Bexar Texas Authorize Sale of fractional shares

Description

How to fill out Authorize Sale Of Fractional Shares?

A document process consistently accompanies any legal action you undertake.

Establishing a business, applying for or accepting an employment offer, transferring ownership, and many other life circumstances necessitate that you prepare formal documentation that differs from state to state. This is why having everything organized in one location is highly advantageous.

US Legal Forms is the largest online repository of current federal and state-specific legal documents.

On this site, you can effortlessly locate and download a document for any personal or business use relevant to your county, including the Bexar Authorize Sale of fractional shares.

Click Buy Now when you find the needed template. Select the appropriate subscription plan, then Log In or create an account. Choose your preferred payment method (credit card or PayPal) to continue. Choose the file format and save the Bexar Authorize Sale of fractional shares on your device. Use it as necessary: print it or complete it electronically, sign it, and send it where needed. This is the most straightforward and reliable method to procure legal documents. All templates in our library are skillfully drafted and verified for compliance with local laws and regulations. Prepare your documentation and manage your legal matters effectively with US Legal Forms!

- Finding templates on the platform is surprisingly simple.

- If you already possess a subscription to our service, Log In to your account, search for the sample using the search bar, and click Download to save it to your device.

- After that, the Bexar Authorize Sale of fractional shares will be available for further utilization in the My documents section of your profile.

- If you're interacting with US Legal Forms for the first time, follow this brief guide to obtain the Bexar Authorize Sale of fractional shares.

- Confirm you have accessed the correct page with your localized document.

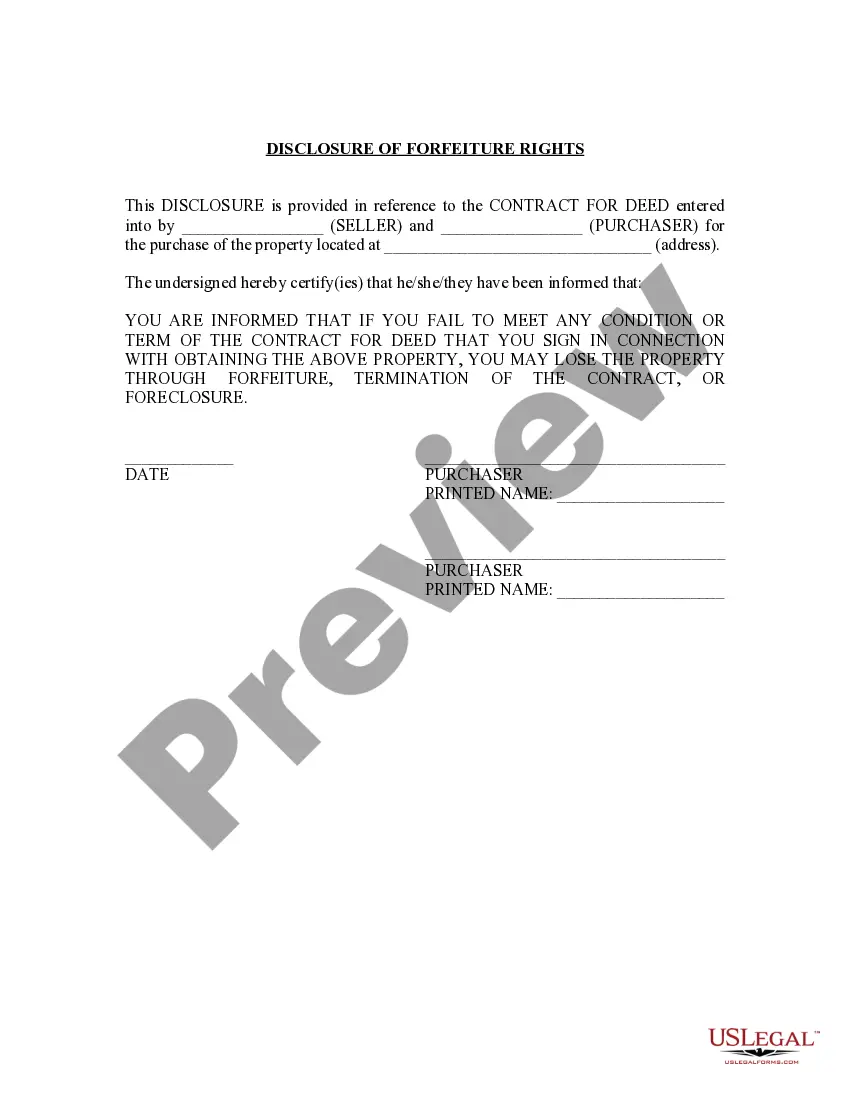

- Use the Preview mode (if available) and review the sample.

- Examine the description (if provided) to ensure the template fulfills your needs.

- If the sample doesn’t suit you, search for another document using the search feature.

Form popularity

FAQ

Article 11 outlines the framework for local government, specifying the rights and responsibilities of municipalities in Texas. It empowers cities and counties to govern local matters effectively, providing a structure for growth and development. In relation to the Bexar Texas Authorize Sale of fractional shares, local regulations and guidelines play a significant role in facilitating smooth transactions and managing investments.

The only way to sell fractional shares is through a major brokerage firm, which can join them with other fractional shares until a whole share is attained. If the selling stock does not have a high demand in the marketplace, selling the fractional shares might take longer than hoped.

With a fractional share, a single share or other asset is divided up and distributed among purchasers. You can simply set the dollar amount you wish to invest, and your broker will invest that amount. Fractional shares were used as parts of dividend reinvestment plans.

Less than one full share of equity is called a fractional share. Such shares may be the result of stock splits, dividend reinvestment plans (DRIPs), or similar corporate actions. Typically, fractional shares aren't available from the stock market, and while they have value to investors, they are also difficult to sell.

Fractional shares cannot be transferred, and stock certificates are not available for them. Fractional shares need to be sold prior to any transfer.

Your fractional shares receive the same execution price as your whole shares. After you place your first order in fractions or dollars, any sell order will need to include the whole and fractional share amounts that you want to trade, as fractional shares will no longer automatically liquidate.

Fractional shares cannot be sold through a market, limit, stop, or stop-limit orderthey can only be purchased or sold through a window order.

What happens to fractional shares from reinvested dividends when you sell? Fractional shares from reinvested dividends can be sold the same way an investor would sell fractional shares acquired by any other means.