Kings New York Incentive and Nonqualified Share Option Plan is a comprehensive employee benefit program offered by Kings New York, a prominent company based in New York City. This plan is specifically designed to incentivize and reward employees by providing them with the opportunity to acquire company shares at a discounted rate, thereby aligning their interests with the long-term growth and success of the organization. Under the Kings New York Incentive and Nonqualified Share Option Plan, employees are granted the option to purchase a predetermined number of company shares at a predetermined price, known as the exercise price. This option can be exercised after a specified vesting period, during which employees must continue their employment with the company to be eligible for the benefits. One of the variations within the Kings New York Incentive and Nonqualified Share Option Plan is the Incentive Share Option Plan. This plan is designed to favor key employees and incentivize them to drive the company's growth and maximize shareholder value. It offers certain tax advantages to employees, with potential tax benefits upon the eventual sale of the acquired shares. Another variation is the Nonqualified Share Option Plan, which is more widely available to employees at various levels of the organization. Unlike the Incentive Share Option Plan, it does not offer the same tax advantages for employees, but still provides an attractive opportunity to acquire company shares at a discounted rate. Both the Incentive and Nonqualified Share Option Plans aim to promote employee loyalty, engagement, and a sense of ownership in the company's growth. By granting employees the ability to participate in the company's success through stock ownership, Kings New York aims to foster a stronger alignment between the interests of the employees and those of the shareholders. In conclusion, the Kings New York Incentive and Nonqualified Share Option Plan is a comprehensive employee benefit program that offers employees the opportunity to acquire discounted company shares and be part of the organization's growth. It consists of variations such as the Incentive Share Option Plan and the Nonqualified Share Option Plan, each having its own advantages and eligibility criteria. Through these plans, Kings New York strives to motivate and retain its employees while fostering a sense of ownership in the company's future.

Kings New York Incentive and Nonqualified Share Option Plan

Description

How to fill out Kings New York Incentive And Nonqualified Share Option Plan?

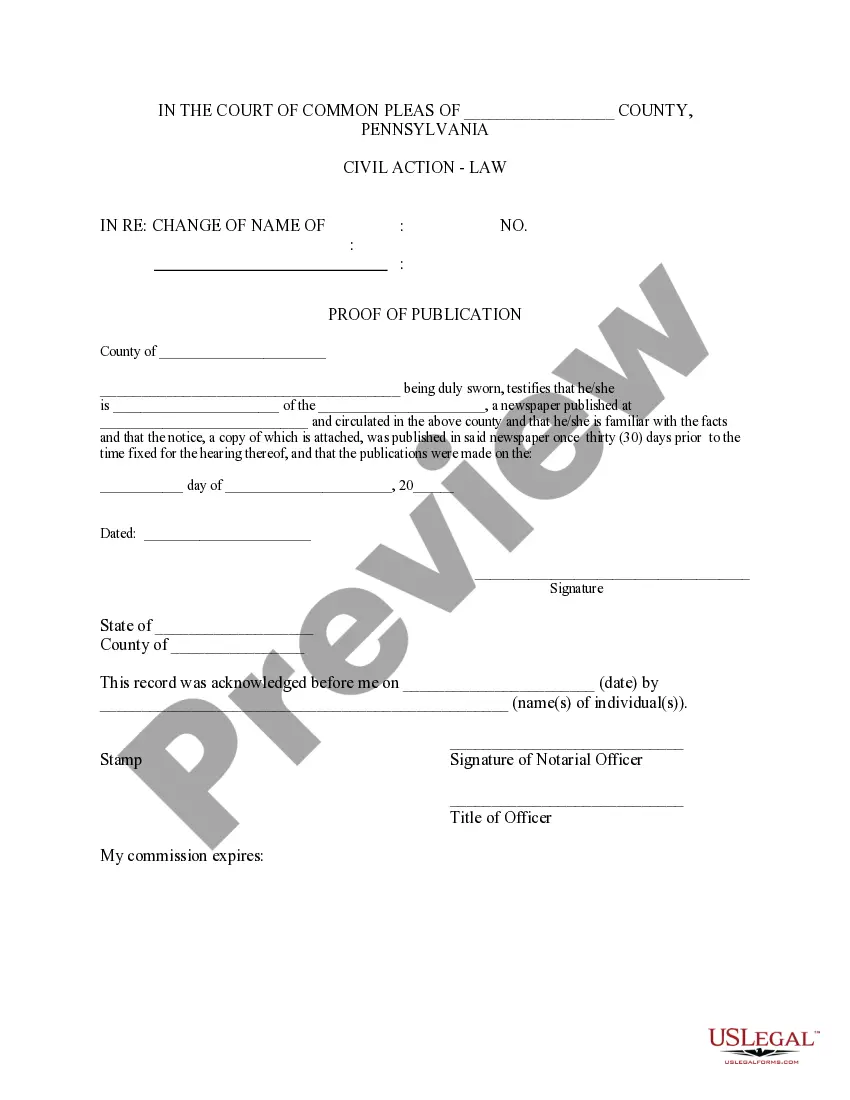

Creating paperwork, like Kings Incentive and Nonqualified Share Option Plan, to take care of your legal matters is a challenging and time-consumming process. A lot of cases require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can get your legal matters into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms created for a variety of scenarios and life situations. We make sure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Kings Incentive and Nonqualified Share Option Plan form. Simply log in to your account, download the form, and personalize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before getting Kings Incentive and Nonqualified Share Option Plan:

- Make sure that your template is specific to your state/county since the regulations for writing legal documents may vary from one state another.

- Learn more about the form by previewing it or going through a brief description. If the Kings Incentive and Nonqualified Share Option Plan isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin utilizing our website and get the form.

- Everything looks great on your side? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment information.

- Your template is all set. You can go ahead and download it.

It’s easy to find and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!