Nassau New York: Authorize Sale of Fractional Shares for Investment Opportunities Nassau, a suburban county located on Long Island, New York, has recently authorized the sale of fractional shares to expand investment opportunities for its residents. This move is expected to enable individuals with smaller budgets to engage in stock investing, diversify their portfolios, and potentially generate income through the stock market. By allowing the sale of fractional shares, Nassau aims to democratize investing and provide an avenue for both seasoned investors and beginners to participate in the financial markets. This initiative is particularly appealing for those who may not have the capital to purchase full shares of high-priced stocks but still desire to invest in specific companies or industries. With the authorization of fractional shares, residents of Nassau can now acquire smaller portions or fractions of a share, which grants them proportional ownership in the respective company. For example, instead of purchasing a full share priced at $1000 in a company, an investor can now buy a fraction of that share for a lower cost, such as $100. This mechanism makes investing more accessible and affordable, presenting an opportunity for potential investors to dip their toes into the stock market without significant financial commitments. Furthermore, fractional shares offer the advantage of portfolio diversification. Investors can now spread their capital across a wider range of stocks, investing in multiple companies or sectors that align with their investment goals and risk tolerance. This diversification helps to mitigate risk, as losses from one investment can be offset by gains from another. By embracing fractional shares, Nassau provides its residents the opportunity to build a diversified investment portfolio tailored to their individual preferences. In addition to facilitating investing for individuals, fractional shares also present benefits for companies seeking capital. By selling fractions of their shares, companies can attract a broader range of investors, potentially increasing their investor base. This infusion of capital can enable companies to expand their operations, fund research and development initiatives, or even facilitate mergers and acquisitions. The authorization of fractional shares in Nassau thus benefits not just the investors but also contributes to the overall economic growth of the region. Different types of fractional shares that Nassau may authorize for sale can include shares of individual companies listed on major stock exchanges like the New York Stock Exchange (NYSE) or the NASDAQ. These shares can represent a variety of industries such as technology, healthcare, finance, or retail. Additionally, fractional shares of exchange-traded funds (ETFs) or mutual funds may also be available, allowing investors to gain exposure to diverse portfolios of stocks or assets. In conclusion, Nassau's decision to authorize the sale of fractional shares promotes inclusivity and accessibility in the world of investing. By breaking down the barriers associated with high costs of full shares, residents now have the opportunity to participate in the stock market and potentially grow their wealth. With fractional shares, investors in Nassau can diversify their portfolios, build wealth over time, and unlock new investment opportunities that were previously inaccessible.

Nassau New York Authorize Sale of fractional shares

Description

How to fill out Nassau New York Authorize Sale Of Fractional Shares?

How much time does it typically take you to create a legal document? Given that every state has its laws and regulations for every life sphere, locating a Nassau Authorize Sale of fractional shares meeting all local requirements can be tiring, and ordering it from a professional attorney is often expensive. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. Apart from the Nassau Authorize Sale of fractional shares, here you can find any specific document to run your business or personal affairs, complying with your county requirements. Professionals check all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can pick the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Nassau Authorize Sale of fractional shares:

- Check the content of the page you’re on.

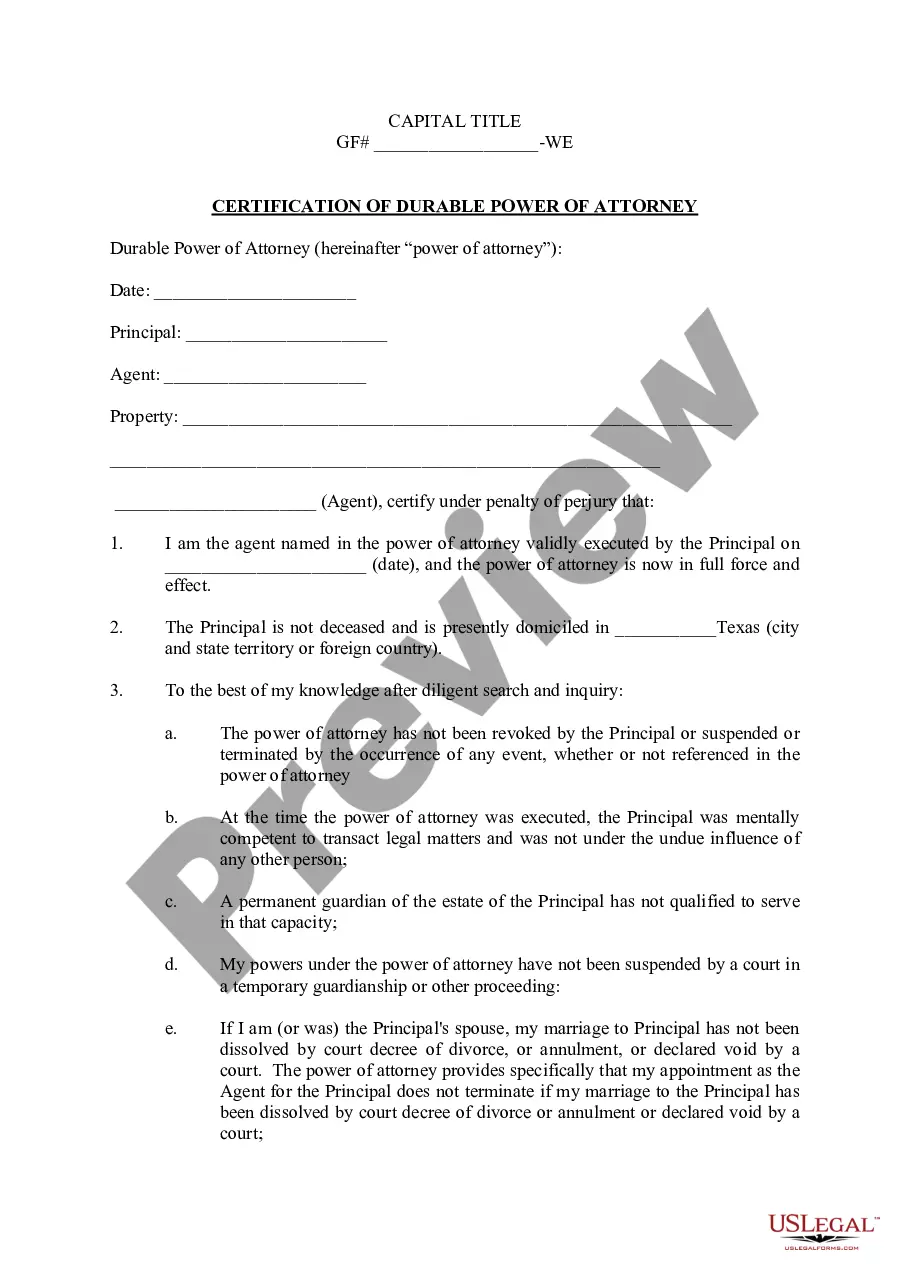

- Read the description of the sample or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Nassau Authorize Sale of fractional shares.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!