Nassau is a town located in Rensselaer County, New York, known for its rich history and scenic beauty. The town is considering a proposed issuance of common stock, which is a type of equity security that represents ownership in a corporation. This means that individuals who purchase these stocks become shareholders and hold a proportionate share in the company's assets, earnings, and voting rights. The proposed issuance of common stock in Nassau, New York, aims to raise capital to support various initiatives and investments within the town. These funds can be utilized for infrastructure development, improving public facilities, initiating community-oriented projects, and stimulating economic growth. By issuing common stock, Nassau can attract investors who believe in the potential growth and success of the town. These investors, called shareholders, can provide the necessary financial backing and contribute to the overall socioeconomic development of the community. Common stockholders typically have the right to attend shareholder meetings, vote on corporate matters, receive dividends, and receive information on the company's performance. Different types of common stock may be proposed in Nassau, New York, depending on the specific needs and goals of the town. These may include: 1. Class A Common Stock: This type of stock typically grants voting rights to shareholders, allowing them to participate in important decision-making processes. Class A shares are often offered to key stakeholders or individuals with significant investment in the town. 2. Class B Common Stock: This designation of common stock might be created to provide certain investors with additional benefits or privileges. Class B stockholders may receive preferential treatment when it comes to dividends or voting rights. 3. Restricted Common Stock: In some cases, Nassau might propose the issuance of restricted common stock, which comes with certain limitations or restrictions. These restrictions might limit the transferability or sale of the stock, ensuring that long-term investors or strategic partners are involved. Overall, the proposed issuance of common stock in Nassau, New York, presents an opportunity for individuals and organizations to play an active role in the town's progress. As the town attracts investors and raises capital, it can unlock a range of benefits, including enhanced infrastructure, improved amenities, and a thriving local economy.

Nassau New York Proposed issuance of common stock

Description

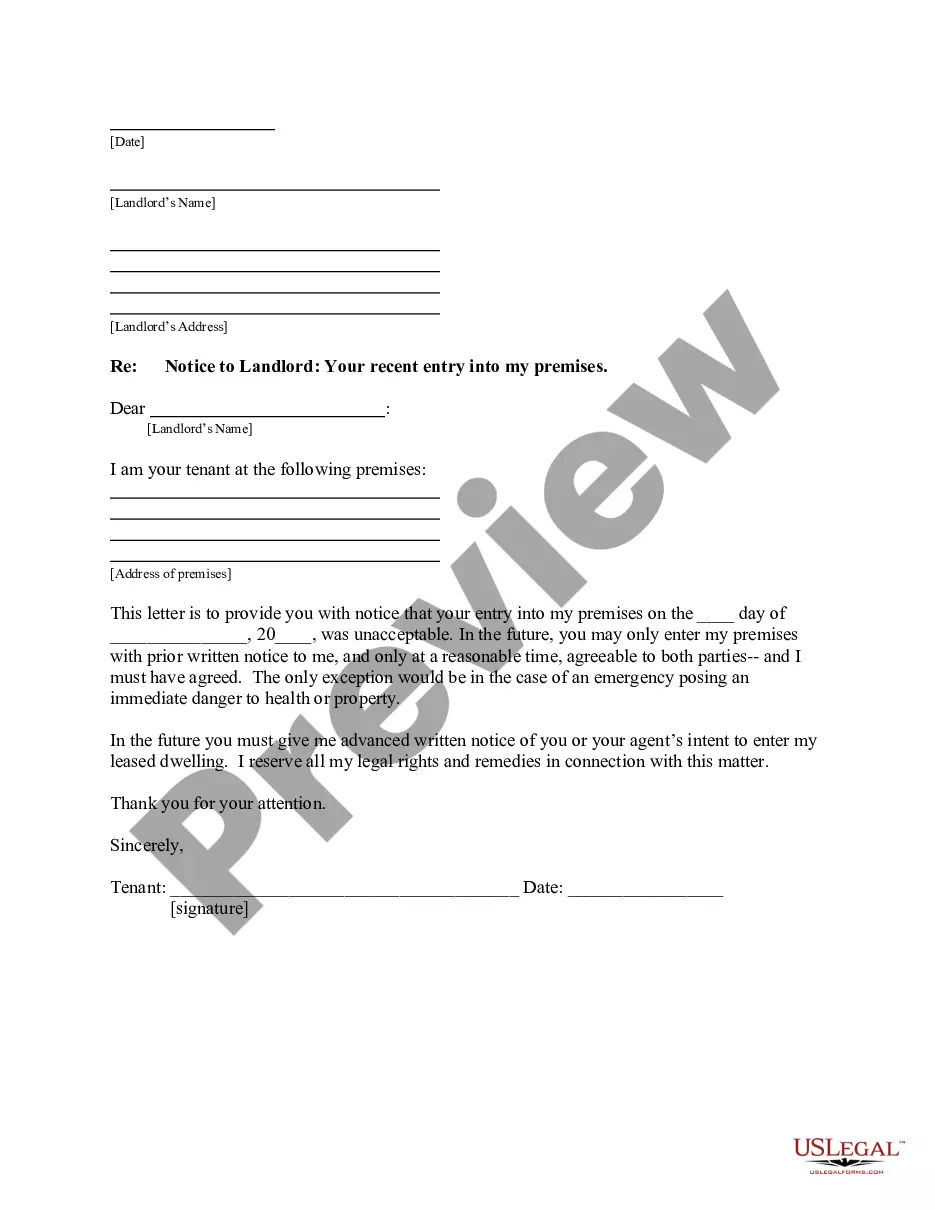

How to fill out Nassau New York Proposed Issuance Of Common Stock?

If you need to get a reliable legal form supplier to find the Nassau Proposed issuance of common stock, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can browse from more than 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of learning resources, and dedicated support team make it easy to find and execute various papers.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

Simply type to search or browse Nassau Proposed issuance of common stock, either by a keyword or by the state/county the form is intended for. After locating needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Nassau Proposed issuance of common stock template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Register an account and choose a subscription plan. The template will be immediately ready for download as soon as the payment is completed. Now you can execute the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes this experience less expensive and more reasonably priced. Create your first business, organize your advance care planning, create a real estate agreement, or complete the Nassau Proposed issuance of common stock - all from the comfort of your home.

Join US Legal Forms now!