San Antonio is a vibrant city located in the state of Texas, United States. Known for its rich history, diverse culture, and picturesque landscapes, San Antonio offers a unique blend of tradition and modernity. In the context of the approval of a grant of security interest in all assets to secure obligations pursuant to the terms of an informal creditor workout plan, San Antonio presents various opportunities for businesses and individuals looking to establish a secure financial arrangement. San Antonio offers several types of approvals for grants of security interest in assets to secure obligations under informal creditor workout plans, including: 1. Real Estate: San Antonio boasts a thriving real estate market with an array of residential, commercial, and industrial properties. Obtaining approval for a grant of security interest in real estate assets can provide a solid foundation for securing obligations under an informal creditor workout plan. 2. Business Assets: San Antonio is home to a diverse range of businesses, from small startups to multinational corporations. Approval for a grant of security interest in business assets such as inventory, equipment, and intellectual property can be essential in securing obligations during a creditor workout. 3. Financial Instruments: San Antonio has a robust financial sector offering various types of financial instruments such as stocks, bonds, and securities. Approvals for grants of security interest in financial instruments can provide additional collateral to secure obligations in an informal creditor workout plan. 4. Vehicles and Machinery: With a thriving transportation and manufacturing industry, San Antonio has a significant number of vehicles and machinery available for lateralization. Approval for a grant of security interest in these assets can provide added security for obligations in a creditor workout scenario. 5. Accounts Receivable: Many businesses in San Antonio rely on accounts receivable for their day-to-day operations. Approvals for grants of security interest in accounts receivable can provide a viable option to secure obligations under an informal creditor workout plan. In summary, San Antonio, Texas, offers a range of opportunities for obtaining approvals for grants of security interest in various assets, enabling individuals and businesses to secure their obligations as part of an informal creditor workout plan. Whether it is real estate, business assets, financial instruments, vehicles and machinery, or accounts receivable, San Antonio provides a diverse landscape for securing obligations and maintaining financial stability.

San Antonio Texas Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan

Description

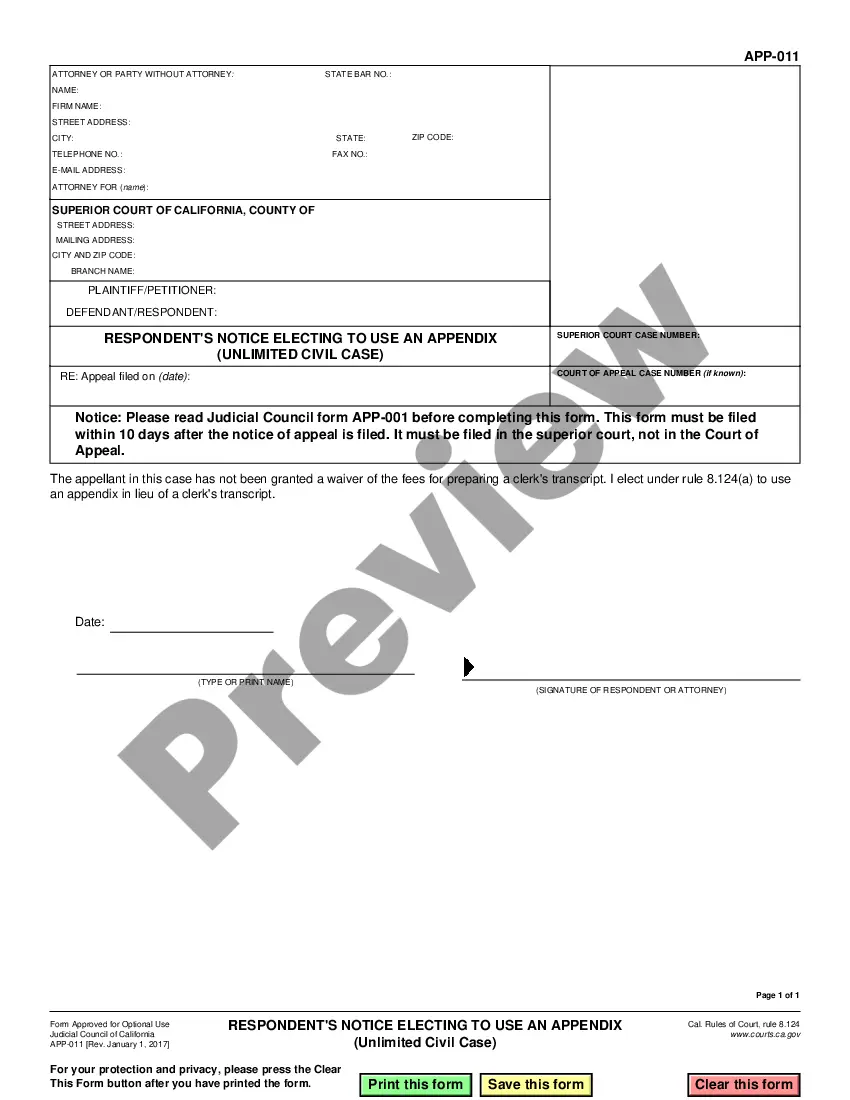

How to fill out San Antonio Texas Approval Of Grant Of Security Interest In All Of Assets To Secure Obligations Pursuant To Terms Of Informal Creditor Workout Plan?

Creating legal forms is a must in today's world. However, you don't always need to seek qualified assistance to create some of them from the ground up, including San Antonio Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in various types ranging from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching process less overwhelming. You can also find detailed resources and tutorials on the website to make any activities related to paperwork execution simple.

Here's how to locate and download San Antonio Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan.

- Go over the document's preview and outline (if provided) to get a basic idea of what you’ll get after getting the form.

- Ensure that the template of your choice is specific to your state/county/area since state laws can affect the validity of some records.

- Examine the similar forms or start the search over to find the correct file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment method, and purchase San Antonio Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed San Antonio Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan, log in to your account, and download it. Needless to say, our website can’t take the place of a legal professional completely. If you need to cope with an exceptionally complicated case, we advise using the services of a lawyer to check your document before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of users. Become one of them today and purchase your state-compliant documents effortlessly!

Form popularity

FAQ

For a security interest to attach, the following events must have occurred: (A) value must have been given by the Secured Party; (B) the Debtor must have rights in the collateral; and (C) the Secured Party must have been granted a security interest in the collateral.

In one of three ways: The secured party is the bank maintaining the account; The debtor, secured party and bank have authenticated a record agreeing that the secured party has control; or. The secured party's name is added to the debtor's account.

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.

2022 In order for a creditor's security interest to attach (i.e., to become enforceable): (1) The debtor must have rights in the collateral; and. (2) The secured party must give value (e.g., extension of credit, consideration) in exchange for an interest in the collateral; and either.

However, generally speaking, the primary ways for a secured party to perfect a security interest are: by filing a financing statement with the appropriate public office. by possessing the collateral. by "controlling" the collateral; or. it's done automatically upon attachment of the security interest.

To become a secured party, the creditor must obtain a security interest in the collateral of the debtor.

For a security interest to attach, the following events must have occurred: (A) value must have been given by the Secured Party; (B) the Debtor must have rights in the collateral; and (C) the Secured Party must have been granted a security interest in the collateral.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the

You give the lender this right when you sign your closing forms. The document granting the security interest can be called by different names, but the most common names are "Mortgage" or "Deed of Trust."

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral.