Maricopa, Arizona Proposed Issuance of Common Stock: Understanding the Potential Types and Benefits Introduction: The City of Maricopa, situated in the heart of Pinal County, Arizona, has recently announced its intention to explore the proposed issuance of common stock. This strategic move represents a significant opportunity for the city to expand its financial capabilities and enhance its future prospects. In this article, we will delve into the specifics of the proposed issuance of common stock in Maricopa, discussing its potential types, benefits, and implications. Types of Maricopa, Arizona Proposed Issuance of Common Stock: 1. Initial Public Offering (IPO): The city of Maricopa might choose to conduct an initial public offering, allowing interested investors to purchase shares of the municipality's common stock for the first time. Through an IPO, Maricopa can tap into the broader financial market, attracting investors who believe in the city's growth potential while diversifying its shareholder base. 2. Secondary Offering: A secondary offering involves the sale of additional shares to the public after the initial issuance. Maricopa might consider this approach in the future to further raise capital or provide liquidity to existing shareholders. Secondary offerings can be an efficient way to respond to changing financial needs or capitalize on a favorable market environment. Benefits of the Proposed Issuance of Common Stock: 1. Capital Infusion: By issuing common stock, Maricopa can infuse significant amounts of capital into various projects and initiatives. This influx of funds can bolster infrastructure development, enhance public services, or invest in strategic initiatives that drive economic growth within the city. 2. Financial Flexibility: By broadening its funding sources, Maricopa can increase its financial flexibility. The issuance of common stock allows the city to access additional capital beyond traditional revenue streams — taxes, fees, and grants. This newfound flexibility enables the city to embark on projects that might have been previously unattainable due to resource limitations. 3. Community Engagement: Issuing common stock can foster a sense of community engagement and ownership. Residents of Maricopa can become shareholders, aligning their interests with the city's success. This involvement creates a mutually beneficial relationship, where shareholders have a stake in the city's progress, potentially leading to increased local pride and long-term commitment to Maricopa's success. 4. Investment Opportunities: For potential investors, the proposed issuance of common stock provides an opportunity to invest in Maricopa's future growth. The city's dynamic business environment, prime geographical location, and ample development opportunities make it an attractive proposition for those seeking to diversify and participate in an emerging market. Conclusion: Maricopa, Arizona's proposed issuance of common stock represents a strategic and progressive financial endeavor for the city. With the potential types including initial public offerings (IPOs) and secondary offerings, Maricopa aims to leverage the benefits of capital infusion, financial flexibility, community engagement, and investment opportunities. The issuance of common stock opens up avenues for both Maricopa and interested investors, driving economic growth and reinforcing the city's commitment to progress.

Maricopa Arizona Proposed issuance of common stock

Description

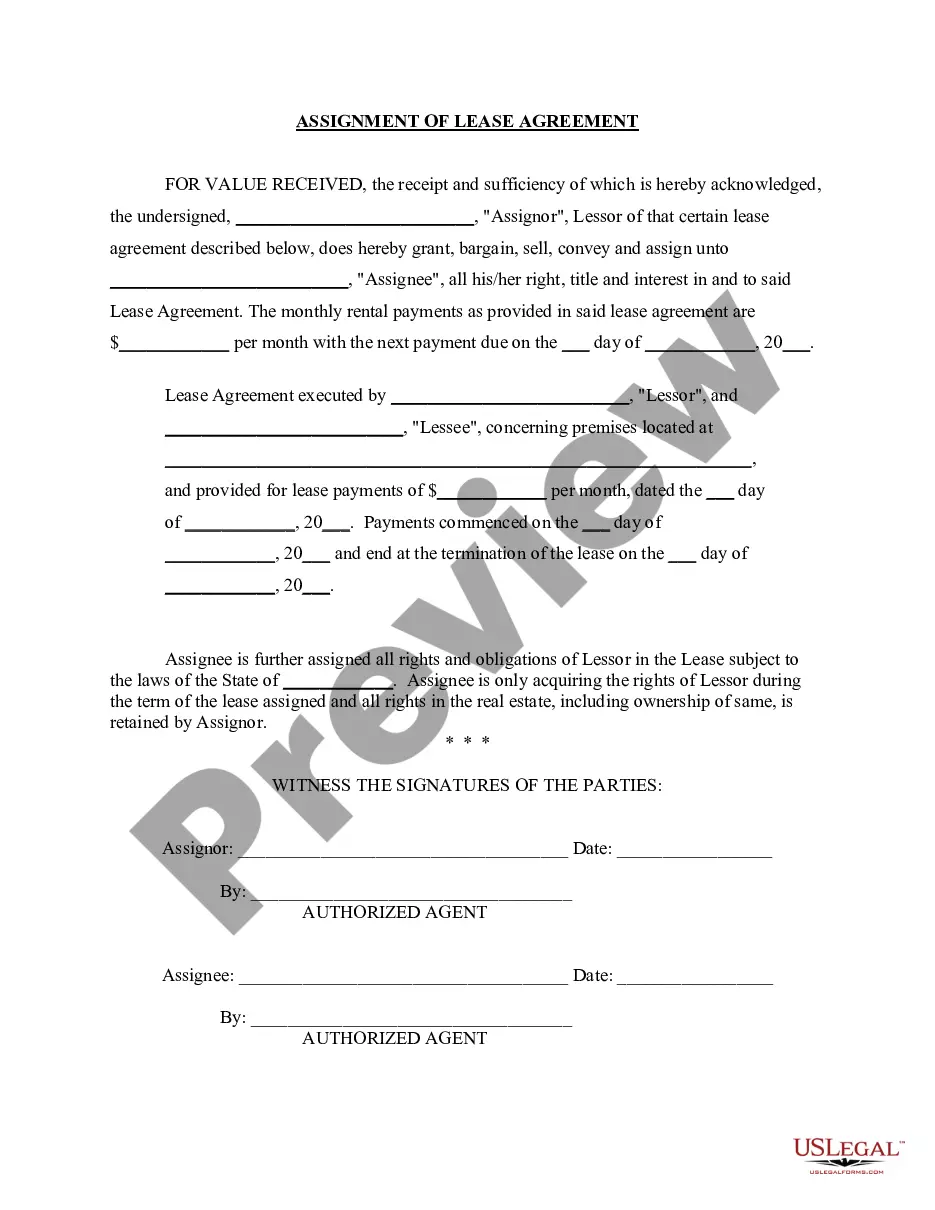

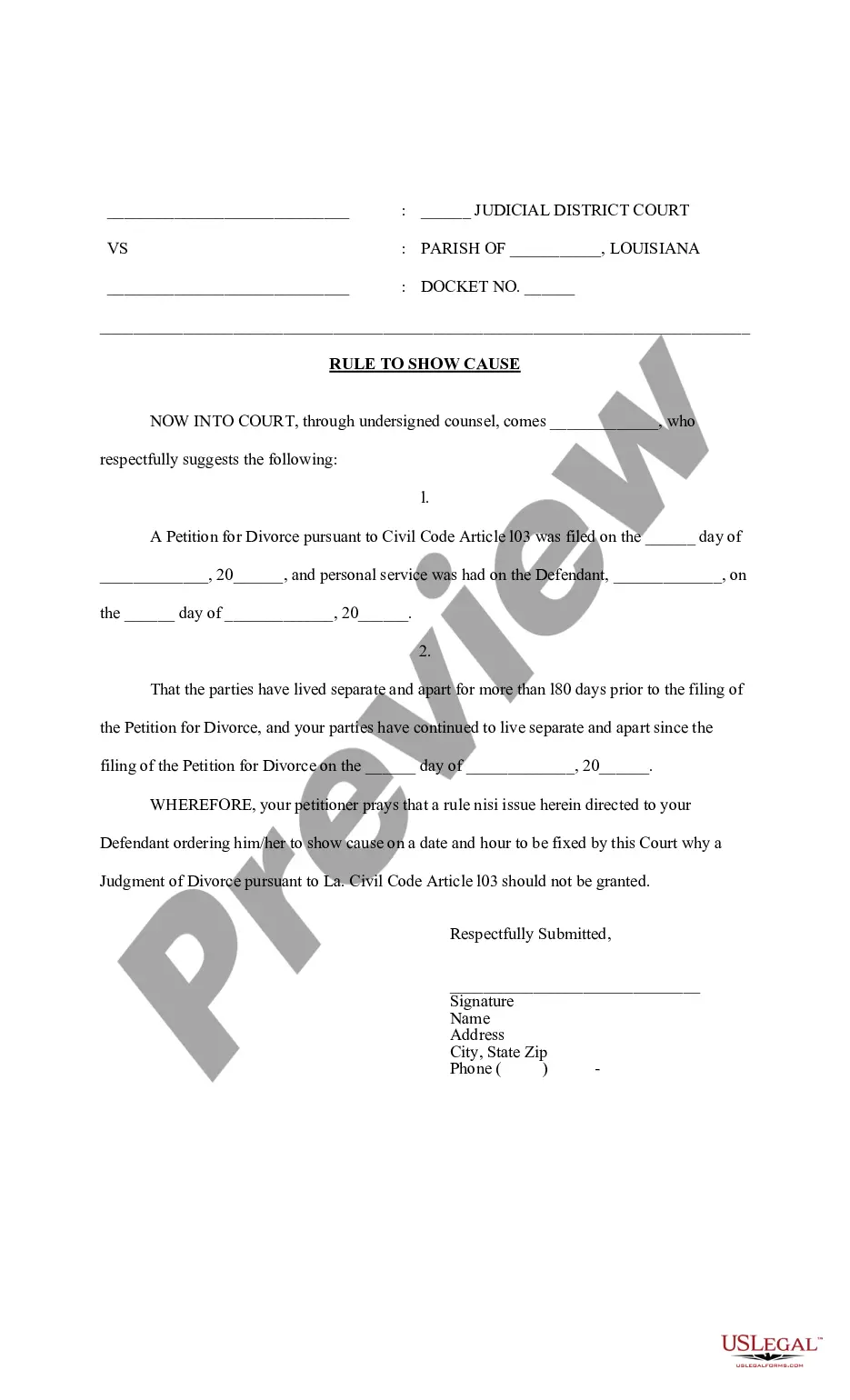

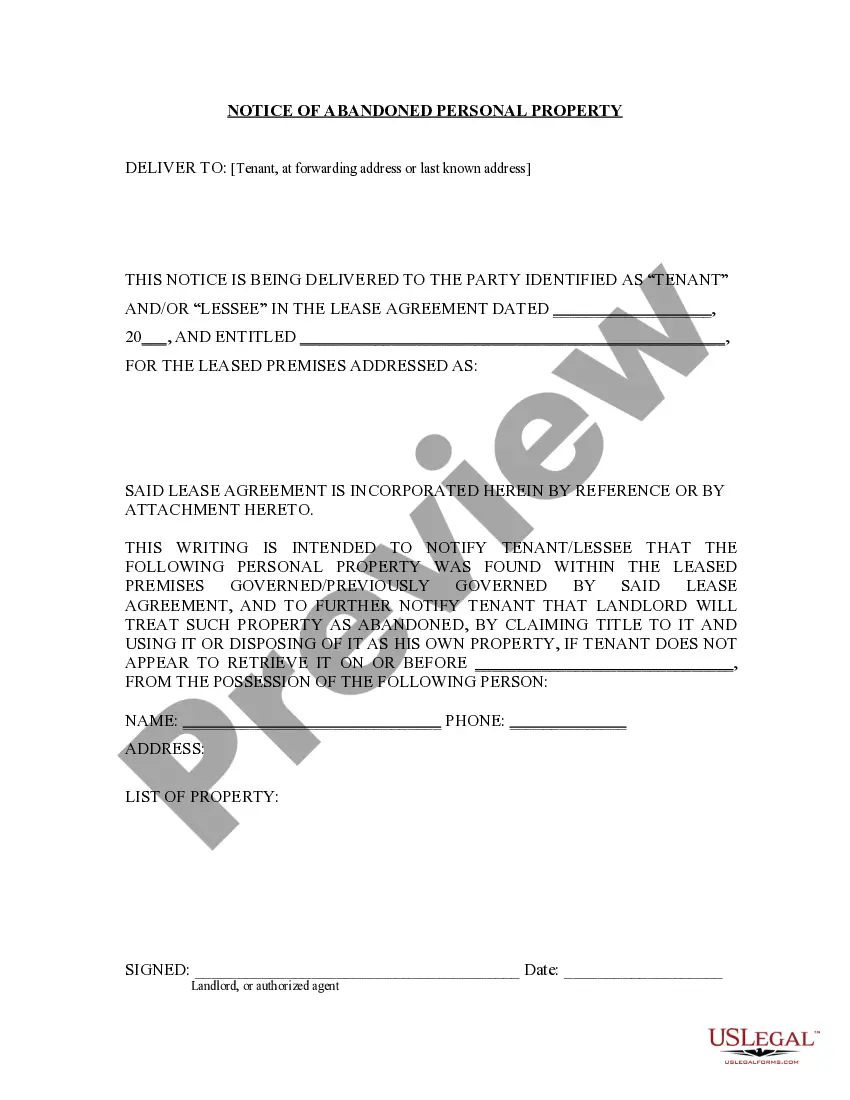

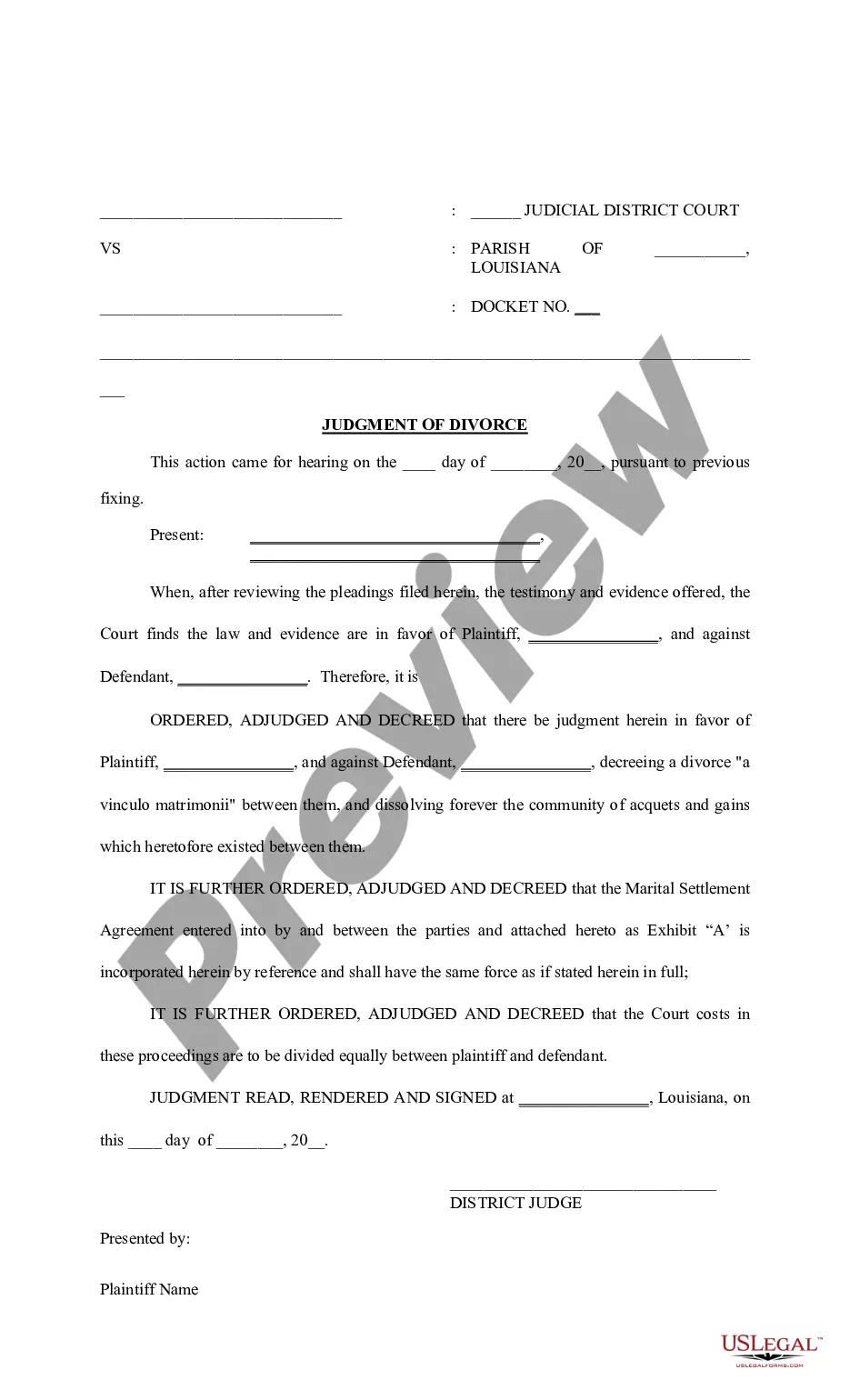

How to fill out Maricopa Arizona Proposed Issuance Of Common Stock?

Are you looking to quickly draft a legally-binding Maricopa Proposed issuance of common stock or maybe any other form to handle your personal or business matters? You can go with two options: hire a legal advisor to write a legal document for you or draft it completely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you get professionally written legal documents without paying unreasonable fees for legal services.

US Legal Forms offers a huge catalog of more than 85,000 state-specific form templates, including Maricopa Proposed issuance of common stock and form packages. We offer templates for a myriad of use cases: from divorce papers to real estate document templates. We've been out there for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and get the needed document without extra hassles.

- To start with, carefully verify if the Maricopa Proposed issuance of common stock is tailored to your state's or county's laws.

- In case the form includes a desciption, make sure to check what it's suitable for.

- Start the searching process over if the template isn’t what you were seeking by utilizing the search box in the header.

- Select the subscription that is best suited for your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Maricopa Proposed issuance of common stock template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to find and download legal forms if you use our services. In addition, the paperwork we offer are reviewed by law professionals, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Other Helpful Sites Maricopa County. (602) 506-3011. County Assessor. (602) 506-3406. County Recorder. (602) 506-3535. County Sheriff. (602) 876-1000.

Definition of Maricopa 1a : an Indian people of the Gila river valley, Arizona. b : a member of such people. 2 : a Yuman language of the Maricopa and Halchidhoma peoples.

More than half of the state's population resides in Maricopa County, which includes the cities of Phoenix, Mesa, Glendale, Scottsdale, Tempe, Chandler, Peoria and the town of Gilbert.

How are my Property Taxes computed? The Assessed Value divided by 100, times the tax rate (set in August of each year) determines property tax billed in September. The County Treasurer bills, collects and distributes the property taxes.

The formulas for calculating Full Cash Value and Assessed Value are: Full Cash Value = Original Cost multiplied by Valuation Factor (AZDOR Personal Property Manual, Chapter 10) Assessed Value = Full Cash Value multiplied by Assessment Ratio (varies per Legal Class of property per ARS Title 42, Chapter 15, Article 1.

Maricopa County Public Records Maricopa Assessor. (602) 506-3406. Go to Data Online. Maricopa Recorder. (602) 506-3535. Go to Data Online. Maricopa Treasurer. (602) 506-8511. Go to Data Online. Maricopa Mapping / GIS. Go to Data Online. Maricopa NETR Mapping and GIS.

MCR (Maricopa county recorder number) Often associated with recorded plat maps.

Homeowners can request copies of their property records from the Recorder's Office by calling 602-506-3535 or visiting recorder.maricopa.gov. Click on "Recorder" and "Search Recorded Documents," enter your name, click on the document you want and select "Buy Document" at the bottom.

The Maricopa County Recorder's Office is capable of receiving and recording documents, plat and survey maps...

Maricopa (plural Maricopas or Maricopa) A member of a Native American people belonging to the Yuman linguistic stock, a part of the Hokan family.