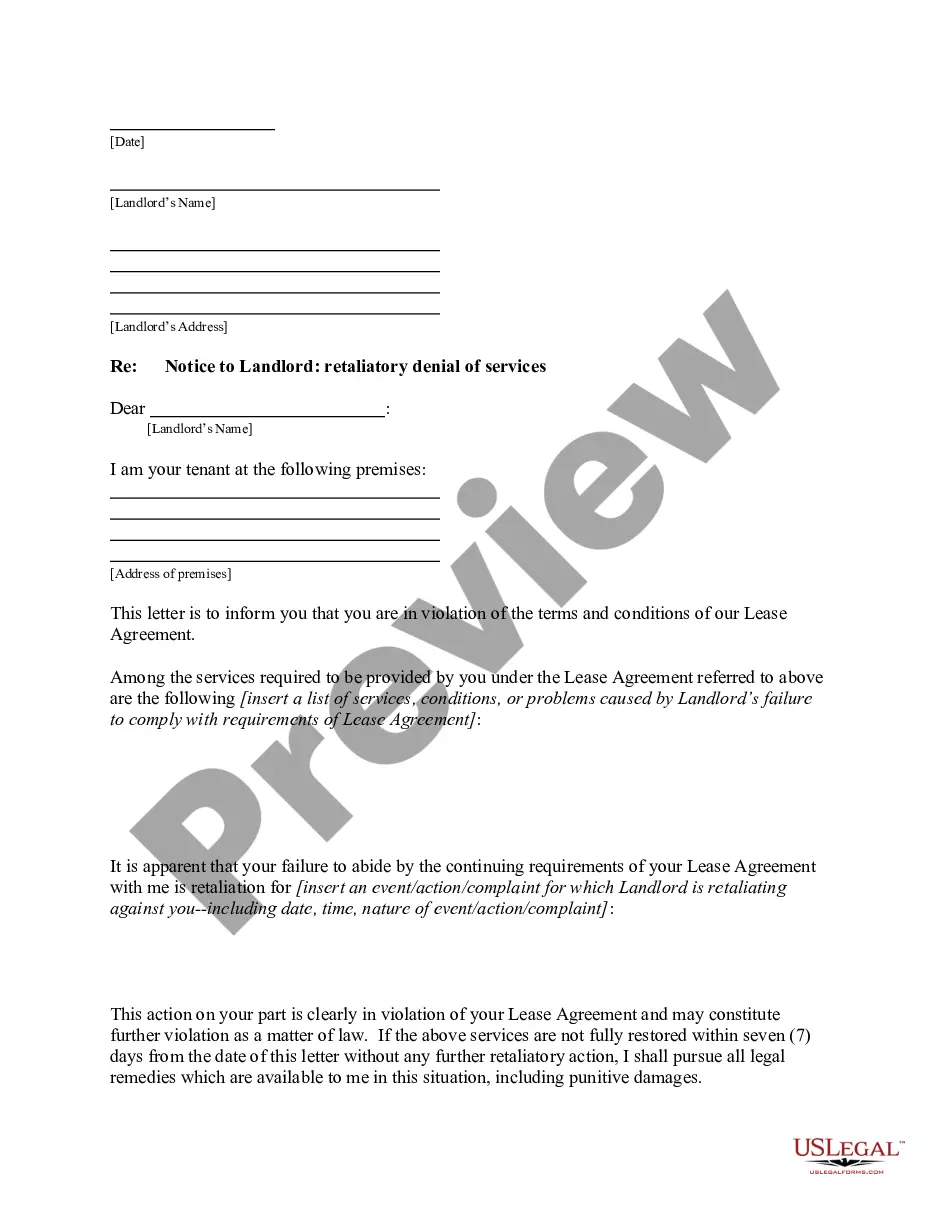

- Examine the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the document when you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!