The Franklin Ohio Stock Option Plan of Star States Corporation is a comprehensive program designed to incentivize and reward employees of the company by granting them the opportunity to purchase company stock at a predetermined price within a specified period. This plan is specifically tailored for employees located in the Franklin, Ohio region and is a part of Star States Corporation's overall compensation and benefits package. Under the Franklin Ohio Stock Option Plan, employees are granted stock options, which are the right to purchase a certain number of company shares at a set price known as the exercise price. These stock options provide employees with a potential financial benefit as they can purchase company shares at a lower price compared to the prevailing market value. The Franklin Ohio Stock Option Plan is intended to align the interests of the employees with those of the company's shareholders, encouraging a sense of ownership and dedication among the employees. By allowing employees to become shareholders, Star States Corporation aims to foster a culture of accountability and commitment, ultimately driving the company's performance and success. There are different types of stock options available under the Franklin Ohio Stock Option Plan: 1. Non-Qualified Stock Options (Nests): These are the most common form of stock options offered to employees. Nests have more flexibility in terms of eligibility requirements and offer greater freedom in exercising the options. The employee may need to pay taxes on the difference between the exercise price and the market value of the shares at the time of exercise. 2. Incentive Stock Options (SOS): SOS are subject to specific tax regulations outlined by the Internal Revenue Code. To qualify for SOS, certain eligibility criteria must be met. If the employee holds the SOS for a specified period, no taxes are incurred upon exercise and taxes may be deferred until the shares are sold. However, a potential alternative minimum tax (AMT) liability may arise. 3. Restricted Stock Units (RSS): RSS are a form of equity compensation where employees are granted units that convert into actual company shares upon vesting. Unlike stock options, RSS have no exercise price and are subject to a vesting period. Once the RSS vest, employees receive company shares. The tax treatment of RSS may vary according to local tax laws. The Franklin Ohio Stock Option Plan of Star States Corporation serves as a valuable tool for attracting, retaining, and motivating talented employees in the Franklin, Ohio region. Through various stock option types, the plan ensures that employees have a stake in the company's growth and long-term success, aligning their interests with those of the shareholders.

Franklin Ohio Stock Option Plan of Star States Corporation

Description

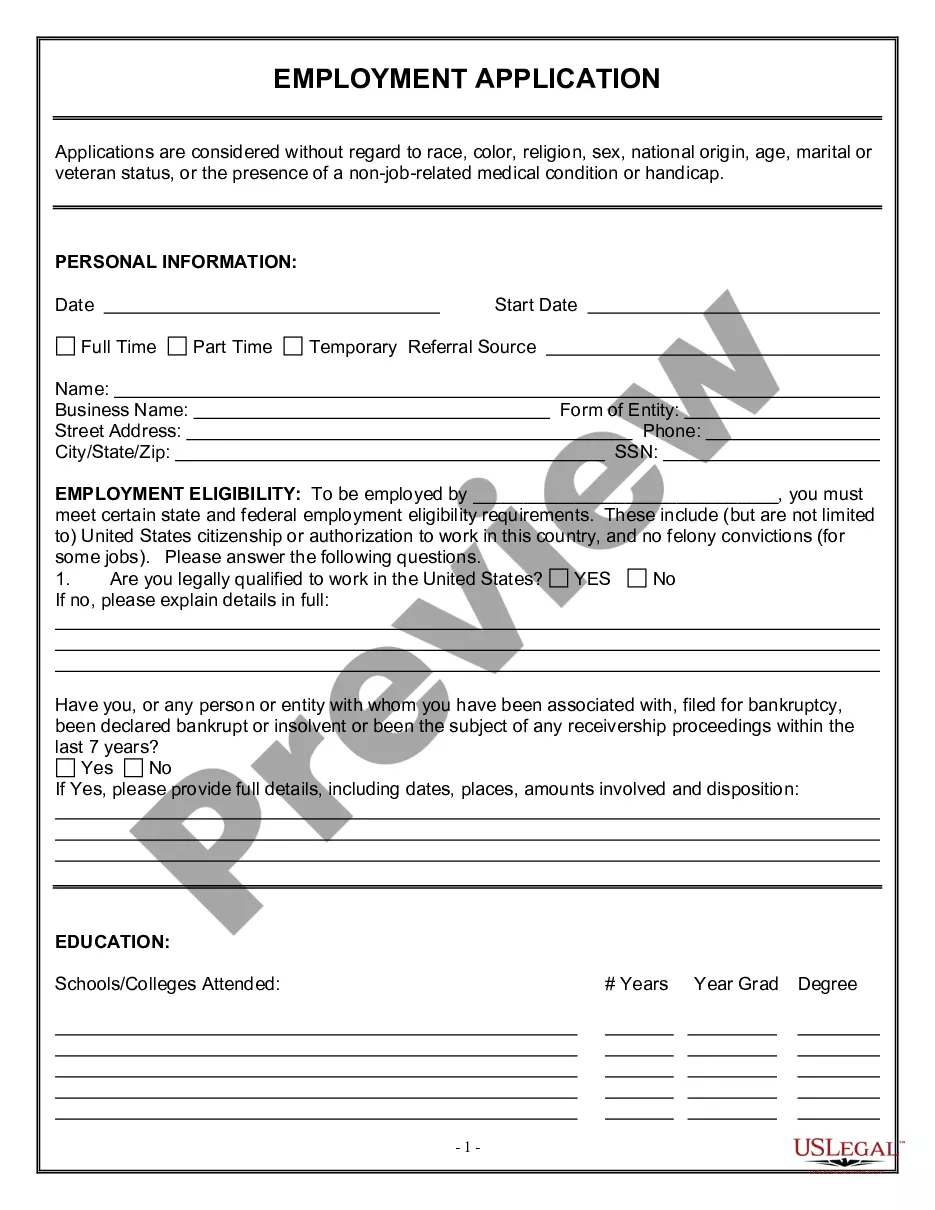

How to fill out Franklin Ohio Stock Option Plan Of Star States Corporation?

Whether you intend to open your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business case. All files are grouped by state and area of use, so opting for a copy like Franklin Stock Option Plan of Star States Corporation is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several additional steps to get the Franklin Stock Option Plan of Star States Corporation. Follow the guide below:

- Make sure the sample meets your individual needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample when you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Franklin Stock Option Plan of Star States Corporation in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!