Salt Lake City, Utah is the capital and the most populous city in the state of Utah, United States. It is situated in the Salt Lake Valley on the eastern edge of the Great Salt Lake. Known for its stunning mountainous backdrop, outdoor recreational activities, and vibrant city life, Salt Lake City is a popular destination for tourists and a thriving hub for various industries. One significant aspect of conducting business in Salt Lake Utah is the approval of granting a security interest in all assets to secure obligations pursuant to the terms of an informal creditor workout plan. This process involves ensuring that creditors are provided with security in the form of collateral to protect their interests. The approval of such grant of security interest is a critical step in the informal creditor workout plan, which aims to address financial difficulties and find a mutually beneficial solution between the debtor and the creditor. By granting security interest in all assets, the debtor pledges their possessions, including tangible property, inventory, intellectual property, and accounts receivable, as collateral for the obligations owed to creditors. This approval process ensures that creditors have a legal claim on the debtor's assets, which can be liquidated or used to fulfill the outstanding obligations if the debtor defaults. It provides a safety net for creditors, increasing the likelihood of recovering their debts and mitigating the risk involved in lending funds. In Salt Lake City, there may be various types of approvals for granting security interest in all assets to secure obligations pursuant to informal creditor workout plans. These could include approvals for specific industries like manufacturing, real estate, technology, or healthcare. Each industry may have different criteria and requirements for granting security interest, ensuring that the collateral provided is relevant and adequate to secure the debtor's obligations. Overall, Salt Lake City's approval of granting security interest in all assets to secure obligations pursuant to an informal creditor workout plan is an essential legal and financial process. It provides reassurance to creditors that their investments are protected, encourages cooperation between debtors and creditors, and supports the overall stability and growth of businesses in the area.

Salt Lake Utah Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan

Description

How to fill out Salt Lake Utah Approval Of Grant Of Security Interest In All Of Assets To Secure Obligations Pursuant To Terms Of Informal Creditor Workout Plan?

Whether you intend to start your company, enter into a contract, apply for your ID update, or resolve family-related legal issues, you need to prepare certain documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business case. All files are collected by state and area of use, so opting for a copy like Salt Lake Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few additional steps to obtain the Salt Lake Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan. Follow the guide below:

- Make certain the sample meets your personal needs and state law regulations.

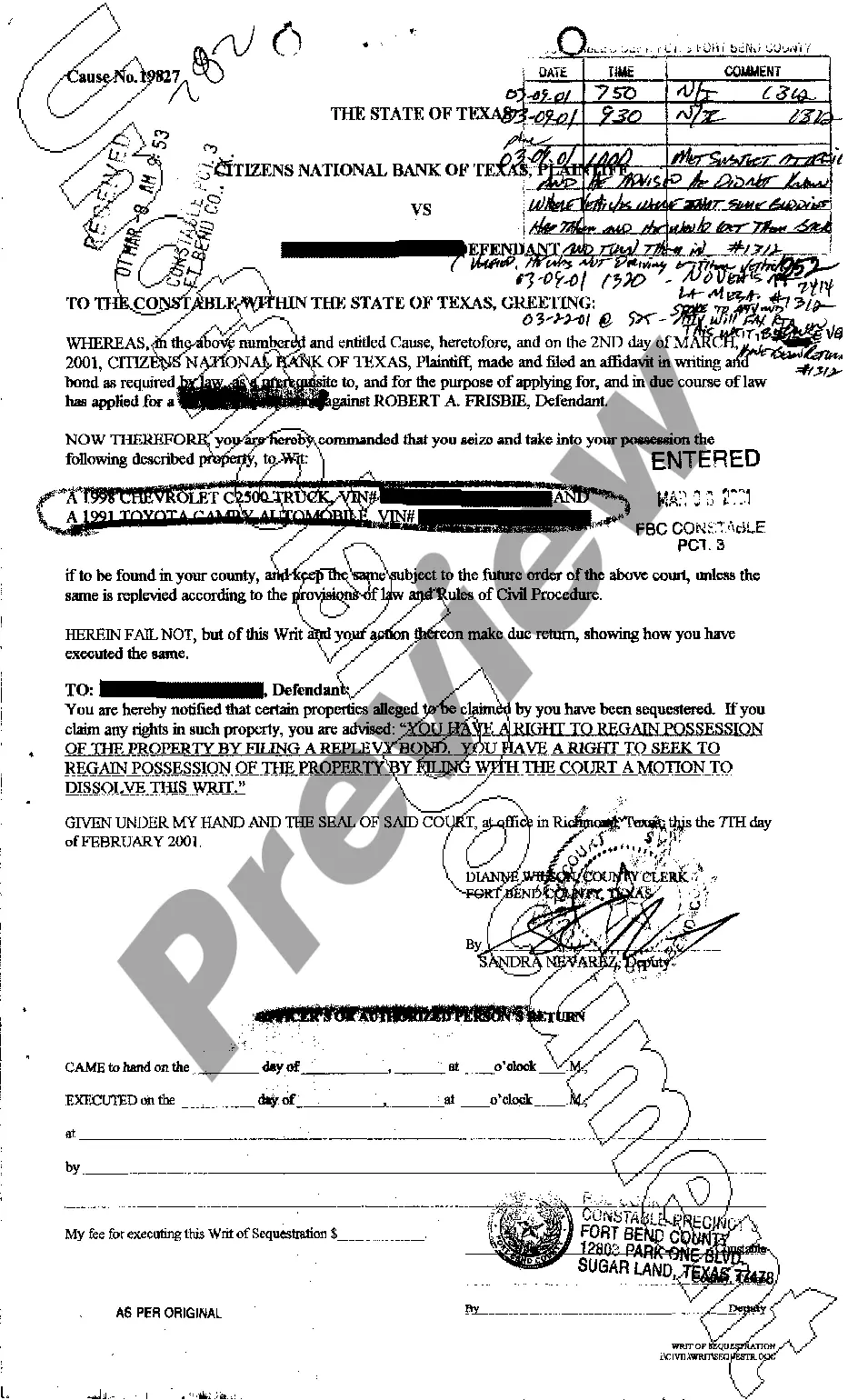

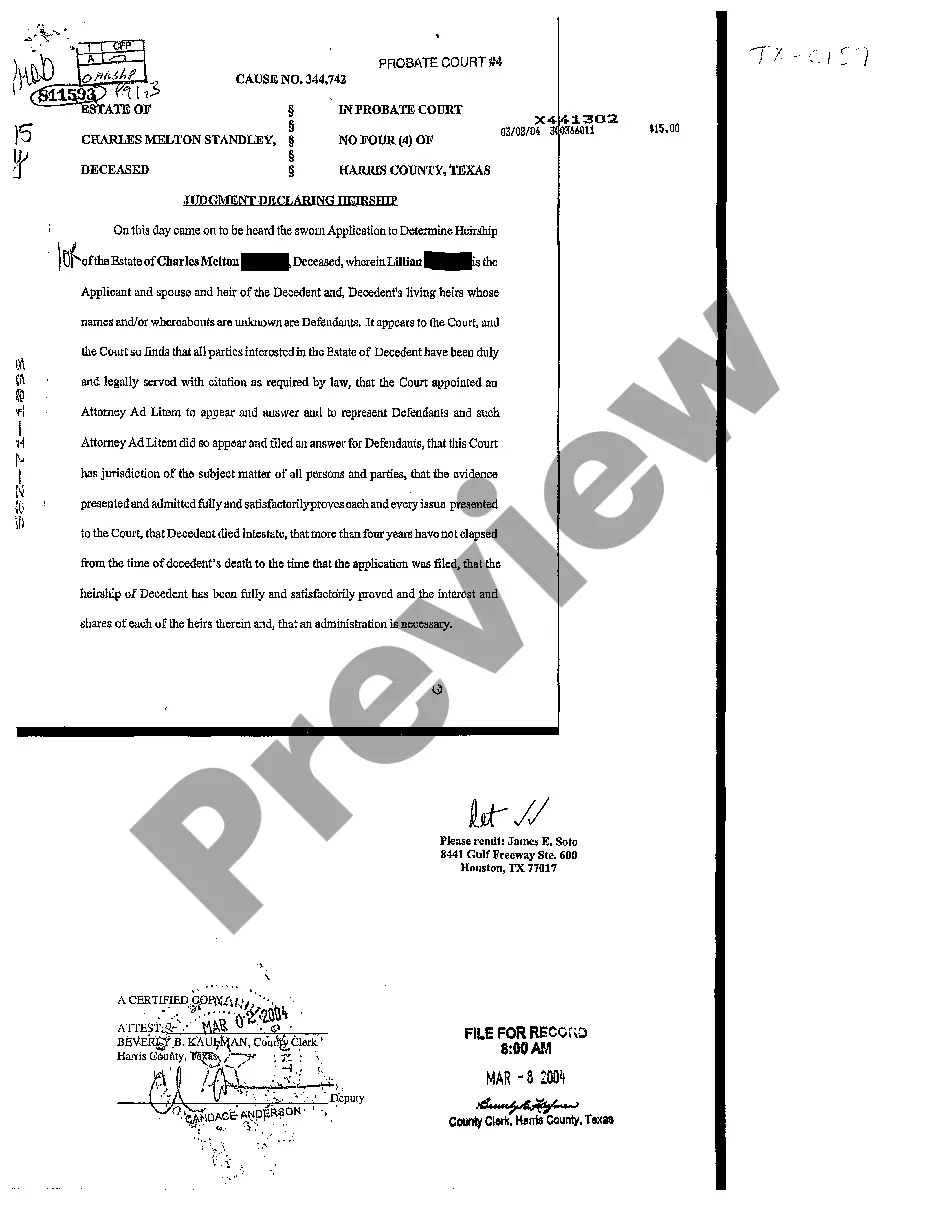

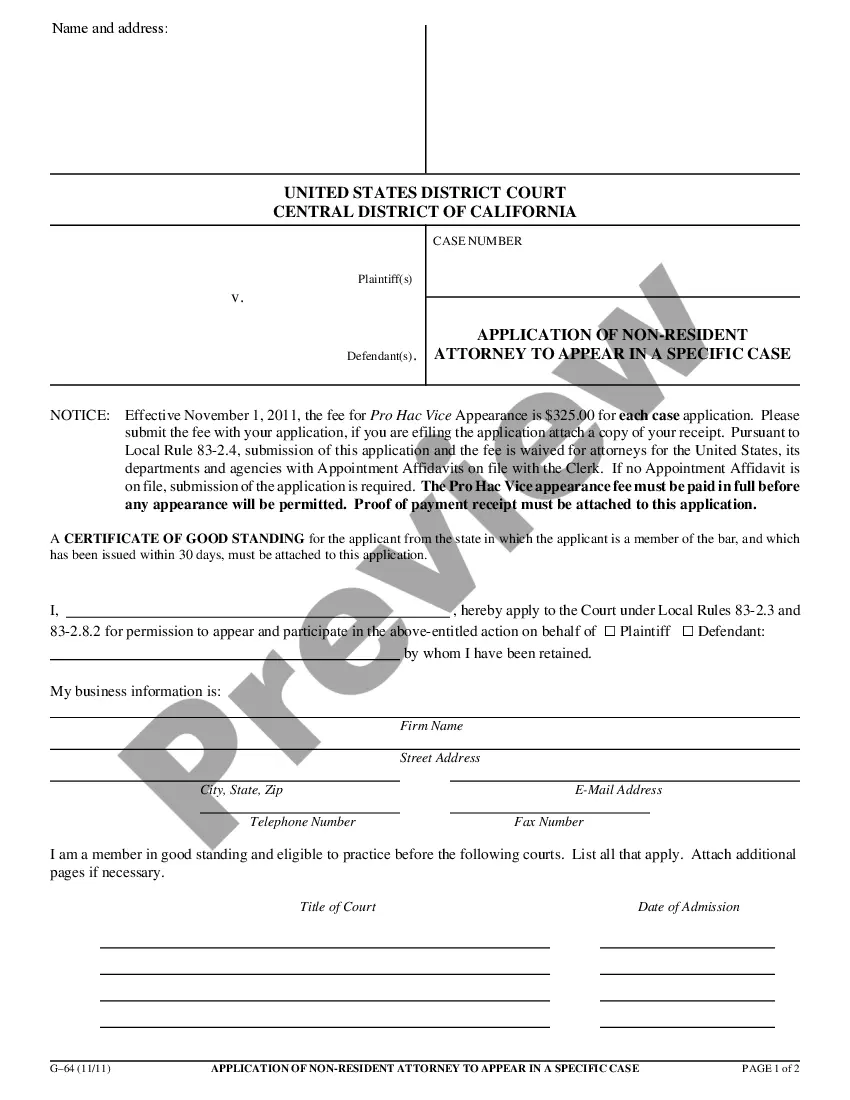

- Read the form description and check the Preview if available on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to get the file when you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Salt Lake Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

The three requirements of: giving value, debtor rights in the collateral, and an authenticated security agreement apply to the most common types of collateral, such as equipment, inventory and even payments due under a contract.

Under the Secured Transactions Article of the UCC, which of the following requirements is necessary to have a security interest attach? An interest in personal property or fixtures that secures payment or performance of an obligation. Is sufficient to cover all inventory.

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.

In finance, a security interest is a legal right granted by a debtor to a creditor over the debtor's property (usually referred to as the collateral) which enables the creditor to have recourse to the property if the debtor defaults in making payment or otherwise performing the secured obligations.

For a security interest to attach, the following events must have occurred: (A) value must have been given by the Secured Party; (B) the Debtor must have rights in the collateral; and (C) the Secured Party must have been granted a security interest in the collateral. A.

The three requirements of: giving value, debtor rights in the collateral, and an authenticated security agreement apply to the most common types of collateral, such as equipment, inventory and even payments due under a contract.

2022 In order for a creditor's security interest to attach (i.e., to become enforceable): (1) The debtor must have rights in the collateral; and. (2) The secured party must give value (e.g., extension of credit, consideration) in exchange for an interest in the collateral; and either.

For a security interest to attach, the following events must have occurred: (A) value must have been given by the Secured Party; (B) the Debtor must have rights in the collateral; and (C) the Secured Party must have been granted a security interest in the collateral.

Attachment involves three elements: 1) the secured party must give value to the debtor; 2) the debtor must have rights in the collateral or the power to give rights in the collateral to the secured party; and a third condition must be satisfiedusually, the debtor's authentication of a security agreement describing the