Philadelphia, Pennsylvania Incentive and Nonqualified Share Option Plan: A Comprehensive Overview The Philadelphia, Pennsylvania Incentive and Nonqualified Share Option Plan is a dynamic framework that aims to incentivize employees in both private and publicly traded companies within the city. This plan entails offering employees the opportunity to acquire company shares through incentive stock options (SOS) or nonqualified stock options (SOS). These options grant employees the ability to purchase company shares at a predetermined price within a specified timeframe. Incentive Stock Options (SOS): 1. Employee SOS: This type of ISO is exclusively available to employees of the company. It serves as a valuable tool to motivate and reward employees for their contributions to the organization's success. Employees can purchase shares at a predetermined strike price, usually lower than the market value, allowing them to potentially benefit from the company's growth. 2. Executive SOS: Reserved for high-level executives and key personnel, these SOS offer additional benefits to incentivize and retain top talent. Executive SOS may include special terms, such as acceleration clauses or performance-based vesting, to align the executive's interests with the organization's long-term success. Nonqualified Stock Options (SOS): 1. Consultant SOS: Designed for independent contractors and consultants, this type of NO provides an opportunity to reward these professionals for their expertise and contributions. Although not subject to the same tax advantages as SOS, consultant SOS offer flexibility in their terms and vesting schedules. 2. Director SOS: Directors serving on the organization's board can benefit from director SOS. These options are intended to align the interests of the board members with those of shareholders, promoting active involvement and dedication to the company's growth and development. Both SOS and SOS are subject to specific regulations outlined by the Internal Revenue Service (IRS) and must adhere to the guidelines set forth in the Philadelphia, Pennsylvania Incentive and Nonqualified Share Option Plan. The Philadelphia, Pennsylvania Incentive and Nonqualified Share Option Plan aims to drive economic growth, attract and retain top talent, and foster a thriving business environment within the city. By offering employees and professionals the ability to participate in the company's success through share ownership, this plan cultivates a sense of ownership and shared destiny between employers and employees. As Philadelphia continues to position itself as an innovation hub and a center for business growth, the Incentive and Nonqualified Share Option Plan plays a crucial role in supporting the city's economic development goals. Whether through SOS or SOS, this comprehensive plan empowers organizations of all sizes to reward and motivate individuals, driving mutual success and enhancing the overall business landscape in the vibrant city of Philadelphia, Pennsylvania.

Philadelphia Pennsylvania Incentive and Nonqualified Share Option Plan

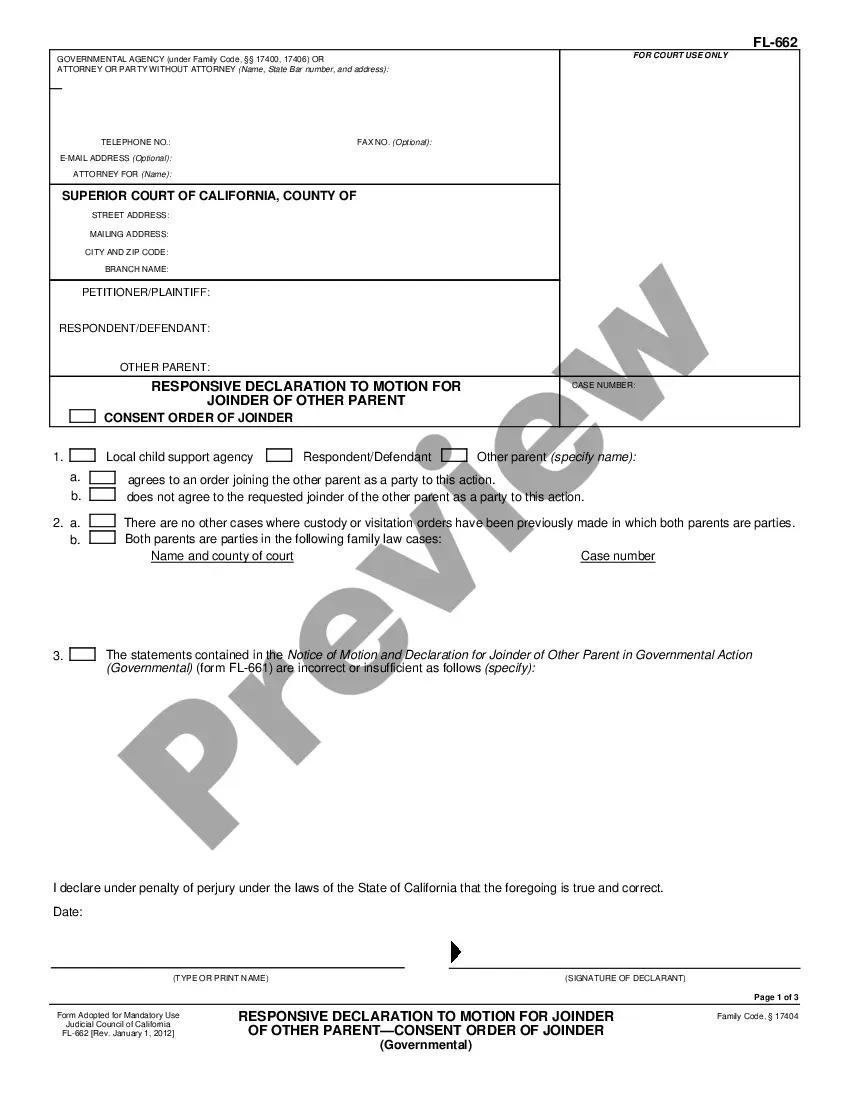

Description

How to fill out Philadelphia Pennsylvania Incentive And Nonqualified Share Option Plan?

Drafting papers for the business or personal demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to draft Philadelphia Incentive and Nonqualified Share Option Plan without expert help.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Philadelphia Incentive and Nonqualified Share Option Plan by yourself, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the required document.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Philadelphia Incentive and Nonqualified Share Option Plan:

- Look through the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that fits your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any use case with just a couple of clicks!