Broward County, located in the state of Florida, is a thriving region known for its diverse economy and vibrant communities. Within this context, the Broward Florida Approval of Grant of Security Interest in All Assets to Secure Obligations Pursuant to the Terms of an Informal Creditor Workout Plan plays a crucial role in facilitating financial stability and creditor protection. The grant of security interest signifies the legal agreement between a debtor and a creditor, wherein the debtor pledges their assets as collateral to secure obligations under an informal creditor workout plan. This plan outlines the terms and conditions agreed upon by all parties involved, aiming to address the debtor's financial challenges while ensuring the rights of the creditors are protected. Broward County recognizes the importance of fostering an environment conducive to successful creditor workout plans. By extending their approval to the grant of security interest, they promote stability in the local economy, encourage debt restructuring, and foster positive creditor-debtor relationships. The approval of grant of security interest applies to multiple asset categories, encompassing both tangible and intangible assets owned by the debtor. These may include but are not limited to real estate properties, vehicles, machinery, equipment, accounts receivable, inventory, intellectual property rights, and investment holdings. Under the terms of an informal creditor workout plan, the debtor is expected to fulfill their obligations by making scheduled payments, adhering to restructuring agreements, or implementing strategic measures to enhance their financial performance. The approved grant of security interest acts as a safety net for creditors, providing them with a legal claim to the debtor's assets should default or non-compliance occur. In Broward County, there may be various types of approvals of grant of security interest, depending on the specific circumstances and nature of the debtor's financial challenges. These may include individual approvals for businesses, organizations, or individuals facing financial distress, or collective approvals for multiple debtors participating in a joint workout plan. Whether it is a local business struggling to meet financial obligations, an organization facing temporary liquidity constraints, or an individual seeking debt relief, the Broward Florida Approval of Grant of Security Interest in All Assets to Secure Obligations Pursuant to the Terms of an Informal Creditor Workout Plan ensures a legal framework that protects the rights and interests of all parties involved. By providing this approval, Broward County demonstrates its commitment to fostering a sound financial environment and encouraging responsible debt resolution strategies.

Broward Florida Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan

Description

How to fill out Broward Florida Approval Of Grant Of Security Interest In All Of Assets To Secure Obligations Pursuant To Terms Of Informal Creditor Workout Plan?

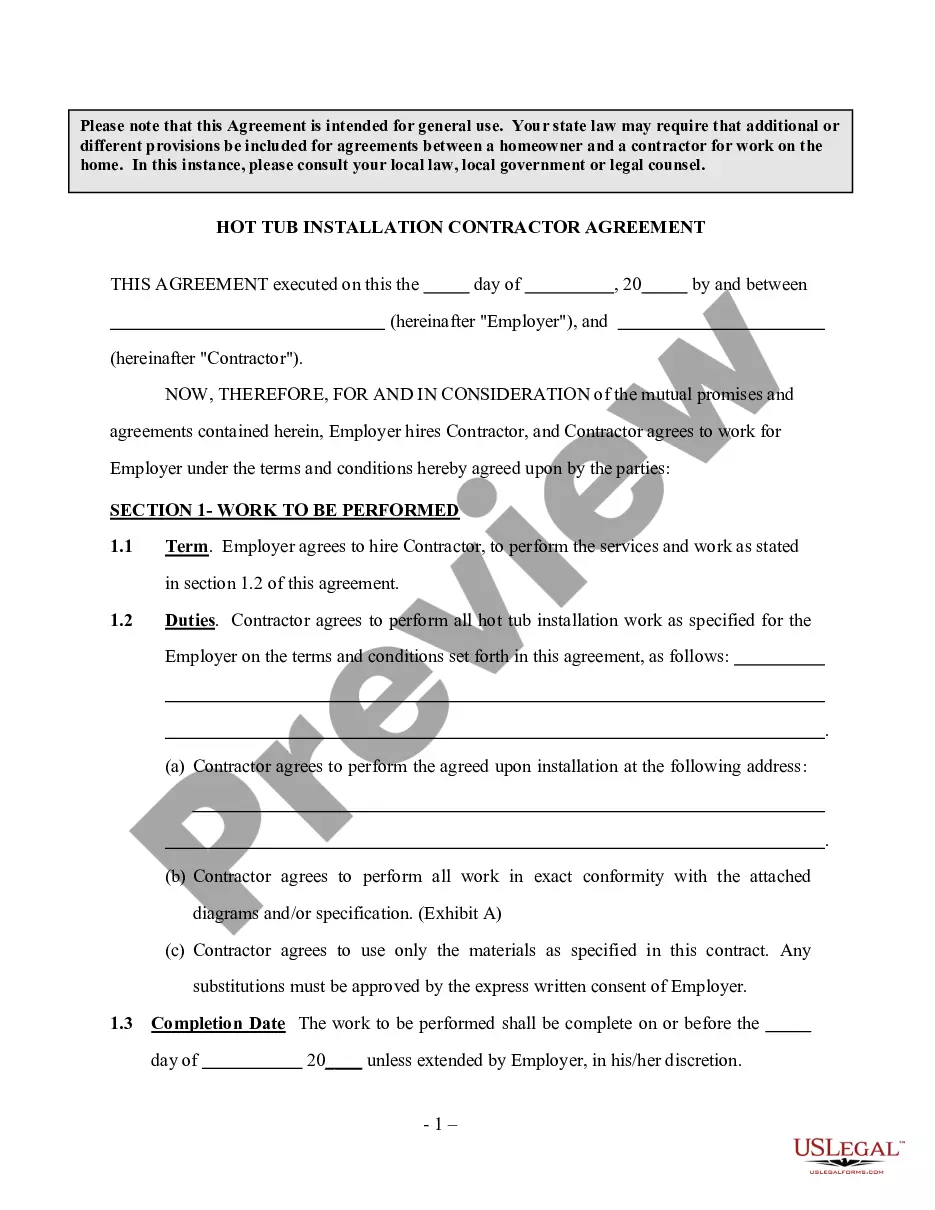

Are you looking to quickly draft a legally-binding Broward Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan or probably any other form to manage your personal or corporate matters? You can select one of the two options: hire a professional to draft a legal document for you or create it entirely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you get neatly written legal papers without having to pay unreasonable fees for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-compliant form templates, including Broward Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan and form packages. We provide documents for an array of life circumstances: from divorce papers to real estate documents. We've been out there for over 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra hassles.

- To start with, double-check if the Broward Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan is tailored to your state's or county's laws.

- In case the form has a desciption, make sure to check what it's suitable for.

- Start the searching process over if the form isn’t what you were seeking by using the search box in the header.

- Select the subscription that best fits your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Broward Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. Additionally, the templates we offer are reviewed by law professionals, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!