Kings New York, a renowned retail chain, has recently proposed an issuance of common stock to raise capital for their expansion and growth plans. This move will allow the company to secure funds from potential investors in exchange for ownership shares. Common stock represents ordinary shares that grant individuals voting rights and an opportunity to receive dividends. The Kings New York Proposed Issuance of Common Stock aims to attract investors and fuel the company's financial resources to support various strategic initiatives. These could include opening new stores, launching innovative marketing campaigns, investing in technology advancements, optimizing supply chain management, and enhancing customer experiences. By offering common stock, Kings New York seeks to broaden its shareholder base, potentially increasing the company's market capitalization, and establishing a strong financial foundation for long-term sustainability and profitability. Investors who purchase common stock from Kings New York become partial owners of the company. This means they will have the right to vote on matters affecting the company, such as electing board members or approving significant business decisions. Furthermore, common stockholders may benefit from receiving dividends, which are a portion of the company's profits distributed among shareholders. The amount and frequency of dividend payments are typically determined by the company's financial performance and board decisions. It is important to note that Kings New York may issue different types of common stock. This can include primary offerings, where newly issued shares enter the market, or secondary offerings, where existing shareholders sell their shares to new investors. Additionally, Kings New York may choose to issue either Class A or Class B common stock. Class A shares usually carry more voting rights per share, allowing holders to have a greater say in corporate decision-making. On the other hand, Class B shares might have limited voting rights but offer other advantages, such as lower price per share or preferential treatment in the distribution of dividends. Investors considering participation in the Kings New York Proposed Issuance of Common Stock should carefully evaluate the offering documents, including the prospectus, to understand the terms and conditions, potential risks, and rewards associated with the investment. It is advisable to consult financial advisors or professionals before making any investment decisions. In conclusion, the Kings New York Proposed Issuance of Common Stock presents an opportunity for investors to participate in the growth and development of a reputable retail chain. By purchasing common stock, individuals can become stakeholders in the company and potentially benefit from voting rights and dividend distributions.

Kings New York Proposed issuance of common stock

Description

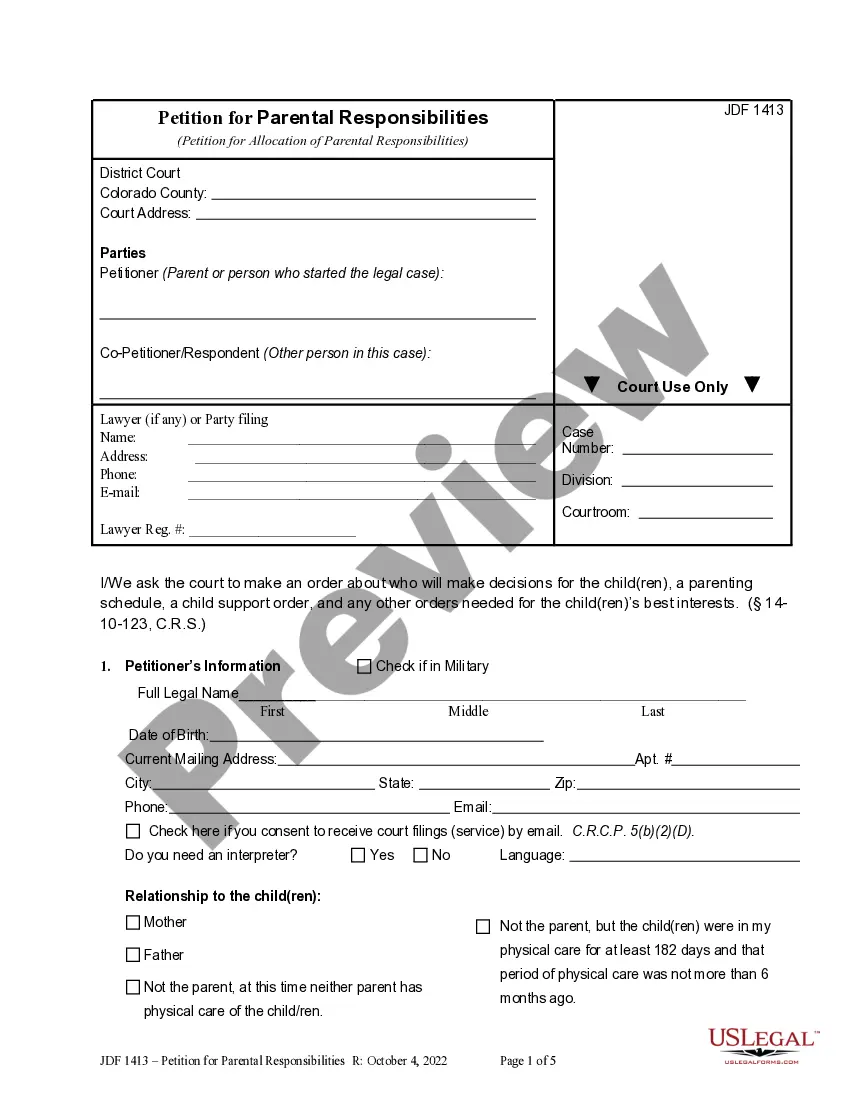

How to fill out Kings New York Proposed Issuance Of Common Stock?

Creating legal forms is a must in today's world. However, you don't always need to look for qualified assistance to create some of them from the ground up, including Kings Proposed issuance of common stock, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in various categories varying from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching process less challenging. You can also find detailed resources and tutorials on the website to make any activities associated with document execution simple.

Here's how to locate and download Kings Proposed issuance of common stock.

- Go over the document's preview and description (if available) to get a general information on what you’ll get after getting the document.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can affect the validity of some documents.

- Check the related document templates or start the search over to find the right file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a suitable payment method, and purchase Kings Proposed issuance of common stock.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Kings Proposed issuance of common stock, log in to your account, and download it. Of course, our platform can’t replace an attorney completely. If you have to cope with an exceptionally complicated case, we recommend getting an attorney to check your document before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Become one of them today and purchase your state-specific paperwork effortlessly!

Form popularity

FAQ

Once the IPO is complete, investors can make secondary offerings to the public on the secondary market or the stock market. As mentioned above, securities sold in a secondary offering are held by investors and sold to one or more other investors through a stock exchange.

The initial issuance of common stock reflects the sale of the first stock by a corporation. Common stock issued at par value for cash creates an additional paid-in capital account for the excess of the issue price over the par value.

1. Public Issue or Initial Public Offer (IPO): Under this method, the company issues a prospectus to the public inviting offers for subscription.

on public offer (FPO) is also called further public offer. When a listed company comes out with a fresh issue of shares or makes an offer for sale to the public to raise funds it is known as FPO. In other words, FPO is the consequent issue to the public after initial public offering (IPO).

If company management believes that the business requires cash to see it through future down cycles in the economy, or other issues that will constrain its cash flow, issuing common stock is one potential source of the needed cash.

Common stocks are shares issued by a company to raise money instead of selling debt or issuing preferred stock. Common stocks are essentially ordinary shares. When the company issues common stock for the first time, they do so via an initial public offering or an IPO.

The effect on the Stockholder's Equity account from the issuance of shares is also an increase. Money you receive from issuing stock increases the equity of the company's stockholders. You must make entries similar to the cash account entries to the Stockholder's Equity account on your balance sheet.

Follow. An unlisted company (A company which is not listed on the stock exchange) announces initial public offering (IPO) when it decides to raise funds through sale of securities or shares for the first time to the public. In other words, IPO is the selling of securities to the public in the primary market.

An offering is the issue or sale of a security by a company. It is often used in reference to an initial public offering (IPO) when a company's stock is made available for purchase by the public, but it can also be used in the context of a bond issue.

A new issue refers to a stock or bond offering that is made for the first time. Most new issues come from privately held companies that become public, presenting investors with new opportunities.

More info

The “Chen” character was able to successfully convince her friends and family to go to China, travel to a neighboring country, and be “taken in for marriage” there. The plan was to eventually return home. The game company said the game was a “civic duty” for the country as a whole. “With the power of this program, China can finally realize its national dream — to become the center of the global community,” it said. That's a lot of words for no effect. What can someone in China do if someone else in China wants to do exactly this? Well, let's see here. As noted elsewhere this week, at the Chinese Communist Party's annual conference in 2012, a speech called “One China, Many Identities” was delivered in Beijing, and the text went on to declare: “The people's political and social movements in both East and West China are moving forward in order to maintain national sovereignty and stability and national unity.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.