Title: Alameda California Debt Conversion Agreement with Exhibit A: Comprehensive Overview Introduction: Alameda, California, offers various types of Debt Conversion Agreements with Exhibit A, designed to streamline the debt conversion process and provide individuals and organizations with favorable terms. In this comprehensive guide, we will delve into the details of such agreements, highlighting their importance, key features, and the different types available. Types of Alameda, California Debt Conversion Agreements with Exhibit A: 1. Personal Debt Conversion Agreement: — This agreement is designed for individuals seeking to convert their personal debts into more manageable terms. — It covers various debts, such as credit card debt, medical bills, personal loans, or any other outstanding obligations. — Exhibit A provides a detailed breakdown of the current debts alongside the revised terms, including interest rates, payment schedules, and outstanding balances. 2. Business Debt Conversion Agreement: — Alameda, California offers this agreement for businesses struggling with multiple debts or complex financial situations. — It allows businesses to convert their debts into a more manageable structure, ensuring improved cash flow and potentially even debt reduction. — Exhibit A contains a comprehensive list of the business's existing debts, outlining the revised terms, repayment plans, and any potential discounts negotiated. Key Features of Alameda, California Debt Conversion Agreements: 1. Debt Consolidation: — Debt Conversion Agreements aim to consolidate multiple debts into a single, more manageable payment plan. — Exhibit A provides a consolidated view of all existing debts, their respective terms, and the consolidated repayment schedule. 2. Lowered Interest Rates: — Debt Conversion Agreements often involve renegotiating interest rates to more affordable levels. — Exhibit A reflects the revised interest rates applicable to each debt, enabling clarity and transparency. 3. Extended Repayment Terms: — To alleviate financial burdens, Alameda's Debt Conversion Agreements commonly include extended repayment periods. — Exhibit A outlines the revised repayment schedules, showcasing the new timelines and associated payment amounts. 4. Debt Reduction: — In some cases, negotiations within the agreement may lead to a reduction in the total debt amount owed. — Exhibit A provides a clear breakdown of the original debt amounts, any negotiated reductions, and the final outstanding balances. Conclusion: Alameda, California's Debt Conversion Agreements with Exhibit A provide individuals and businesses with effective solutions for managing and reducing their debts. By offering consolidated payment plans, lower interest rates, extended repayment terms, and potential debt reduction, these agreements enable individuals and businesses to regain control of their finances. It is important to consult legal and financial professionals to ensure a thorough understanding and successful implementation of Alameda's Debt Conversion Agreements.

Alameda California Debt Conversion Agreement with exhibit A only

Description

How to fill out Alameda California Debt Conversion Agreement With Exhibit A Only?

Whether you plan to start your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare specific documentation meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business case. All files are grouped by state and area of use, so picking a copy like Alameda Debt Conversion Agreement with exhibit A only is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to obtain the Alameda Debt Conversion Agreement with exhibit A only. Follow the guidelines below:

- Make certain the sample meets your individual needs and state law regulations.

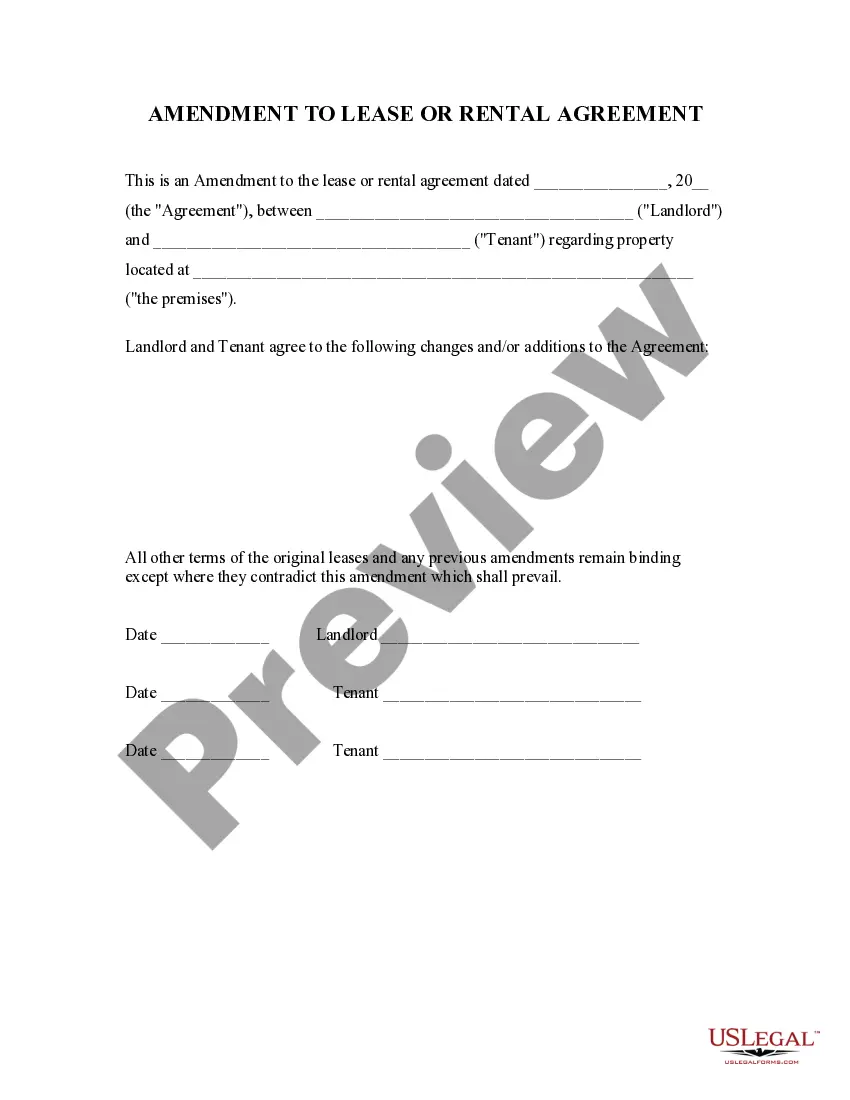

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample when you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Alameda Debt Conversion Agreement with exhibit A only in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you are able to access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!