San Diego, California, is a vibrant coastal city known for its stunning beaches, mild climate, and diverse community. Located in Southern California, it is the second-largest city in the state and boasts a rich history, thriving economy, and numerous attractions. One aspect of San Diego's financial landscape is the authorization to increase bonded indebtedness. This term refers to the legal permission granted to the city or its governing body to issue additional bonds, allowing them to borrow money for various purposes. Bonds are essentially loans given to the city by investors, who will receive regular interest payments until the bond matures and the principal is repaid. There are several types of San Diego California Authorization to increase bonded indebtedness, each serving a specific purpose: 1. General Obligation Bonds: These bonds are backed by the full faith and credit of the city, meaning that they are supported by its taxing power. They are typically used to fund public infrastructure projects such as schools, parks, or transportation systems. 2. Revenue Bonds: Unlike general obligation bonds, revenue bonds rely on specific revenue streams, like tolls or fees generated by a particular project, to repay the debt. San Diego might issue revenue bonds to finance infrastructure projects like water treatment plants or sports stadiums. 3. Assessment District Bonds: San Diego may also establish assessment districts to finance improvements in specific areas. These bonds are repaid through assessments levied on the properties in the district, which directly benefit from the improvements. Examples could include street lighting upgrades or landscaping projects. These types of San Diego California Authorization to increase bonded indebtedness play a significant role in funding essential services and infrastructure projects, driving the city's growth and development. By issuing bonds, San Diego can finance projects that might otherwise be out of reach due to limited budgetary resources. However, it is crucial for the city to carefully manage its indebtedness and ensure that bond funds are used effectively and responsibly. In summary, San Diego, California, relies on various types of authorization to increase bonded indebtedness to fund important infrastructure projects and initiatives. General obligation bonds, revenue bonds, and assessment district bonds are just a few examples of the tools used to enhance the city's amenities, address community needs, and stimulate economic growth. Through careful financial planning and responsible management, San Diego continues to flourish as a premier destination on the West Coast.

San Diego California Authorization to increase bonded indebtedness

Description

How to fill out San Diego California Authorization To Increase Bonded Indebtedness?

Whether you intend to open your business, enter into a deal, apply for your ID update, or resolve family-related legal issues, you need to prepare certain documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business occasion. All files are collected by state and area of use, so picking a copy like San Diego Authorization to increase bonded indebtedness is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several more steps to get the San Diego Authorization to increase bonded indebtedness. Adhere to the guide below:

- Make certain the sample meets your personal needs and state law regulations.

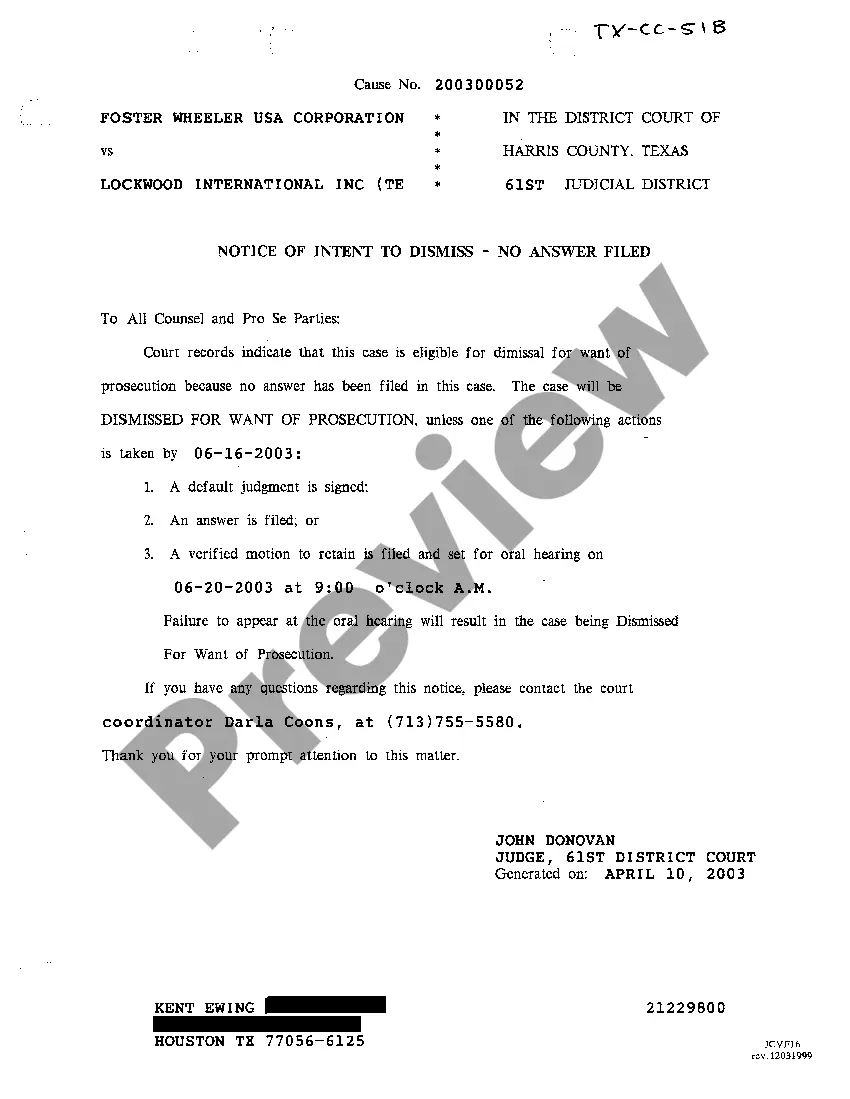

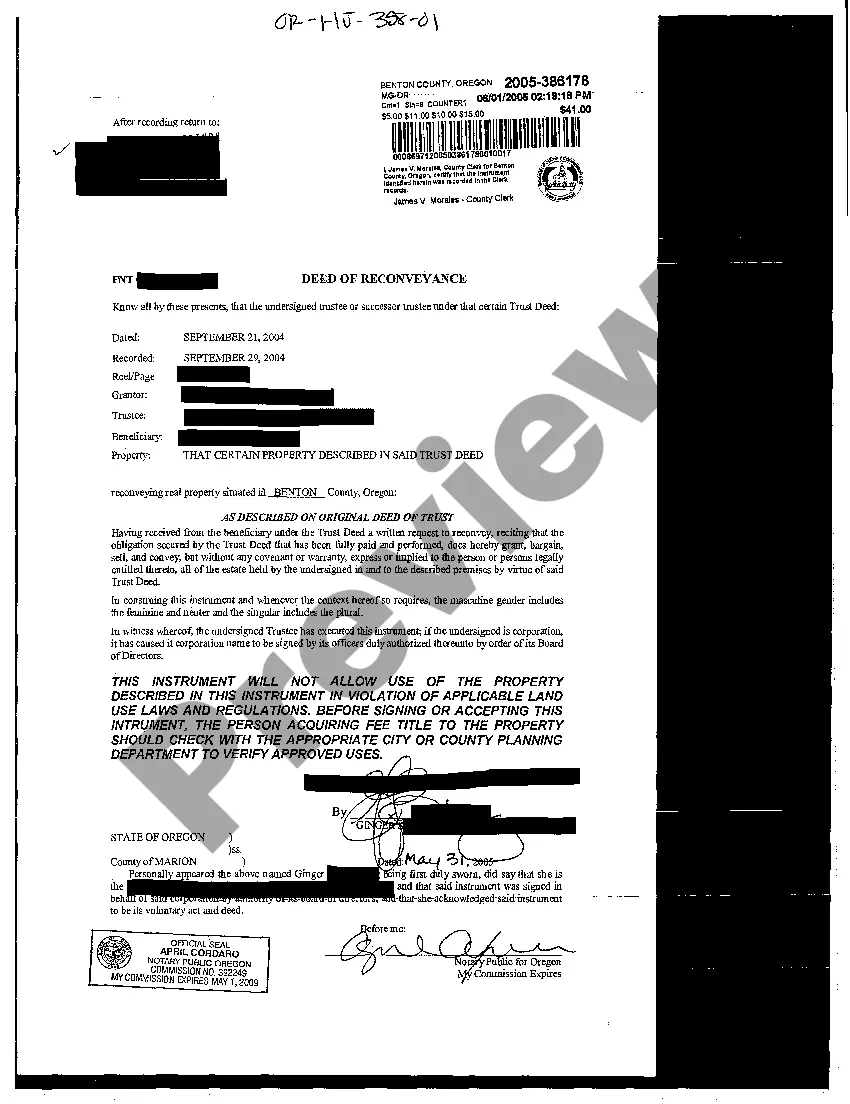

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to get the file when you find the right one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Diego Authorization to increase bonded indebtedness in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!