Nassau County, located in New York, is a vibrant and populous area that encompasses a variety of cities, towns, and villages. It is crucial for the county to have the authority to increase its bonded indebtedness to cater to its growing needs and ensure the wellbeing of its residents. This authorization provides Nassau County with the means to finance essential projects and initiatives that directly impact its infrastructure, public services, and overall development. One of the types of Nassau New York Authorization to increase bonded indebtedness is known as General Obligation (GO) bonds. These bonds are typically used to fund capital projects, such as constructing or renovating public buildings, improving transportation systems, enhancing parks and recreational areas, or upgrading utilities. GO bonds are backed by the county's full faith and credit, meaning that the government pledges to repay the borrowed amount through various revenue sources, including taxes and fees. Another type of authorization to increase bonded indebtedness in Nassau County is Revenue Bonds. These bonds are often issued to finance projects that generate income or revenue streams, such as toll roads, parking facilities, or water and sewer systems. Revenue bonds are secured by the revenue generated by the project they fund, reducing the burden on taxpayers as the repayment is derived independently. The need for increased bonded indebtedness arises as Nassau County faces various challenges and opportunities. Examples include improving aging infrastructure, providing affordable housing options, enhancing public safety measures, investing in education and healthcare facilities, and supporting economic growth and innovation. By obtaining authorization to increase bonded indebtedness, Nassau County can fulfill its commitments and strive towards becoming a more prosperous and inclusive community. The process of obtaining the authorization involves careful planning, budgeting, and public input. County officials assess the projected costs of proposed projects, analyze the potential impact on taxes and public services, and engage in discussions with residents and community stakeholders to gather feedback and address concerns. These transparent and participatory processes ensure that decisions regarding bonded indebtedness are made in the best interest of Nassau County residents. In conclusion, the Nassau New York Authorization to increase bonded indebtedness is a crucial mechanism that empowers the county to finance vital projects and initiatives. Both General Obligation and Revenue Bonds enable Nassau County to invest in its future and meet the needs of its growing population. By obtaining this authorization and responsibly managing the borrowed funds, Nassau County can continue to thrive and provide a high quality of life for its residents.

Nassau New York Authorization to increase bonded indebtedness

Description

How to fill out Nassau New York Authorization To Increase Bonded Indebtedness?

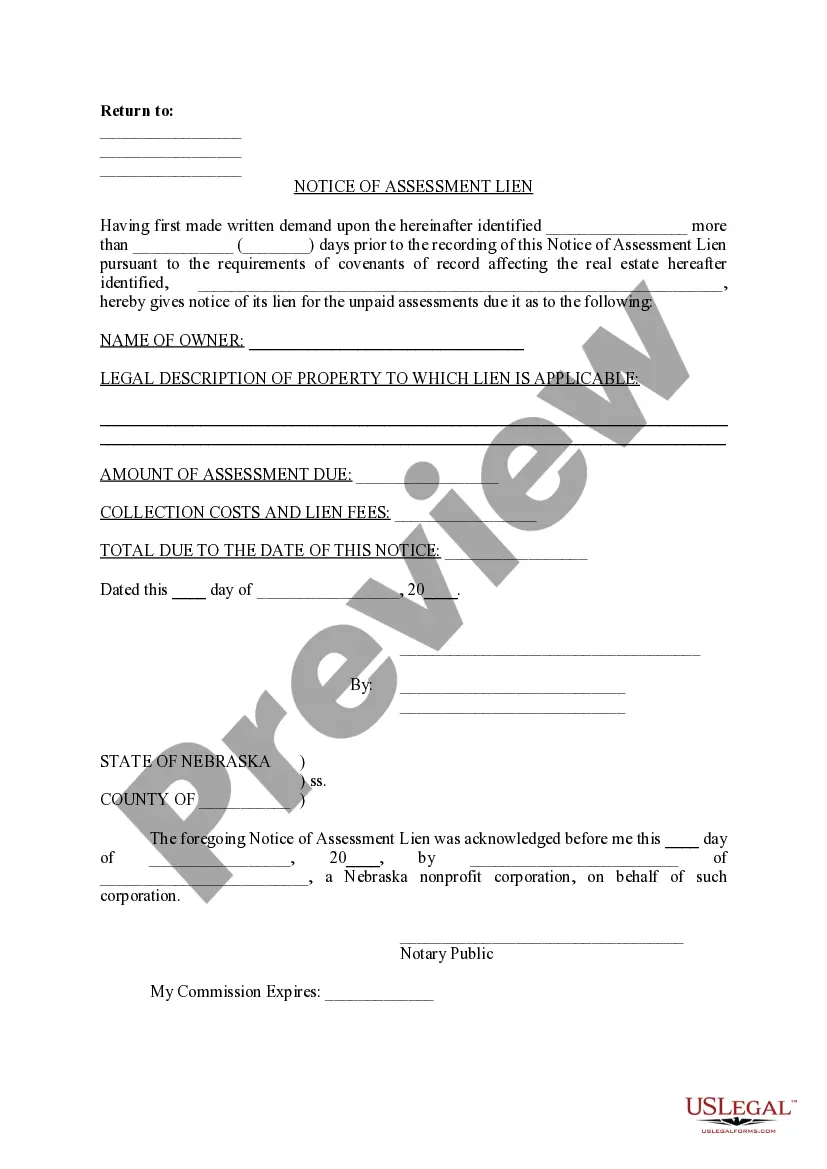

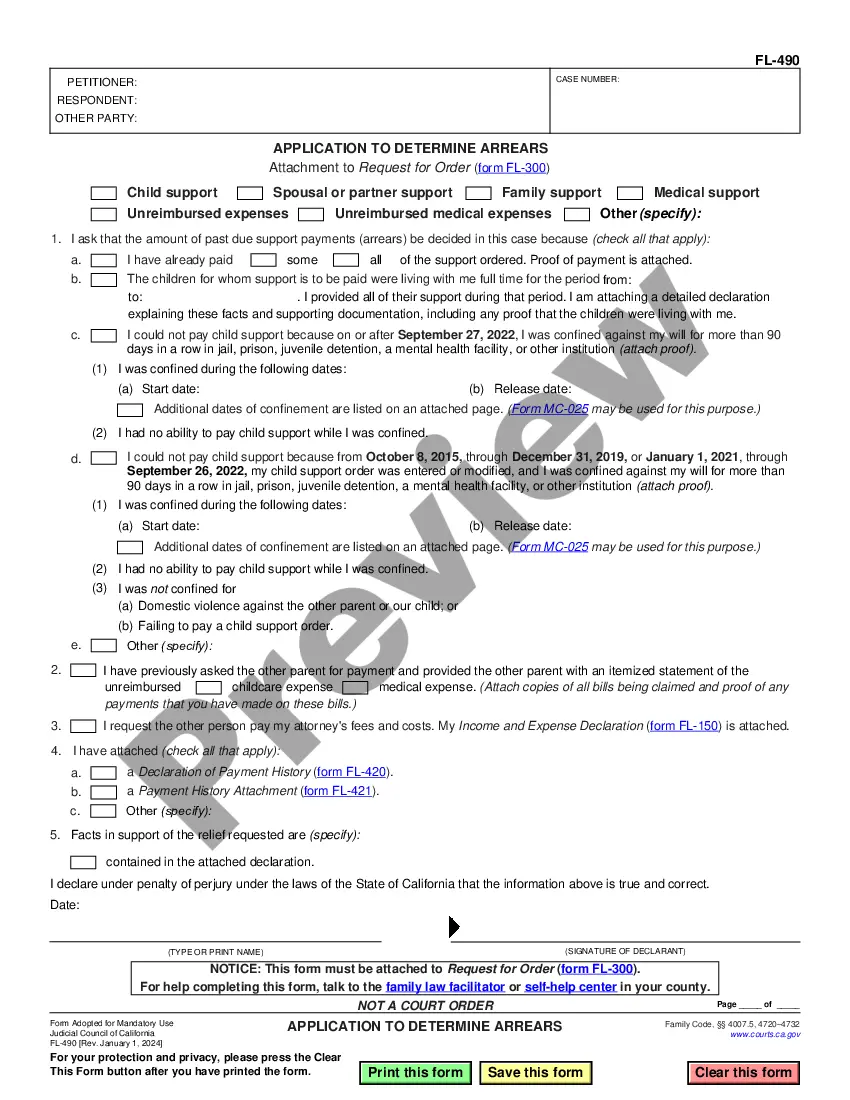

Are you looking to quickly create a legally-binding Nassau Authorization to increase bonded indebtedness or maybe any other document to take control of your own or business matters? You can go with two options: contact a legal advisor to write a legal document for you or create it completely on your own. Luckily, there's another option - US Legal Forms. It will help you get neatly written legal documents without having to pay unreasonable fees for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-specific document templates, including Nassau Authorization to increase bonded indebtedness and form packages. We offer templates for an array of life circumstances: from divorce paperwork to real estate documents. We've been out there for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary template without extra troubles.

- To start with, carefully verify if the Nassau Authorization to increase bonded indebtedness is tailored to your state's or county's regulations.

- In case the form includes a desciption, make sure to check what it's intended for.

- Start the search over if the template isn’t what you were looking for by using the search box in the header.

- Choose the plan that best fits your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Nassau Authorization to increase bonded indebtedness template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. Moreover, the paperwork we offer are reviewed by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!